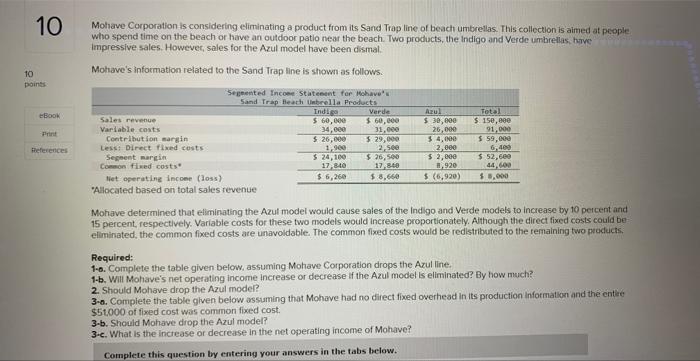

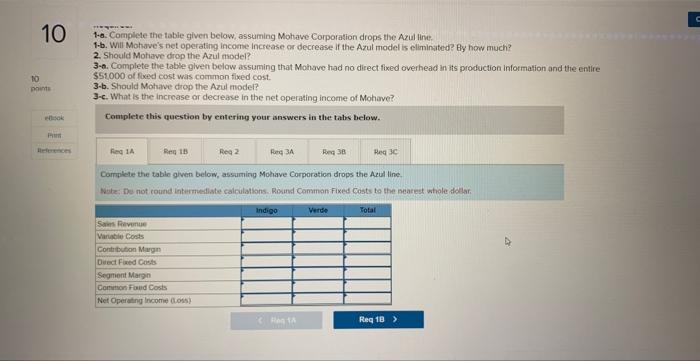

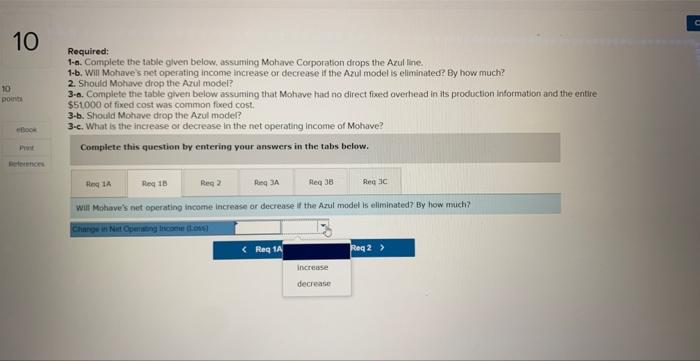

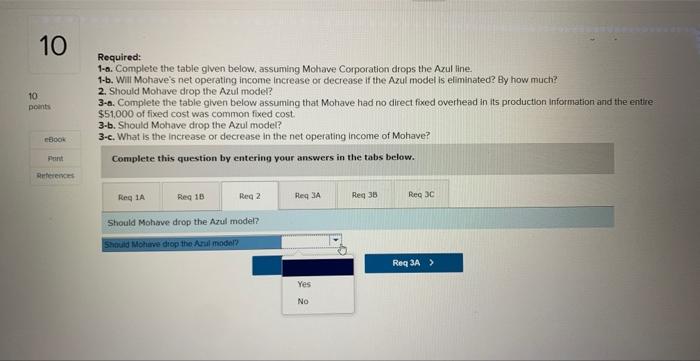

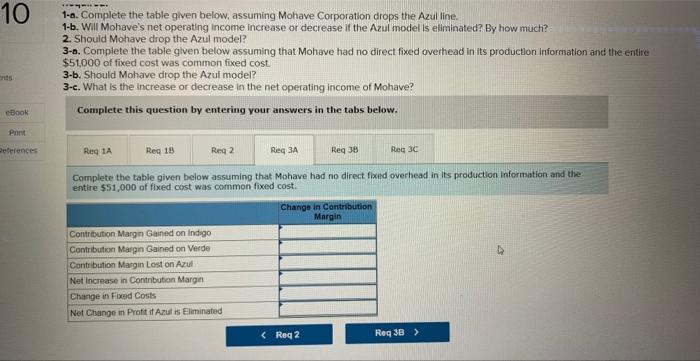

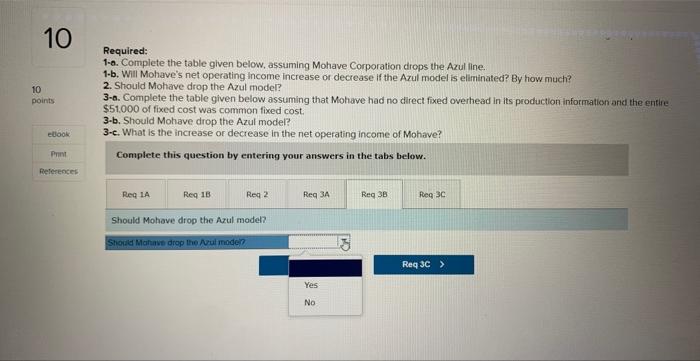

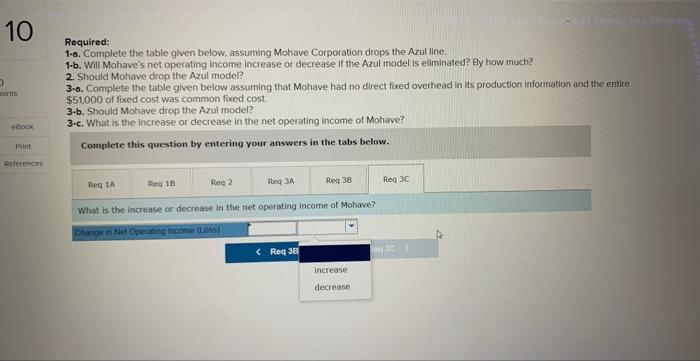

Mohave Corporation is considering eliminating a product from its Sand Trap line of beach umbrellas. This collection is aimed at people who spend time on the beach or have an outdoor patio near the beach. Two products, the indigo and Verde umbreilas, herve impressive sales. Howevec, sales for the Azul model have been dismal. Mohave's information related to the Sand Trap line is shown as follows. Mohave determined that eliminating the Azul model would cause sales of the indigo and Verde models to increase by 10 peicent and 15 percent, respectively. Variable costs for these two models would increase proportionately. Although the direct fixed costs could beeliminated, the common fixed costs ate unavoidable. The common fixed costs would be redistributed to the remaining two products. Required: 1.-. Complete the table given below, assuming Mohave Corporation drops the Azul line. 1-b. Will Mohave's net operating income increase or decrease if the Azul model is eliminated? By how much? 2. Should Mohave drop the Azul model? 3-a. Complete the table given below assuming that Mohave had no difect fixed overhead in its production information and the entive $51000 of fixed cost was common fixed cost. 3-b. Should Mohave drop the Azul model? 3.-. What is the increase or decrease in the net operating income of Mohave? 1.a. Complete the table given below, assuming Mohawe Corporation drops the Azul line: 1.b. Will Mohave's net operating income increase or decrease if the Azul model is ellminated? By how much? 2. Should Mohave diop the Azul model? 3-a. Complete the table glven belaw assuming that Mohave had no direct fixed overhead in its production information and the entire $51000 of foxed cost was common flxed cost. 3-b. Should Mohave diop the Azul model? 3-c. What is the increase or decrease in the net operating income of Mohave? Couplete this question by entering your answers in the tabs below. Camplete the table given below, assuming Mohave Corporation drops the Azul line. Wate: De not round intermediate calcilations. Rosud Comman Fixed Costs to the nearest whole dollar. Required: 1-a. Complete the table glven below, assuaning Mohave Corporation drops the Azul line. 1-b. Will Mohave's net operating income increase or decrease if the Azul model is eliminated? By how much? 2. Should Motave drop the Arul model? 3-a. Complete the table given below assuming that Mohave had na direct fixed averhead in its production Information and the entire $51000 of fixed cost was common fored cost. 3-b. Should Mohtave diop the Azul model? 