Question

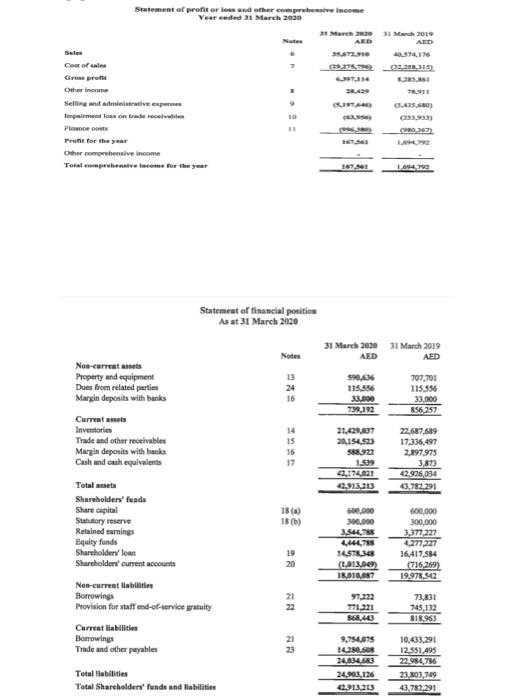

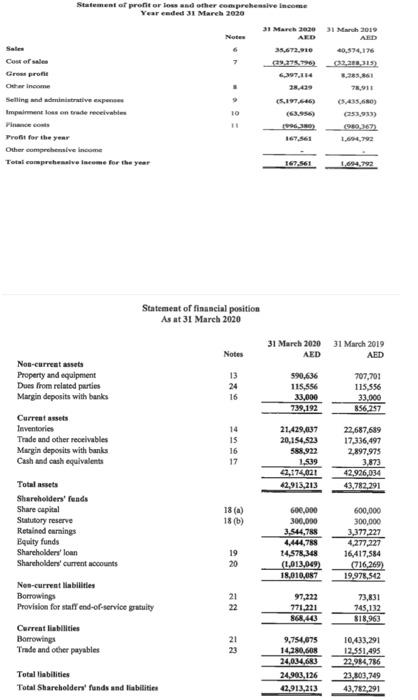

Mohammed & Co. is a Corporation with a focus on Food and Beverage manufacturing in the UAE. They are now looking to finance their new

Mohammed & Co. is a Corporation with a focus on Food and Beverage manufacturing in the UAE. They are now looking to finance their new project, a restaurant chain. To raise funds they will issue shares to the public. You are required to calculate andinterpret the following ratios for two years:

Mohammed & Co. currently has 60,000 shares outstanding with the dividend announced for the current year (2020) at AED 49,000 and last year (2019)the dividend announced was at AED 52,000 for the entire group.

The opening share price of Mohammed & Co. on 30thof March 2020 was AED156.7 and AED104.8 on 30thMarch 2019.

Based on the ratios calculated above, Can you conclude if Mohammed & Co. is a good investment opportunity for the prospective Shareholder? [2]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started