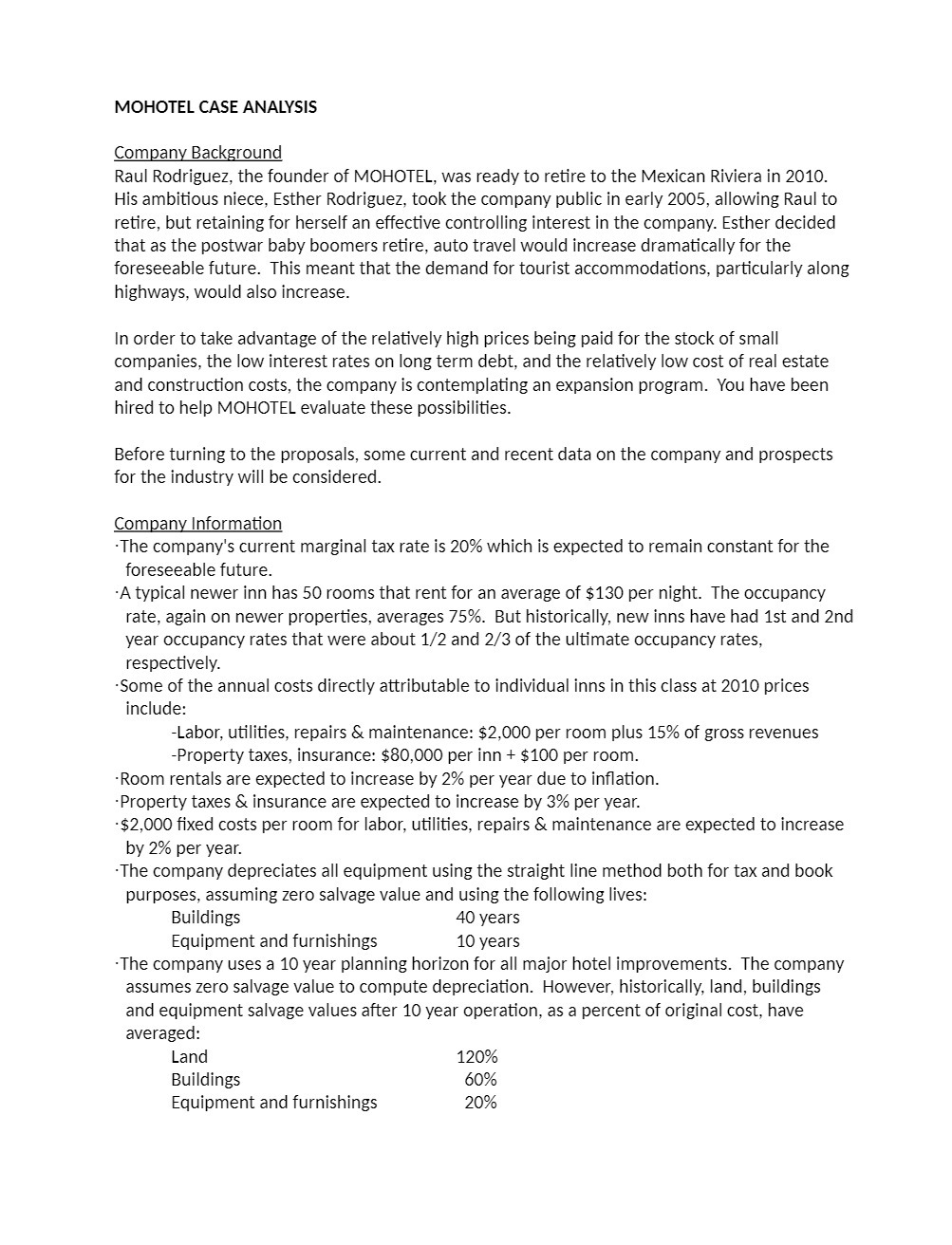

MOHOTEL CASE ANALYSIS Company Background Raul Rodriguez, the founder of MOHOTEL, was ready to retire to the Mexican Riviera in 2010. His ambitious niece, Esther Rodriguez, took the company public in early 2005, allowing Raul to retire, but retaining for herself an effective controlling interest in the company. Esther decided that as the postwar baby boomers retire, auto travel would increase dramatically for the foreseeable future. This meant that the demand for tourist accommodations, particularly along highways, would also increase. In order to take advantage of the relatively high prices being paid for the stock of small companies, the low interest rates on long term debt, and the relatively low cost of real estate and construction costs, the company is contemplating an expansion program. You have been hired to help MOHOTEL evaluate these possibilities. Before turning to the proposals, some current and recent data on the company and prospects for the industry will be considered. Company Information -The company's current marginal tax rate is 20% which is expected to remain constant for the foreseeable future. -A typical newer inn has 50 rooms that rent for an average of $130 per night. The occupancy rate, again on newer properties, averages 75%. But historically, new inns have had lst and 2nd year occupancy rates that were about 112 and 2/3 of the ultimate occupancy rates, respectively. -Some of the annual costs directly attributable to individual inns in this class at 2010 prices include: Labor, utilities, repairs 8: maintenance: $2,000 per room plus 15% of gross revenues Property taxes, insurance: $80,000 per inn + $100 per room. -Room rentals are expected to increase by 2% per year due to ination. -Property taxes 8: insurance are expected to increase by 3% per year. -$2,000 xed costs per room for labor, utilities, repairs & maintenance are expected to increase by 2% per year. -The company depreciates all equipment using the straight line method both for tax and book purposes, assuming zero salvage value and using the following lives: Buildings 40 years Equipment and furnishings 10 years -The company uses a 10 year planning horizon for all major hotel improvements. The company assumes zero salvage value to compute depreciation. However, historically, land, buildings and equipment salvage values after 10 year operation, as a percent of original cost, have averaged: La nd 120% Buildings 60% Equipment and furnishings 20%