3-c. What is the increase or decrease in the net operating income of Mohave? Complete this question ty entering your answers in the tabs below. Witf Mrhave's net operating incoene increase or decrease it the Arul modet is eliminated? By how mich? Required: 1-a. Complete the table glven below, assuming Mohave Corporation drops the Axul tine. 1-b. Will Mohave's net operating income increase or decrease if the Azul model is eliminated? By how much? 2. Should Mohave drop the Azul model? 3-6. Complete the table given below assuming that Mohave had no direct fixed overhead in its production information and the entire $51,000 of fixed cost was common foxed cost. 3-b. Should Mohave drop the Azul model? 3-c. What is the increase or decrease in the net operating income of Mohave? Complete this question by entering your answers in the tabs below. Should Mohave drop the Arul model? 1-a. Complete the table given below, assuming Mohave Corporation drops the Azul line. 1-b. Will Mohave's net operating income increase or decrease if the Azul model is eliminated? By how much? 2. Should Mohave drop the Azul model? 3-a. Compiete the table given below assuming that Mohave had no direct fixed overhead in its production information and the entire $51,000 of fixed cost was common fixed cost. 3-b. Should Mohave drop the Azul model? 3-e. What is the increase or decrease in the net operating income of Mohave? Complete this question by entering your answers in the tabs below. Complete the table given below assuming that Mohave had no direct fixid overhead in its production information and the: entire $51,000 of fixed cost was common fixed cost. Required: 1-a. Complete the table given below, assuming Mohave Corporation drops the Azul line. 1-b. Will Mohave's net operating income increase or decrease if the Azul model is eliminated? By how much? 2. Should Mohave drop the Azul model? 3-6. Complete the table given below assuming that Mohave had no direct fixed overhead in its production information and the entin $51.000 of fixed cost was common fixed cost. 3-b. Should Mohave drop the Azul model? 3-c. What is the increase or decrease in the net operating income of Mohave? Complete this question by entering your answers in the tabs below. Should Mohave drop the Arul model? Required: 1-a. Complete the table given below, assuming Mohave Corporation drops the Azul line. 1.b. Will Mohave's net operating income increase or decrease if the Azul model is elliminated? By how much? 2. Should Mohave drop the Azul model? 3-0. Complete the table glven below assuming that Mohave had no direct fixed overhead in its production information and the entire $51,000 of fixed cost was common fixed cost. 3-b. Should Mohave drop the Azul model? 3.c. What is the increase or decrease in the net operating income of Mohave? Complete this question by entering your answers in the tabs below. What is the increase of decrease in the net operating income of Mohave