Question

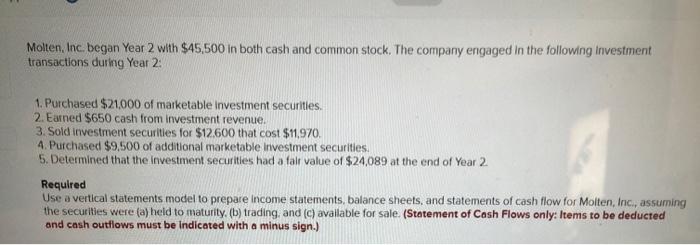

Molten, Inc. began Year 2 with $45,500 in both cash and common stock. The company engaged in the following investment transactions during Year 2: Purchased

Molten, Inc. began Year 2 with $45,500 in both cash and common stock. The company engaged in the following investment transactions during Year 2: Purchased $21,000 of marketable investment securities. Earned $650 cash from investment revenue. Sold investment securities for $12,600 that cost $11,970. Purchased $9,500 of additional marketable investment securities. Determined that the investment securities had a fair value of $24,089 at the end of Year 2.

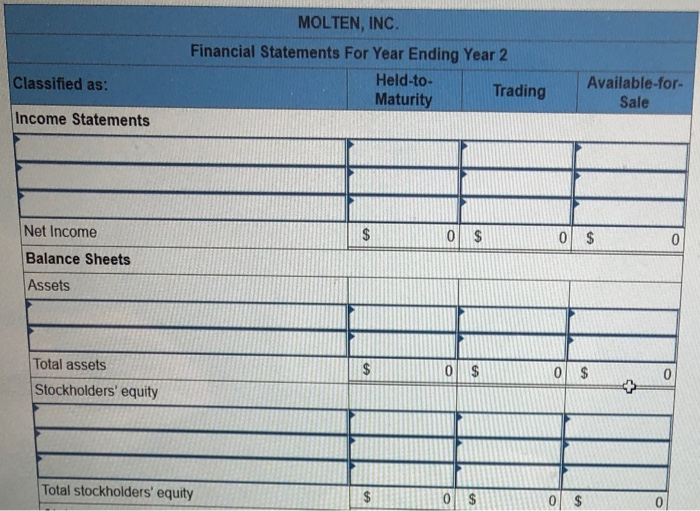

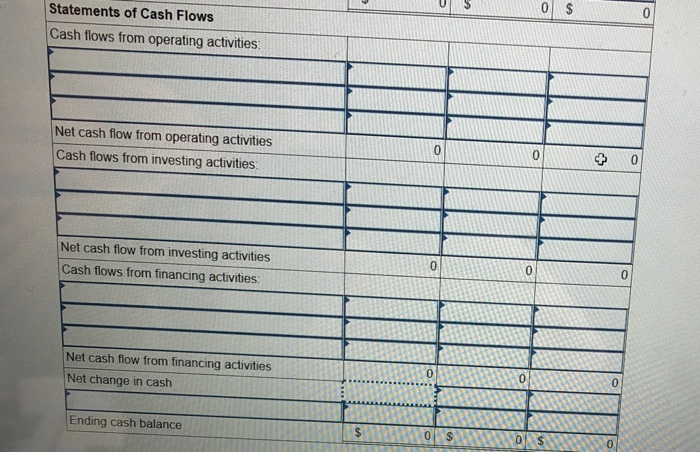

Required: Use a vertical statements model to prepare income statements, balance sheets, and statements of cash flow for Molten, Inc., assuming the securities were (a) held to maturity, (b) trading, and (c) available for sale. (Statement of Cash Flows only: Items to be deducted and cash outflows must be indicated with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started