Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mogul oil refinery is planning to buy 9000 barrels of oil in 9 months. Suppose Mogul hedges the risk by buying futures on 6300.0 barrels

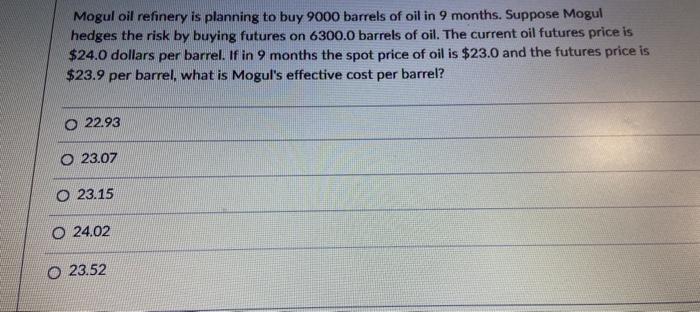

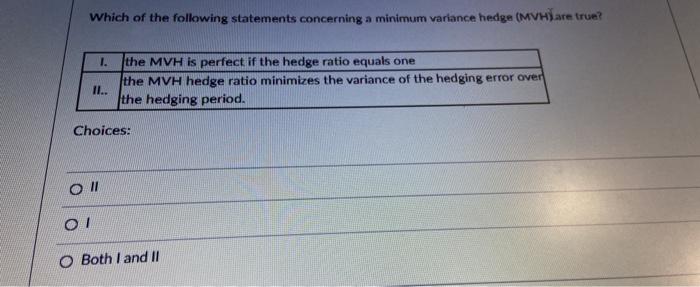

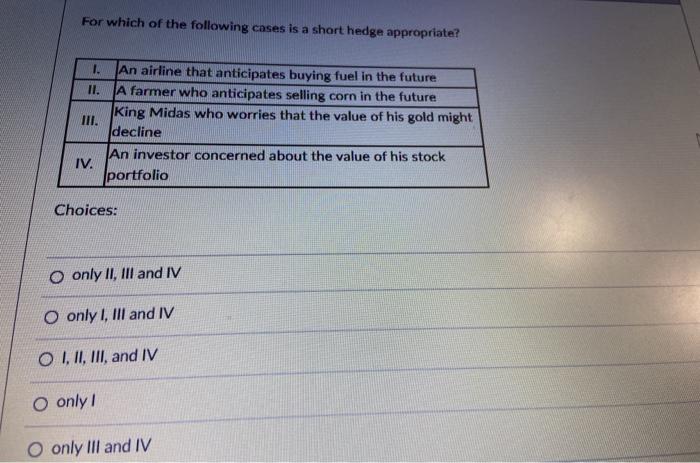

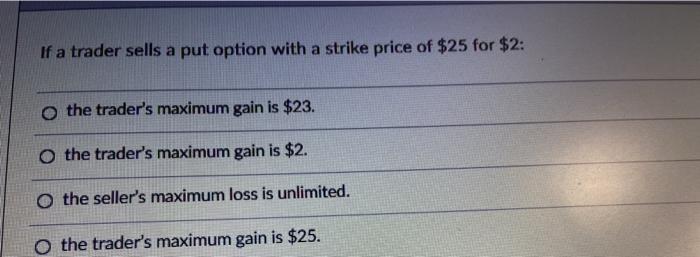

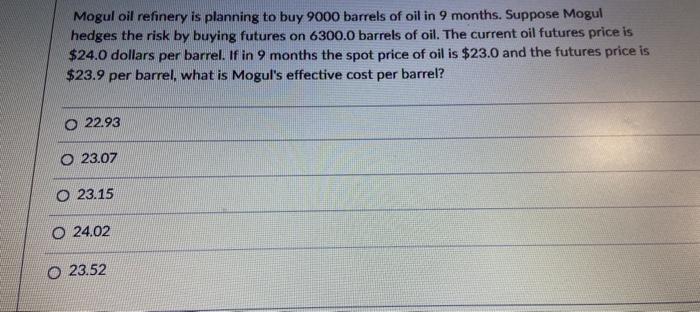

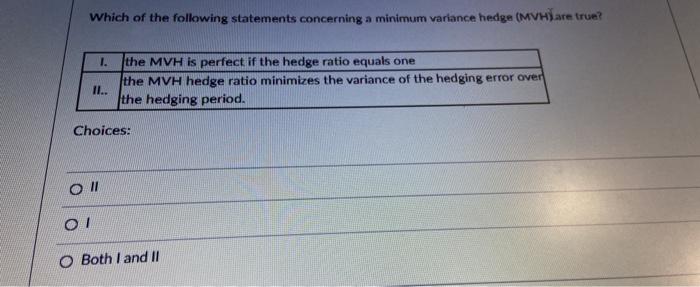

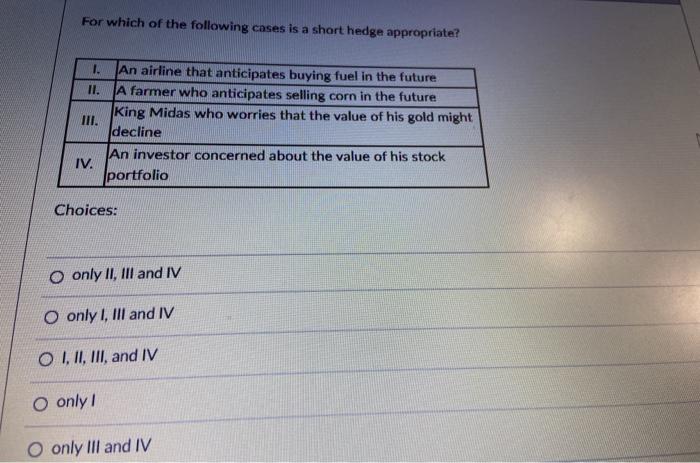

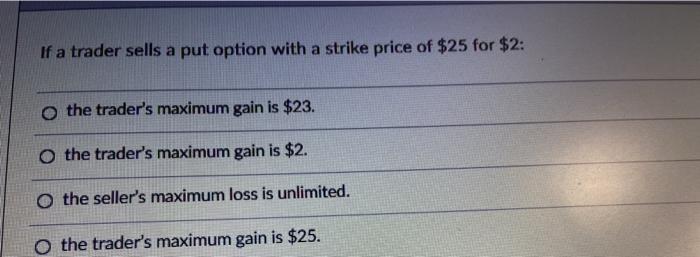

Mogul oil refinery is planning to buy 9000 barrels of oil in 9 months. Suppose Mogul hedges the risk by buying futures on 6300.0 barrels of oil. The current oil futures price is $24.0 dollars per barrel. If in 9 months the spot price of oil is $23.0 and the futures price is $23.9 per barrel, what is Mogul's effective cost per barrel? o 22.93 O 23.07 o 23.15 O 24.02 O 23.52 Which of the following statements concerning a minimum variance hedge (MVH) are trum? 1. the MVH is perfect if the hedge ratio equals one the MVH hedge ratio minimizes the variance of the hedging error over the hedging period. II.. Choices: O II 01 O Both I and II For which of the following cases is a short hedge appropriate? 1. An airline that anticipates buying fuel in the future II. A farmer who anticipates selling corn in the future King Midas who worries that the value of his gold might decline An investor concerned about the value of his stock IV. portfolio Choices: o only II, III and IV O only 1, III and IV O I, II, III, and IV