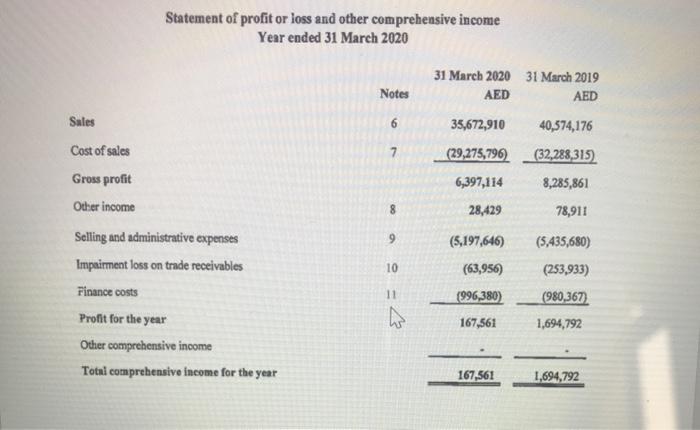

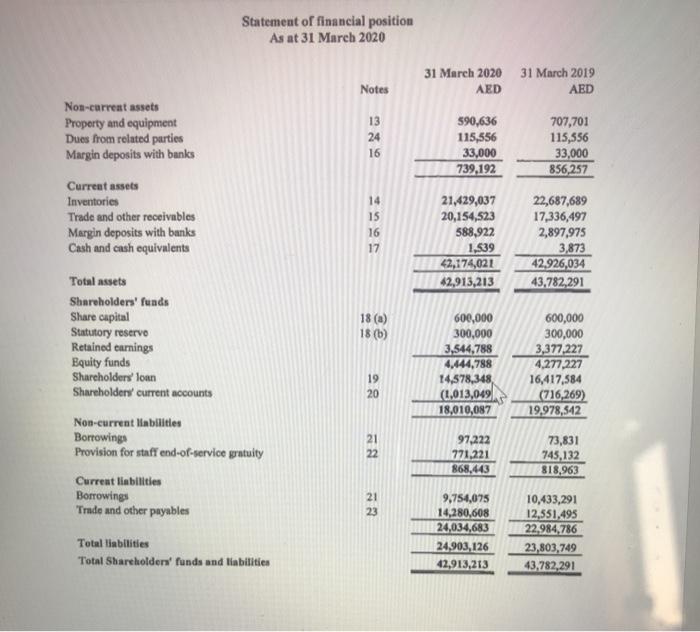

Mohammed & Co. is a Corporation with a focus on Food and Beverage manufacturing in the UAE. They are now looking to finance their new project, a restaurant chain. To raise funds they will issue shares to the public. You are required to calculate and analyze the following ratios: a) Total Asset turnover b) Fixed Asset turnover c) Price to Earnings Ratio d) Market to Book Ratio e) Net Profit Margin f) Gross Profit Margin I g) Dividends per share h) Operating Return on Assets [8 points) Mohammed & Co. currently has 60,000 shares outstanding with the dividend announced for the current year (2020) at AED 49,000 and last year (2019) the dividend announced was at AED 52,000 for the entire group. The opening share price of Mohammed & Co. on 30th of March 2020 was AED156.7 and AED104.8 on 30th March 2019. Based on the ratios calculated above. Can you conclude if Mohammed & Co. is a good investment opportunity for the prospective Shareholder? [2 points) Statement of profit or loss and other comprehensive income Year ended 31 March 2020 31 March 2020 31 March 2019 AED AED Notes Sales 6 35,672,910 40,574,176 Cost of sales 7 (29,275,796) (32,288,315) 6,397,114 8,285,861 8 28,429 78,911 9 Gross profit Other income Selling and administrative expenses Impairment loss on trade receivables Finance costs Profit for the year Other comprehensive income Total comprehensive income for the year (5,197,646) (63,956) (5.435,680) (253,933) 10 11 (996,380) (980,367 27 167,561 1,694,792 167,561 1,694,792 Statement of financial position As at 31 March 2020 31 March 2020 AED 31 March 2019 AED Notes Non-current assets Property and equipment Dues from related parties Margin deposits with banks 13 24 16 590,636 115,556 33,000 739,192 707,701 115,556 33,000 856,257 Current assets Inventories Trade and other receivables Margin deposits with banks Cash and cash equivalents 14 15 16 17 21,429,037 20,154,523 588,922 1,539 42,174,021 42,913,213 22,687,689 17,336,497 2,897,975 3,873 42.926,034 43.782,291 18 (*) 18 (b) Total assets Shareholders' funds Share capital Statutory reservo Retained earnings Equity funds Shareholders' loan Shareholders' current accounts Non-current Mobilitles Borrowings Provision for staff end-of-service gratuity Current liabilities Borrowings Trade and other payables 600,000 300,000 3,544.788 4,444,788 14,578,348 (1.013,049 18,010,087 600,000 300,000 3,377.227 4,277,227 16,417,584 (716,269) 19,978,542 20 21 22 97,222 771,221 868,443 73,831 745,132 818,963 21 23 9,754,075 14,280,608 24,034,683 24,903, 126 42,913,213 10,433,291 12,551,495 22.984,786 23,803,749 43.782,291 Total liabilities Total Shareholders' funds and liabilities