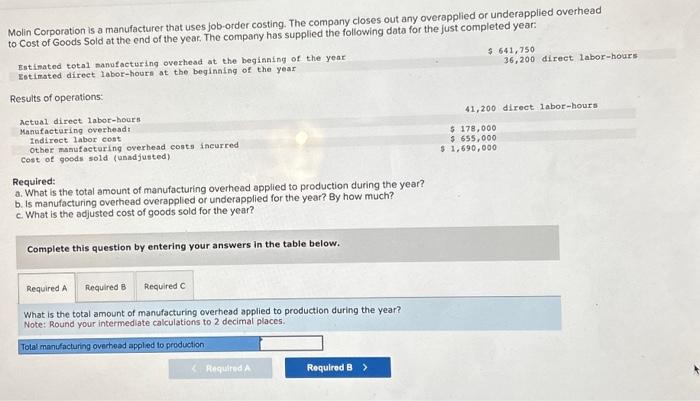

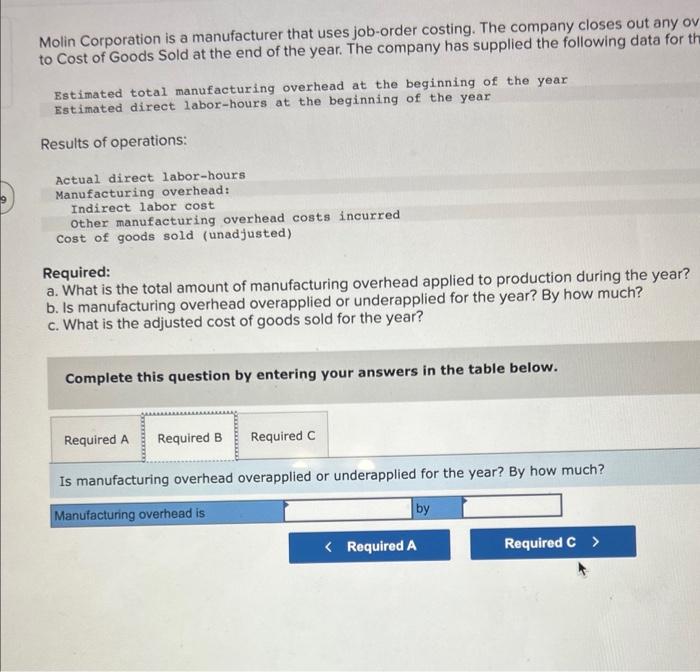

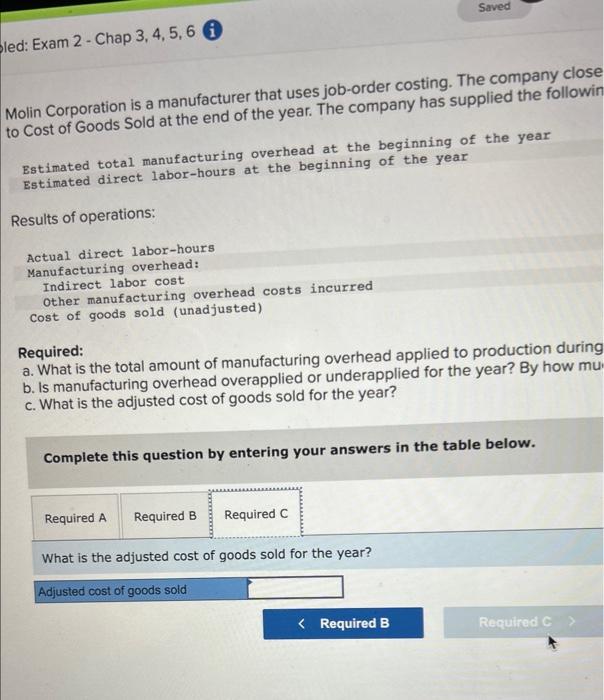

Molin Corporation is a manufacturer that uses job-order costing. The company closes out any ov to Cost of Goods Sold at the end of the year. The company has supplied the following data for th Estimated total manufacturing overhead at the beginning of the year Estimated direct labor-hours at the beginning of the year Results of operations: Actual direct labor-hours Manufacturing overhead: Indirect labor cost other manufacturing overhead costs incurred cost of goods sold (unadjusted) Required: a. What is the total amount of manufacturing overhead applied to production during the year? b. Is manufacturing overhead overapplied or underapplied for the year? By how much? c. What is the adjusted cost of goods sold for the year? Complete this question by entering your answers in the table below. Is manufacturing overhead overapplied or underapplied for the year? By how much? Molin Corporation is a manufacturer that uses job-order costing. The company close to Cost of Goods Sold at the end of the year. The company has supplied the followir Estimated total manufacturing overhead at the beginning of the year Estimated direct labor-hours at the beginning of the year Results of operations: Actual direct labor-hours Manufacturing overhead: Indirect labor cost other manufacturing overhead costs incurred cost of goods sold (unadjusted) Required: a. What is the total amount of manufacturing overhead applied to production during b. Is manufacturing overhead overapplied or underapplied for the year? By how mu c. What is the adjusted cost of goods sold for the year? Complete this question by entering your answers in the table below. What is the adjusted cost of goods sold for the year? Molin Corporation is a manufacturer that uses job-order costing. The company closes out any overapplied or underapplied overhead to Cost of Goods Sold at the end of the year. The company has supplied the following data for the just completed year: Estinated total manofacturing overhead at the begianing of the yoar 641,750 36,200 direct labor-hours Estimated direct labor-hours at the beginaling of the year Results of operations: i-bor-hours Required: a. What is the total amount of manufacturing overhead applied to production during the year? b. Is manufacturing overhead overapplied or underapplied for the year? By how much? c. What is the adjusted cost of goods sold for the year? Complete this question by entering your answers in the table below. What is the total amount of manufacturing overhead applied to production during the year? Note: Round your intermediate calculations to 2 decimal places