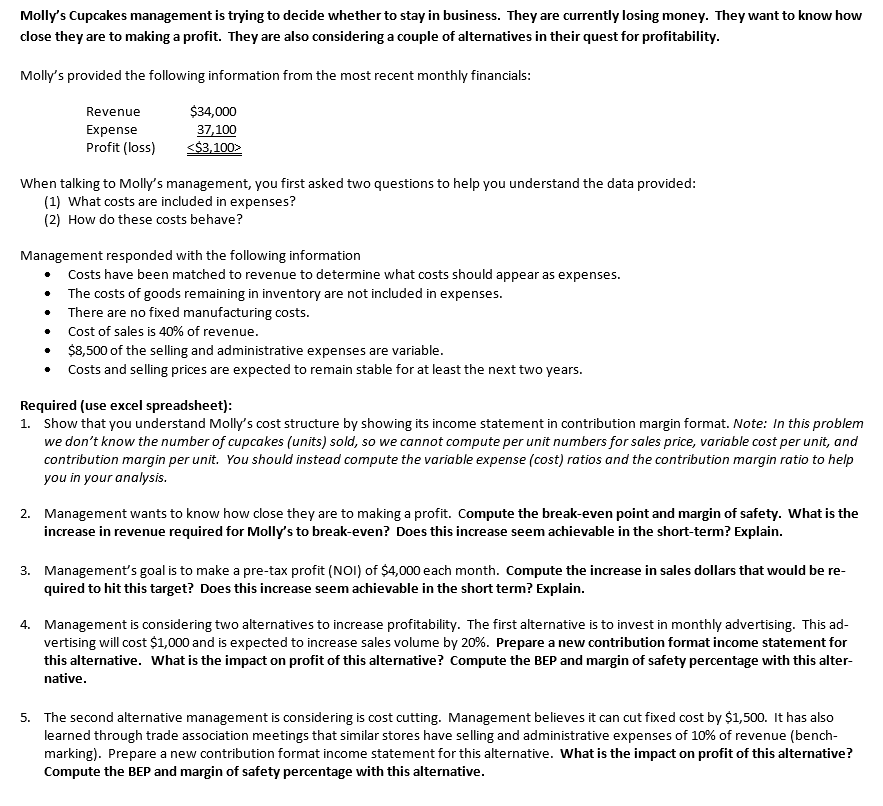

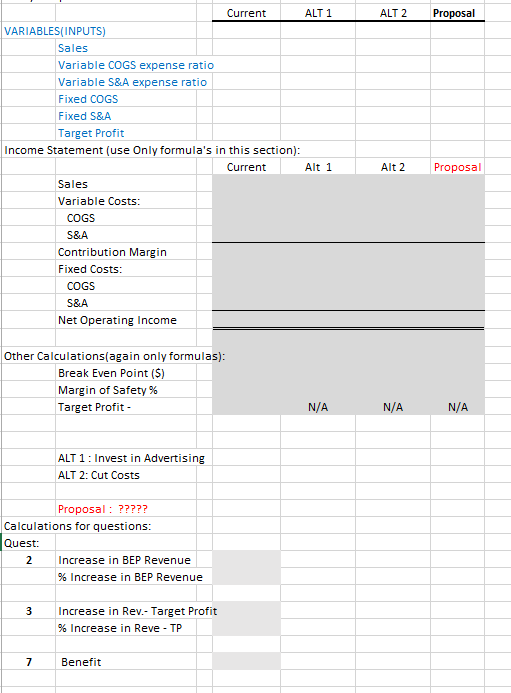

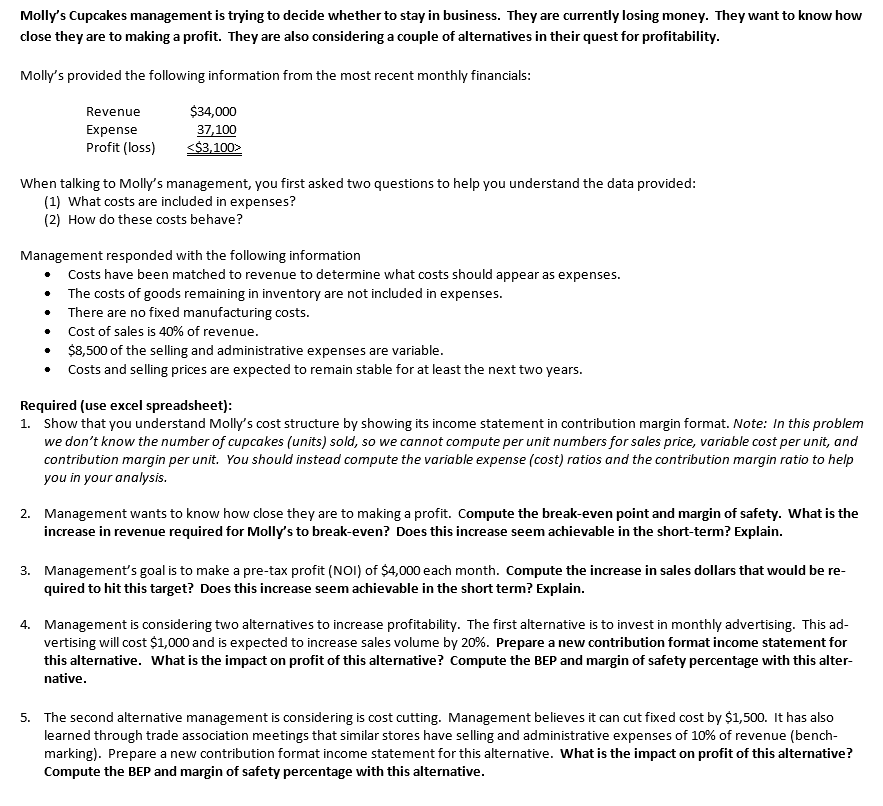

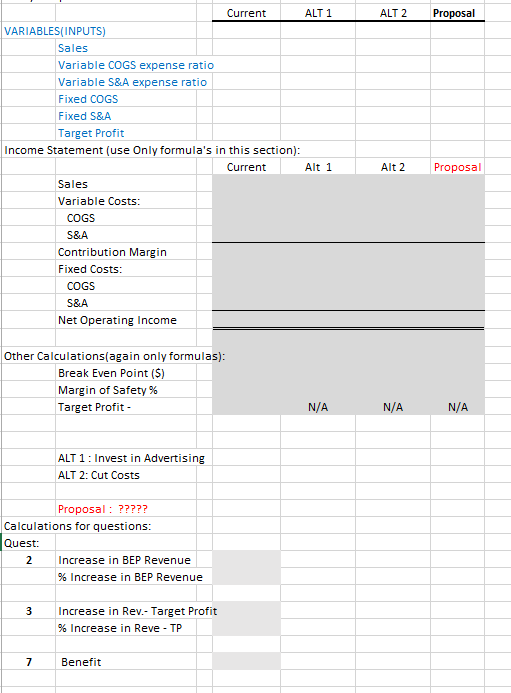

Molly's Cupcakes management is trying to decide whether to stay in business. They are currently losing money. They want to know how close they are to making a profit. They are also considering a couple of alternatives in their quest for profitability Molly's provided the following information from the most recent monthly financials: Revenue Expense Profit (loss) 3,1002 $34,000 37,100 When talking to Molly's management, you first asked two questions to help you understand the data provided: (1) What costs are included in expenses? (2) How do these costs behave? Management responded with the following information Costs have been matched to revenue to determine what costs should appear as expenses. The costs of goods remaining in inventory are not included in expenses There are no fixed manufacturing costs. Cost of sales is 40% of revenue $8,500 of the selling and administrative expenses are variable Costs and selling prices are expected to remain stable for at least the next two years . . Required (use excel spreadsheet): 1. Show that you understand Molly's cost structure by showing its income statement in contribution margin format. Note: In this problem we don't know the number of cupcakes (units) sold, so we cannot compute per unit numbers for sales price, variable cost per unit, and contribution margin per unit. You should instead compute the variable expense (cost) ratios and the contribution margin ratio to help you in your analysis 2. Management wants to know how close they are to making a profit. Compute the break-even point and margin of safety. What is the increase in revenue required for Molly's to break-even? Does this increase seem achievable in the short-term? Explain Management's goal is to make a pre-tax profit (NOI) of $4,000 each month. Compute the increase in sales dollars that would be re quired to hit this target? Does this increase seem achievable in the short term? Explain 3. Management is considering two alternatives to increase profitability. The first alternative is to invest in monthly advertising. This ad vertising will cost $1,000 and is expected to increase sales volume by 20%. Prepare a new contribution format income statement for this alternative. What is the impact on profit of this alternative? Compute the BEP and margin of safety percentage with this alter native 4. The second alternative management is considering is cost cutting. Management believes it can cut fixed cost by $1,500. It has also learned through trade association meetings that similar stores have selling and administrative expenses of 10% of revenue (bench- marking). Prepare a new contribution format income statement for this alternative. What is the impact on profit of this alternative? Compute the BEP and margin of safety percentage with this alternative 5