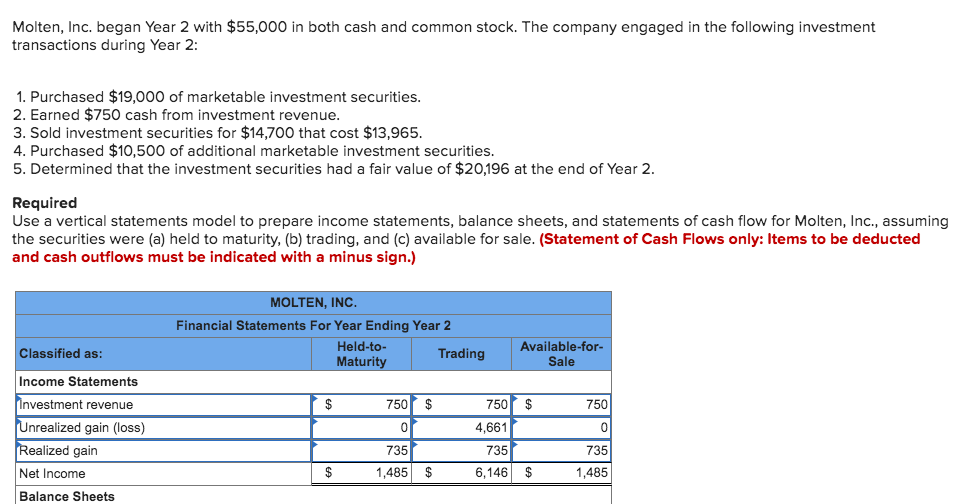

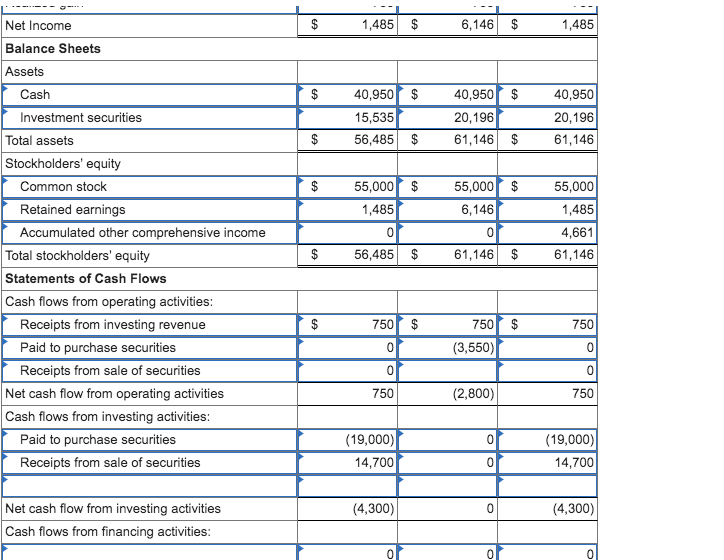

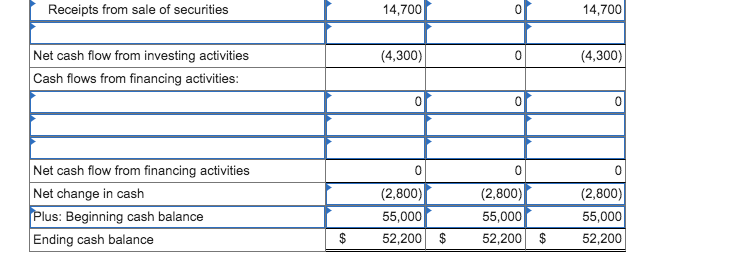

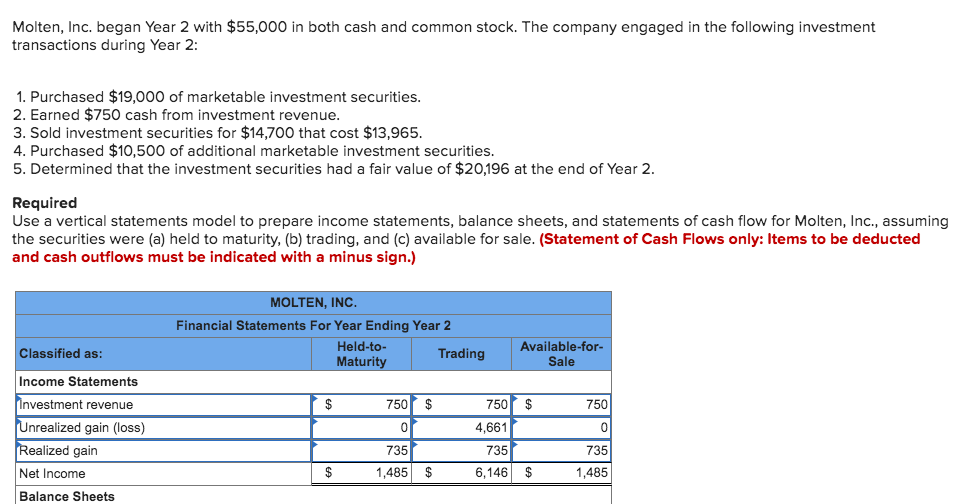

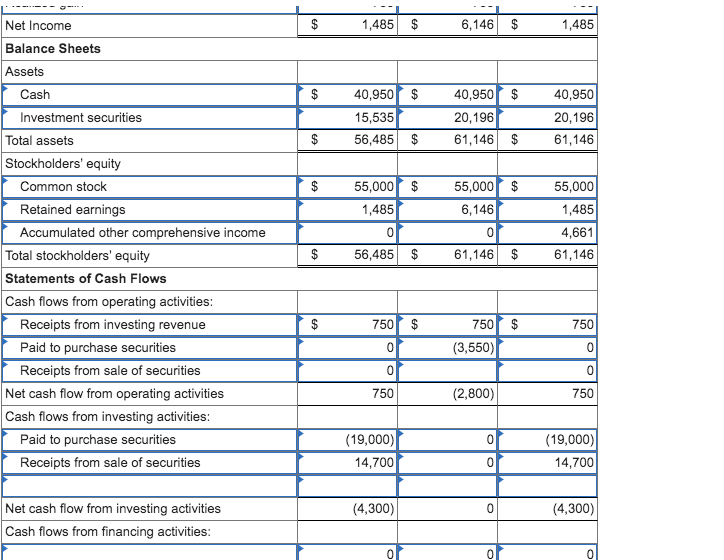

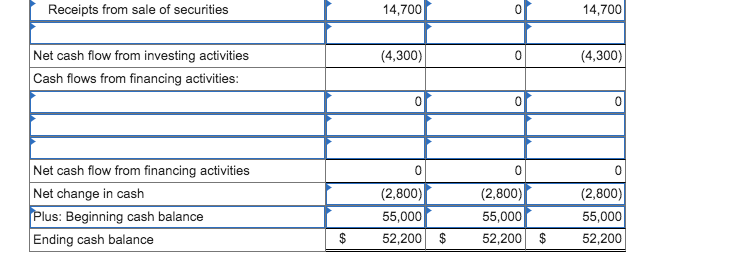

Molten, Inc. began Year 2 with $55,000 in both cash and common stock. The company engaged in the following investment transactions during Year 2: 1. Purchased $19,000 of marketable investment securities. 2. Earned $750 cash from investment revenue. 3. Sold investment securities for $14,700 that cost $13,965. 4. Purchased $10,500 of additional marketable investment securities. 5. Determined that the investment securities had a fair value of $20,196 at the end of Year 2. Required Use a vertical statements model to prepare income statements, balance sheets, and statements of cash flow for Molten, Inc., assuming the securities were (a) held to maturity, (b) trading, and (c) available for sale. (Statement of Cash Flows only: Items to be deducted and cash outflows must be indicated with a minus sign.) MOLTEN, INC. Financial Statements For Year Ending Year 2 Held-to- Trading Maturity Classified as: Available-for- Sale Income Statements $ 750 $ 750 750 $ 4,661 0 0 Investment revenue Unrealized gain (loss) Realized gain Net Income Balance Sheets 735 1,485 $ 735 6,146 $ 735 1,485 $ $ 1,485 $ 6,146 $ 1,485 $ 40,950 $ 15,535 56,485 $ 40,950 $ 20,196 61,146 $ 40,950 20,196 61,146 $ 55,000 $ 6,146 Net Income Balance Sheets Assets Cash Investment securities Total assets Stockholders' equity Common stock Retained earnings Accumulated other