Answered step by step

Verified Expert Solution

Question

1 Approved Answer

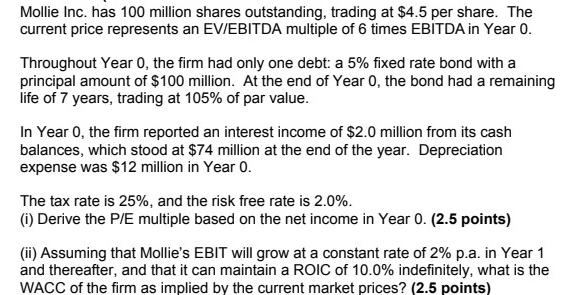

Mollie Inc. has 100 million shares outstanding, trading at $4.5 per share. The current price represents an EV/EBITDA multiple of 6 times EBITDA in

Mollie Inc. has 100 million shares outstanding, trading at $4.5 per share. The current price represents an EV/EBITDA multiple of 6 times EBITDA in Year 0. Throughout Year 0, the firm had only one debt: a 5% fixed rate bond with a principal amount of $100 million. At the end of Year 0, the bond had a remaining life of 7 years, trading at 105% of par value. In Year 0, the firm reported an interest income of $2.0 million from its cash balances, which stood at $74 million at the end of the year. Depreciation expense was $12 million in Year 0. The tax rate is 25%, and the risk free rate is 2.0%. (i) Derive the P/E multiple based on the net income in Year 0. (2.5 points) (ii) Assuming that Mollie's EBIT will grow at a constant rate of 2% p.a. in Year 1 and thereafter, and that it can maintain a ROIC of 10.0% indefinitely, what is the WACC of the firm as implied by the current market prices? (2.5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i Derive the PE multiple based on the net income in Year 0 To derive the PriceEarnings PE multiple we need to calculate the market capitalization MC a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started