only O only III and IV If a trader sells a put option with a strike price of $25 for $2: o the trader's maximum gain is $23. o the trader's maximum gain is $2. O the seller's maximum loss is unlimited. the trader's maximum gain is $25

Mogul oil refinery is planning to buy 9000 barrels of oil in 9 months. Suppose Mogul hedges the risk by buying futures on 6300.0 barrels of oil. The current oil futures price is $24.0 dollars per barrel. If in 9 months the spot price of oil is $23.0 and the futures price is $23.9 per barrel, what is Mogul's effective cost per barrel? o 22.93 O 23.07 o 23.15 O 24.02 O 23.52 Which of the following statements concerning a minimum variance hedge (MVH) are trum? 1. the MVH is perfect if the hedge ratio equals one the MVH hedge ratio minimizes the variance of the hedging error over the hedging period. II.. Choices: O II 01 O Both I and II For which of the following cases is a short hedge appropriate? 1. An airline that anticipates buying fuel in the future II. A farmer who anticipates selling corn in the future King Midas who worries that the value of his gold might decline An investor concerned about the value of his stock IV. portfolio Choices: o only II, III and IV O only 1, III and IV O I, II, III, and IV only O only III and IV If a trader sells a put option with a strike price of $25 for $2: o the trader's maximum gain is $23. o the trader's maximum gain is $2. O the seller's maximum loss is unlimited. the trader's maximum gain is $25

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started