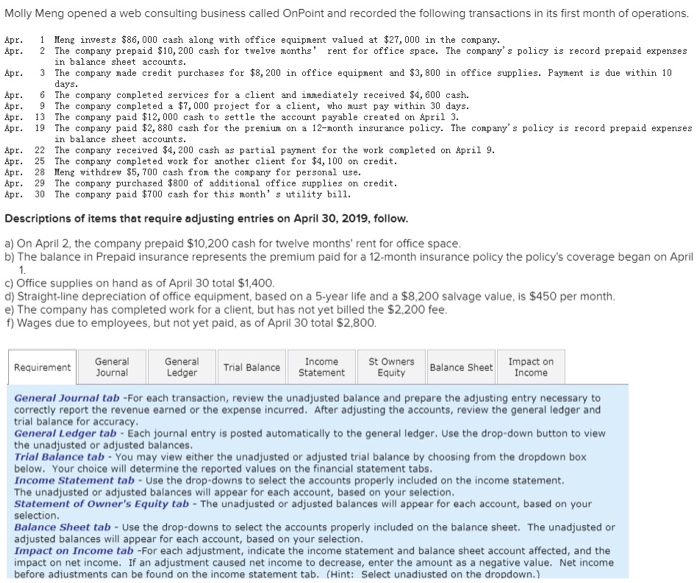

Molly Meng opened a web consulting business called On Point and recorded the following transactions in its first month of operations. Apr. Apr. Apr. Apr. Apr. Apr. Apr. 1 leng invests $86,000 cash along with office equipment valued at $27,000 in the company. 2 The company prepaid $10, 200 cash for twelve months' rent for office space. The company's policy is record prepaid expenses in balance sheet accounts. 3 The company nade credit purchases for $8,200 in office equipment and $3,800 in office supplies. Payment is due within 10 days. 6 The company completed services for a client and insediately received $4,600 cash. 9 The company completed a $7,000 project for a client, who must pay within 30 days. 13 The company paid $12,000 cash to settle the account payable created on April 3. 19 The company paid $2,880 cash for the preniun on a 12-month insurance policy. The conpany's policy is record prepaid expenses in balance sheet accounts. 22 The company received $4,200 cash as partial paynent for the work completed on April 9. 25 The company conpleted work for another client for $4, 100 on credit. 28 Neng withdrew $5, 700 cash from the company for personal use. 29 The company purchased $800 of additional office supplies on credit. 30 The company paid $700 cash for this month' s utility bill. Apr. Apr. Apr. Apr. Apr. Descriptions of items that require adjusting entries on April 30, 2019, follow. a) On April 2, the company prepaid $10,200 cash for twelve months' rent for office space. b) The balance in Prepaid insurance represents the premium paid for a 12-month insurance policy the policy's coverage began on April c) Office supplies on hand as of April 30 total $1,400. d) Straight-line depreciation of office equipment, based on a 5-year life and a $8,200 salvage value, is $450 per month e) The company has completed work for a client, but has not yet billed the $2,200 fee. f) Wages due to employees, but not yet paid, as of April 30 total $2.800. Requirement General Journal General Trial Balance Income Statement St Owners Equity Balance Sheet Ledger Impact on Income General Journal tab -For each transaction, review the unadjusted balance and prepare the adjusting entry necessary to correctly report the revenue earned or the expense incurred. After adjusting the accounts, review the general ledger and trial balance for accuracy. General Ledger tab - Each journal entry is posted automatically to the general ledger. Use the drop-down button to view the unadjusted or adjusted balances. Trial Balance tab - You may view either the unadjusted or adjusted trial balance by choosing from the dropdown box below. Your choice will determine the reported values on the financial statement tabs. Income Statement tab - Use the drop-downs to select the accounts properly included on the income statement. The unadjusted or adjusted balances will appear for each account, based on your selection. Statement of Owner's Equity tab - The unadjusted or adjusted balances will appear for each account, based on your selection. Balance Sheet tab - Use the drop-downs to select the accounts properly included on the balance sheet. The unadjusted or adjusted balances will appear for each account, based on your selection. Impact on Income tab -For each adjustment, indicate the income statement and balance sheet account affected, and the impact on net income. If an adjustment caused net income to decrease, enter the amount as a negative value. Net income before adjustments can be found on the income statement tab. (Hint: Select unadjusted on the dropdown.)