Question

Mohammad Ameri is a vice president of the United Fruit Companys Guatemalan operations in Latin America, a multinational company, based in Spain in Europe. Please

Mohammad Ameri is a vice president of the United Fruit Companys Guatemalan operations in Latin America, a multinational company, based in Spain in Europe. Please note that in Guatemala the Guatemalan currency has the initial - GTQ and Spain is a member of the European Union and its currency is the Euro. Mr. Mohammad Ameri, as vice president of the company, earns a fixed annual salary and a 10% annual bonus based on the pre-tax income of the companys Guatemalan operations.

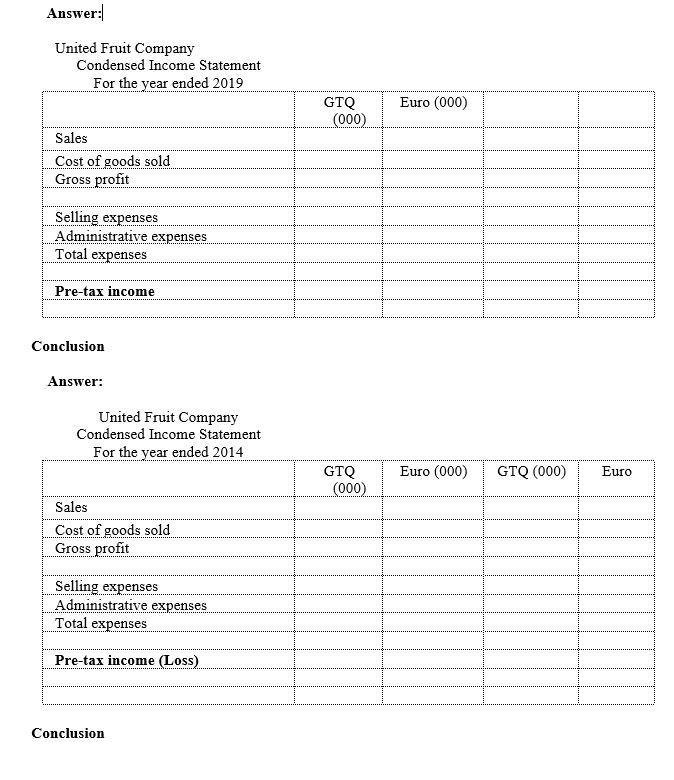

A condensed income statement for 2019 of the United Fruit Companys Guatemalan subsidiary is as follows:

| United Fruit Company Condensed Income Statement For the year ended 2019 |

|

|

|

|

|

| GTQ (000) |

|

|

|

| Sales | 1,260,000 |

|

|

|

| Cost of goods sold | 840,000 |

|

|

|

| Gross profit | 420,000 |

|

|

|

|

|

|

|

|

|

| Selling expenses | 84,000 |

|

|

|

| Administrative expenses | 147,000 |

|

|

|

| Total expenses | 231,000 |

|

|

|

|

|

|

|

|

|

| Pre-tax income | 189,000 |

|

|

|

|

|

|

|

|

|

Required

If Mohammad Ameris contract discloses that his annual bonus is 10% of the pre-tax annual income of the subsidiary in Guatemala after conversion to Euro, determine Mr. Ameris bonus for 2019.

If the Guatemalan subsidiary sales were GTQ 250,000 for 2019, with all other amounts remaining equal what would be the amount of Mr. Ameris 10% bonus for 2019?

Exchange rate for Euro = GTQ 10.50 / Euro

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started