Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MOIC is the multiple of invested capital. It answers the question - what multiple of your investment did you receive during the life of

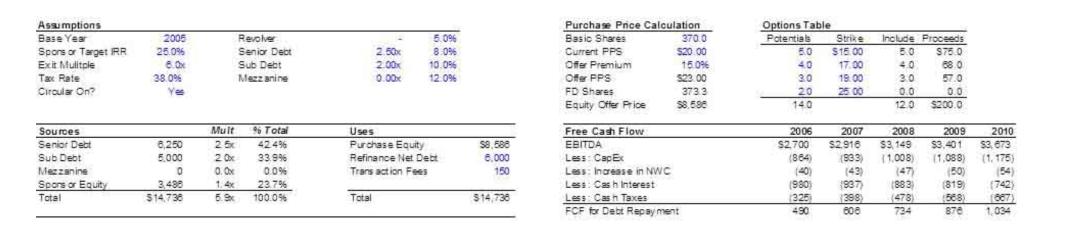

MOIC is the multiple of invested capital. It answers the question - what multiple of your investment did you receive during the life of the investment (dividends if any, and proceeds when you exited the investment)? So if you invested $5 of equity and got back $8 your MOIC would be 8/5 or 1.6x. What is the MOIC for the equity sponsor in this LBO at the end of five years (end of 2010) if the exit EBITDA multiple is 6.6x? Assume that the positive cash flows are used to pay down debt and not to pay dividends. Format 12.34x as 12.3 Assumptions Base Year Sponsor Target IRR Exit Mulitple Tax Rate Circular On? Sources Senior Debt Sub Debt Mezzanine Spors or Equity Total 2005 25.0% 6.0x 38.0% Yes 6,250 5.000 0 3,488 $14,738 Revolver Senior Debt Sub Debt Mezzanine Mult % Total 2.5x 42.4% 20x 33.9% 0.0% 0.0x 1.4x 23.7% 5.9 100.0% 2.50x 2.00x 0.00x Total 5.0% 8.0% 10.0% 12.0% Uses Purchase Equity Refinance Net Debt Transaction Fees $8,588 6,000 150 $14,736 Purchase Price Calculation Basic Shares Current PPS Offer Premium Offer PPS FD Shares Equity Offer Price 370.0 $20.00 15.0% $23.00 373.3 $8.596 Free Cash Flow EBITDA Less: CapEx Less: Increase in NWC Less: Cash Interest Less: Cash Taxes FCF for Debt Repayment Options Table Potentials 5.0 40 30 20 140 2006 $2,700 (864) (40) (980) (325 490 Strike Include Proceeds $15.00 5.0 $75.0 17.00 19.00 25:00 08.0 57.0 4.0 3.0 0.0 12.0 0.0 $200.0 2007 2008 $2.916 $3,149 2009 2010 $3.401 $3,673 (933) (1.008) (1,088) (1.175) (43) (47) (50) (937) (883) (819) (398) (478) (568) 808 734 870 (54) (742) (667) 1,034

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Purchase price in 2005 14736 million Equity invested 3485 millio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started