Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Molson Coors has expected earnings per share of $4.47. Financial data for its two closest competitors are given in the table below. If their average

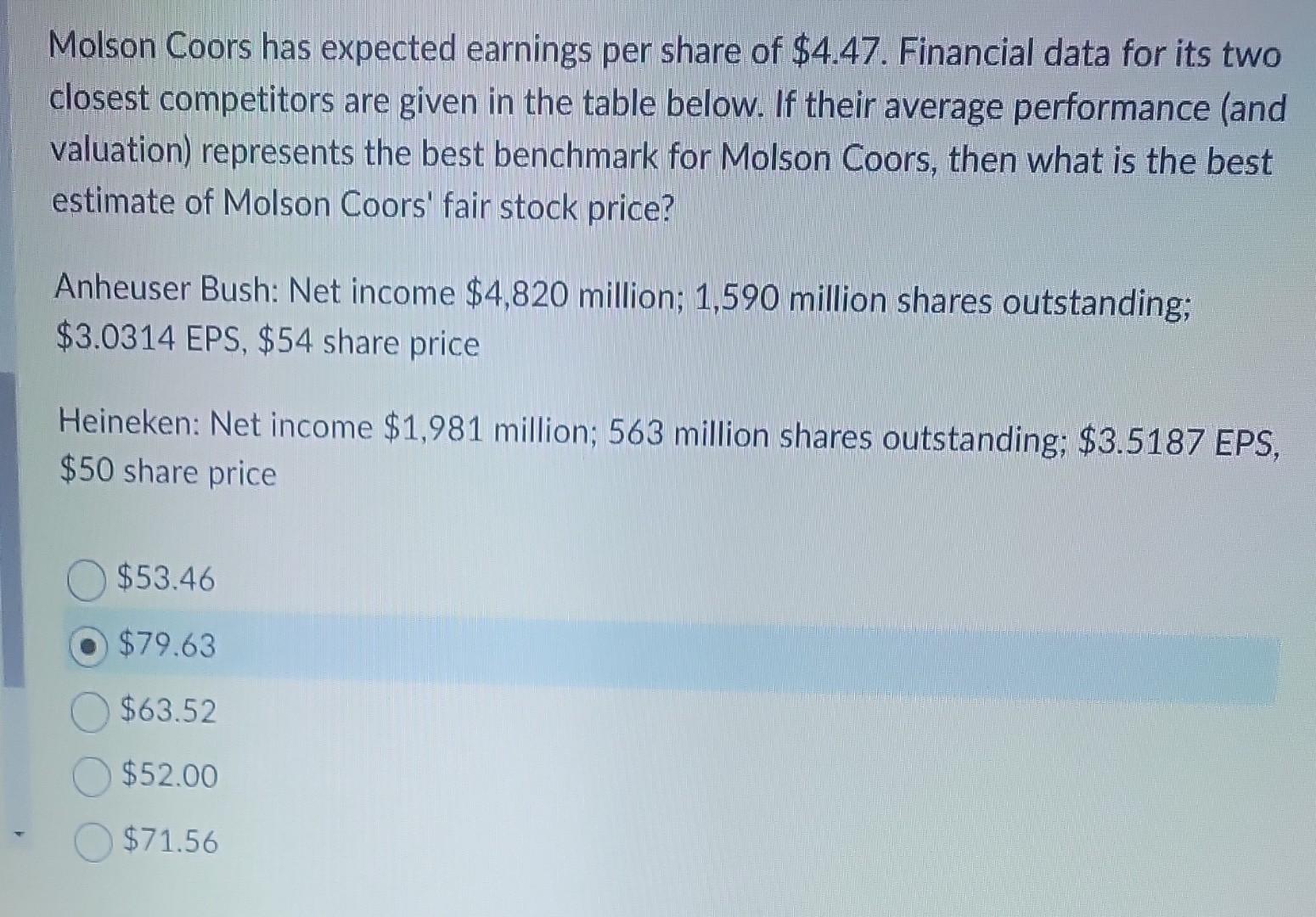

Molson Coors has expected earnings per share of $4.47. Financial data for its two closest competitors are given in the table below. If their average performance (and valuation) represents the best benchmark for Molson Coors, then what is the best estimate of Molson Coors' fair stock price? Anheuser Bush: Net income $4,820 million; 1,590 million shares outstanding; $3.0314 EPS, $54 share price Heineken: Net income $1,981 million; 563 million shares outstanding; $3.5187 EPS, $50 share price $53.46 $79.63 $63.52 $52.00 $71.56

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started