Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mohammed is the owner of a service company that provides consulting services and charges the clients for them. He uses a journal to record

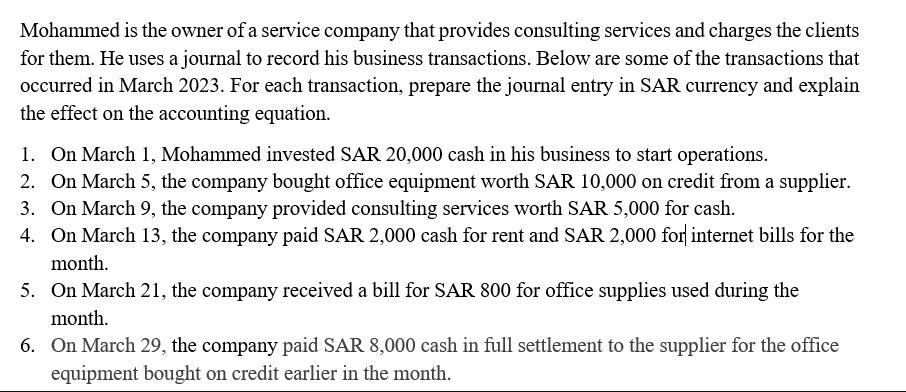

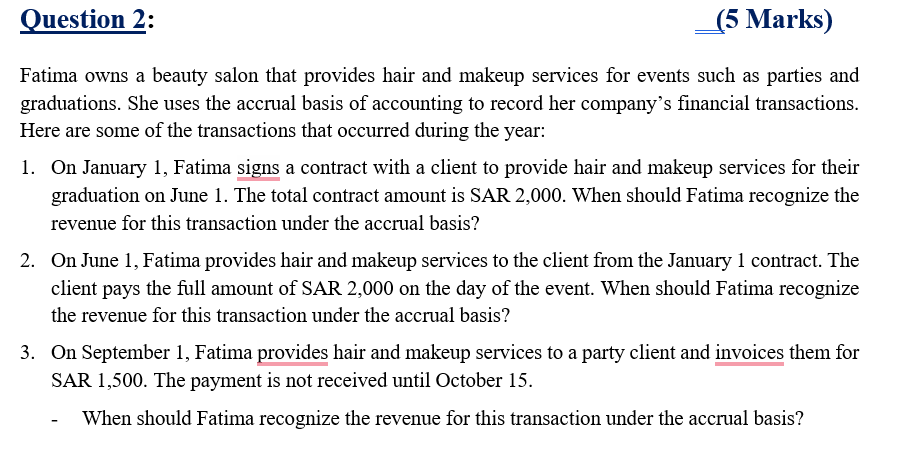

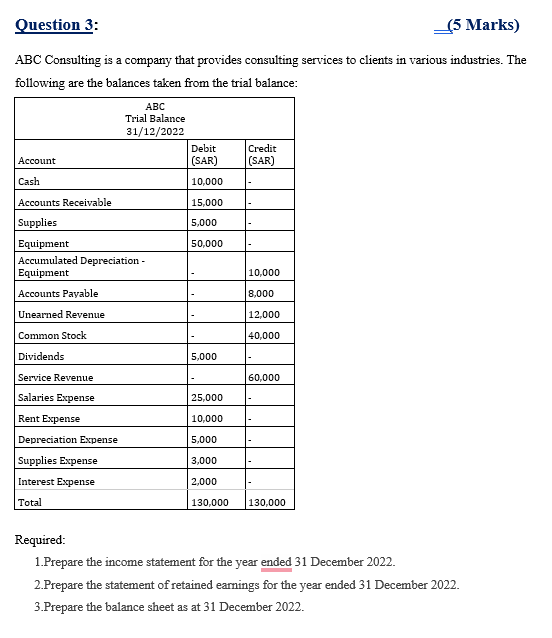

Mohammed is the owner of a service company that provides consulting services and charges the clients for them. He uses a journal to record his business transactions. Below are some of the transactions that occurred in March 2023. For each transaction, prepare the journal entry in SAR currency and explain the effect on the accounting equation. 1. On March 1, Mohammed invested SAR 20,000 cash in his business to start operations. 2. On March 5, the company bought office equipment worth SAR 10,000 on credit from a supplier. 3. On March 9, the company provided consulting services worth SAR 5,000 for cash. 4. On March 13, the company paid SAR 2,000 cash for rent and SAR 2,000 for internet bills for the month. 5. On March 21, the company received a bill for SAR 800 for office supplies used during the month. 6. On March 29, the company paid SAR 8,000 cash in full settlement to the supplier for the office equipment bought on credit earlier in the month. Question 2: (5 Marks) Fatima owns a beauty salon that provides hair and makeup services for events such as parties and graduations. She uses the accrual basis of accounting to record her company's financial transactions. Here are some of the transactions that occurred during the year: 1. On January 1, Fatima signs a contract with a client to provide hair and makeup services for their graduation on June 1. The total contract amount is SAR 2,000. When should Fatima recognize the revenue for this transaction under the accrual basis? 2. On June 1, Fatima provides hair and makeup services to the client from the January 1 contract. The client pays the full amount of SAR 2,000 on the day of the event. When should Fatima recognize the revenue for this transaction under the accrual basis? 3. On September 1, Fatima provides hair and makeup services to a party client and invoices them for SAR 1,500. The payment is not received until October 15. When should Fatima recognize the revenue for this transaction under the accrual basis? Question 3: (5 Marks) ABC Consulting is a company that provides consulting services to clients in various industries. The following are the balances taken from the trial balance: Account Cash Accounts Receivable Supplies Equipment Accumulated Depreciation - Equipment Accounts Payable Unearned Revenue Common Stock Dividends Service Revenue Salaries Expense Rent Expense ABC Trial Balance 31/12/2022 Depreciation Expense Supplies Expense Interest Expense Total Debit (SAR) 10,000 15,000 5,000 50,000 5,000 Credit (SAR) 10,000 8,000 12,000 40,000 60,000 25,000 10,000 5,000 3,000 2,000 130,000 130,000 Required: 1.Prepare the income statement for the year ended 31 December 2022. 2.Prepare the statement of retained earnings for the year ended 31 December 2022. 3.Prepare the balance sheet as at 31 December 2022.

Step by Step Solution

★★★★★

3.60 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Journal entry Recording is an initial step in the whole accounting cycle Under this at least one account is debited and at least one account is credited Accounting equation It is fundamental concept ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started