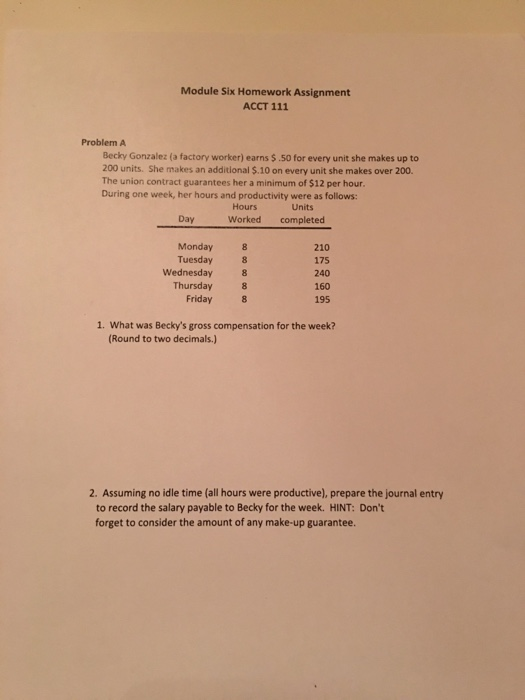

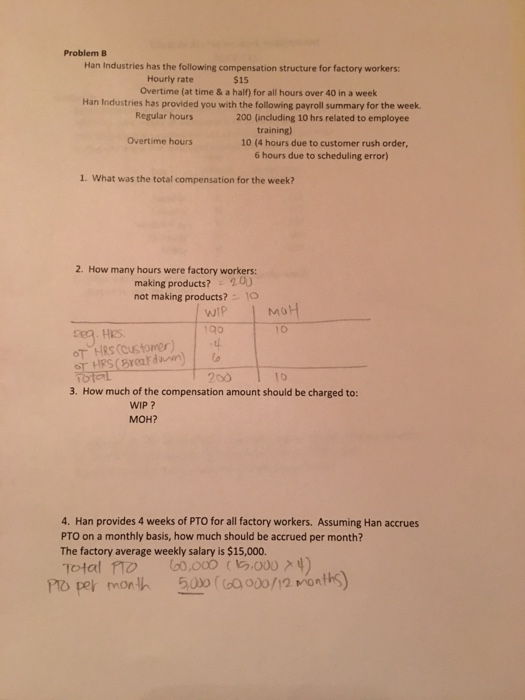

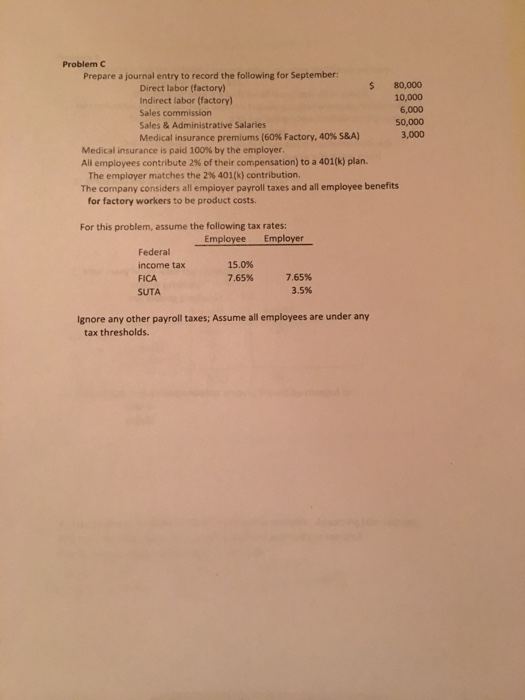

Module Six Homework Assignment ACCT 111 Problem A Becky Gonzalez (a factory worker) earns $.50 for every unit she makes up to 200 units. She makes an additional $.10 on every unit she makes over 200. The union contract guarantees her a minimum of $12 per hour. During one week, her hours and productivity were as follows: Hours Units Day Worked completed Monday8 Tuesday 8 210 175 240 160 195 Wednesday8 Thursday 8 Friday 8 1. What was Becky's gross compensation for the week? (Round to two decimals.) 2. Assuming no idle time (all hours were productive), prepare the journal entry to record the salary payable to Becky for the week. HINT: Don't forget to consider the amount of any make-up guarantee. Problem B Han Industries has the following compensation structure for factory workers $15 Hourly rate Overtime (at time & a half) for all hours over 40 in a week Han Industries has provided you with the following payroll summary for the week Regular hours 200 (including 10 hrs related to employee training) Overtime hours 10 (4 hours due to customer rush order, 6 hours due to scheduling error) 1. What was the total compensation for the week? 2. How many hours were factory workers making products? 2O not making products?10 MO 10 OT HRS(Customer) 3. How much of the compensation amount should be charged to: WIP ? MOH? 4. Han provides 4 weeks of PTO for all factory workers. Assuming Han accrues PTO on a monthly basis, how much should be accrued per month? The factory average weekly salary is $15,000. Problem Prepare a journal entry to record the following for September: Direct labor (factory) Indirect labor (factory) Sales commission Sales & Administrative Salaries Medical insurance premiums (60% Factory, 40% S&A) 80,000 10,000 6,000 50,000 3,000 Medical insurance is paid 100% by the employer Ali employees contribute 2% of their compensation) to a 401(k) plan. The employer matches the 2% 401(k) contribution. he company considers llemployer pavrol taxes and all employee benefts for factory workers to be product costs For this problem, assume the following tax rates: Employee Employer Federal income tax FICA SUTA 15.0% 7.65% 7.65% 3.5% ignore any other payroll taxes; Assume all employees are under any tax thresholds. Module Six Homework Assignment ACCT 111 Problem A Becky Gonzalez (a factory worker) earns $.50 for every unit she makes up to 200 units. She makes an additional $.10 on every unit she makes over 200. The union contract guarantees her a minimum of $12 per hour. During one week, her hours and productivity were as follows: Hours Units Day Worked completed Monday8 Tuesday 8 210 175 240 160 195 Wednesday8 Thursday 8 Friday 8 1. What was Becky's gross compensation for the week? (Round to two decimals.) 2. Assuming no idle time (all hours were productive), prepare the journal entry to record the salary payable to Becky for the week. HINT: Don't forget to consider the amount of any make-up guarantee. Problem B Han Industries has the following compensation structure for factory workers $15 Hourly rate Overtime (at time & a half) for all hours over 40 in a week Han Industries has provided you with the following payroll summary for the week Regular hours 200 (including 10 hrs related to employee training) Overtime hours 10 (4 hours due to customer rush order, 6 hours due to scheduling error) 1. What was the total compensation for the week? 2. How many hours were factory workers making products? 2O not making products?10 MO 10 OT HRS(Customer) 3. How much of the compensation amount should be charged to: WIP ? MOH? 4. Han provides 4 weeks of PTO for all factory workers. Assuming Han accrues PTO on a monthly basis, how much should be accrued per month? The factory average weekly salary is $15,000. Problem Prepare a journal entry to record the following for September: Direct labor (factory) Indirect labor (factory) Sales commission Sales & Administrative Salaries Medical insurance premiums (60% Factory, 40% S&A) 80,000 10,000 6,000 50,000 3,000 Medical insurance is paid 100% by the employer Ali employees contribute 2% of their compensation) to a 401(k) plan. The employer matches the 2% 401(k) contribution. he company considers llemployer pavrol taxes and all employee benefts for factory workers to be product costs For this problem, assume the following tax rates: Employee Employer Federal income tax FICA SUTA 15.0% 7.65% 7.65% 3.5% ignore any other payroll taxes; Assume all employees are under any tax thresholds