Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Molly is single and operates an athletic training business where she specializes in working with basketball and volleyball players. Her business operates on the

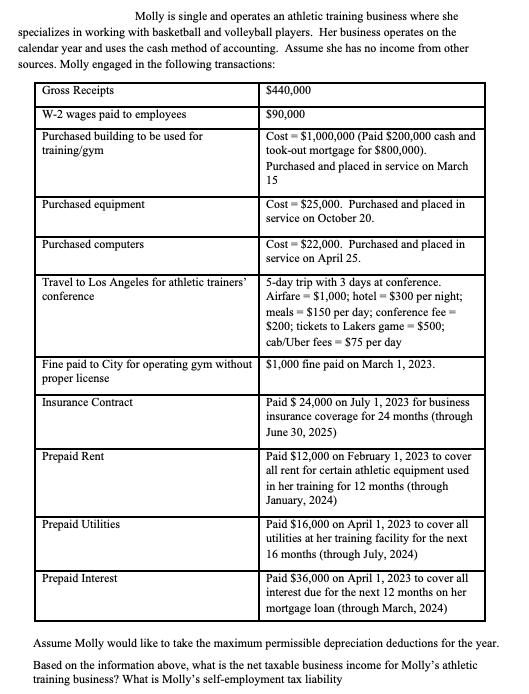

Molly is single and operates an athletic training business where she specializes in working with basketball and volleyball players. Her business operates on the calendar year and uses the cash method of accounting. Assume she has no income from other sources. Molly engaged in the following transactions: Gross Receipts W-2 wages paid to employees Purchased building to be used for training/gym Purchased equipment Purchased computers Travel to Los Angeles for athletic trainers' conference $440,000 $90,000 Cost $1,000,000 (Paid $200,000 cash and took-out mortgage for $800,000). Purchased and placed in service on March 15 Cost $25,000. Purchased and placed in service on October 20. Cost $22,000. Purchased and placed in service on April 25. 5-day trip with 3 days at conference. Airfare $1,000; hotel - $300 per night; meals $150 per day; conference fee- $200; tickets to Lakers game = $500; cab/Uber fees $75 per day Fine paid to City for operating gym without $1,000 fine paid on March 1, 2023. proper license Insurance Contract Prepaid Rent Prepaid Utilities Prepaid Interest Paid $ 24,000 on July 1, 2023 for business insurance coverage for 24 months (through June 30, 2025) Paid $12,000 on February 1, 2023 to cover all rent for certain athletic equipment used in her training for 12 months (through January, 2024) Paid $16,000 on April 1, 2023 to cover all utilities at her training facility for the next 16 months (through July, 2024) Paid $36,000 on April 1, 2023 to cover all interest due for the next 12 months on her mortgage loan (through March, 2024) Assume Molly would like to take the maximum permissible depreciation deductions for the year. Based on the information above, what is the net taxable business income for Molly's athletic training business? What is Molly's self-employment tax liability

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net taxable business income we need to first calculate the gross income and then su...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6641be45b8e6a_989761.pdf

180 KBs PDF File

6641be45b8e6a_989761.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started