comprehensive income Total stockholders' equity Statements of Cash Flows Cash flows from operating activities: Receipts from investing revenue Paid to purchase securities Receipts from sale of securities Net cash flow from operating activities Cash flows from investing activities: Paid to purchase securities Receipts from sale of securities 55,000 $ 1,485 0 56,485 $ 55,000 1,485 4,661 61,146 0 $ 61,146 $ $ 750 $ 750 $ 750 0 (3,550) 0 0 750 (2,800) 750 0 (19,000) 14,700 (19,000) 14,700 0 (4,300) 0 (4,300) Net cash flow from investing activities Cash flows from financing activities: 0 0 Receipts from sale of securities 14,700 0 14,700 (4,300) 0 (4,300) Net cash flow from investing activities Cash flows from financing activities: 0 0 0 0 0 Net cash flow from financing activities Net change in cash Plus: Beginning cash balance Ending cash balance (2,800) 55,000 52,200 $ (2,800) 55,000 52,200 $ (2,800)| 55,000 52,200 $ Molten, Inc. began Year 2 with $55,000 in both cash and common stock. The company engaged in the following investment transactions during Year 2: 1. Purchased $19,000 of marketable investment securities. 2. Earned $750 cash from investment revenue. 3. Sold investment securities for $14,700 that cost $13,965. 4. Purchased $10,500 of additional marketable investment securities. 5. Determined that the investment securities had a fair value of $20,196 at the end of Year 2. Required Use a vertical statements model to prepare income statements, balance sheets, and statements of cash flow for Molten, Inc., assuming the securities were (a) held to maturity, (b) trading, and (c) available for sale. (Statement of Cash Flows only: Items to be deducted and cash outflows must be indicated with a minus sign.) MOLTEN, INC. Financial Statements For Year Ending Year 2 Held-to- Trading Maturity Classified as: Available-for- Sale Income Statements $ 750 $ 750 750 $ 4,661 0 0 Investment revenue Unrealized gain (loss) Realized gain Net Income Balance Sheets 735 1,485 $ 735 6,146 $ 735 1,485 $ $ 1,485 $ 6,146 $ 1,485 $ 40,950 $ 15,535 56,485 $ 40,950 $ 20,196 61,146 $ 40,950 20,196 61,146 $ 55,000 $ 6,146 Net Income Balance Sheets Assets Cash Investment securities Total assets Stockholders' equity Common stock Retained earnings Accumulated other comprehensive income Total stockholders' equity Statements of Cash Flows Cash flows from operating activities: Receipts from investing revenue Paid to purchase securities Receipts from sale of securities Net cash flow from operating activities Cash flows from investing activities: Paid to purchase securities Receipts from sale of securities 55,000 $ 1,485 0 56,485 $ 55,000 1,485 4,661 61,146 0 $ 61,146 $ $ 750 $ 750 $ 750 0 (3,550) 0 0 750 (2,800) 750 0 (19,000) 14,700 (19,000) 14,700 0 (4,300) 0 (4,300) Net cash flow from investing activities Cash flows from financing activities: 0 0 Receipts from sale of securities 14,700 0 14,700 (4,300) 0 (4,300) Net cash flow from investing activities Cash flows from financing activities: 0 0 0 0 0 Net cash flow from financing activities Net change in cash Plus: Beginning cash balance Ending cash balance (2,800) 55,000 52,200 $ (2,800) 55,000 52,200 $ (2,800)| 55,000 52,200 $