Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mondelez International OREO Cadbury Solite COSY Mondelez Kinh Do Vietnam (MKD) is part of the Mondelz International family of companies, the world's largest snacking

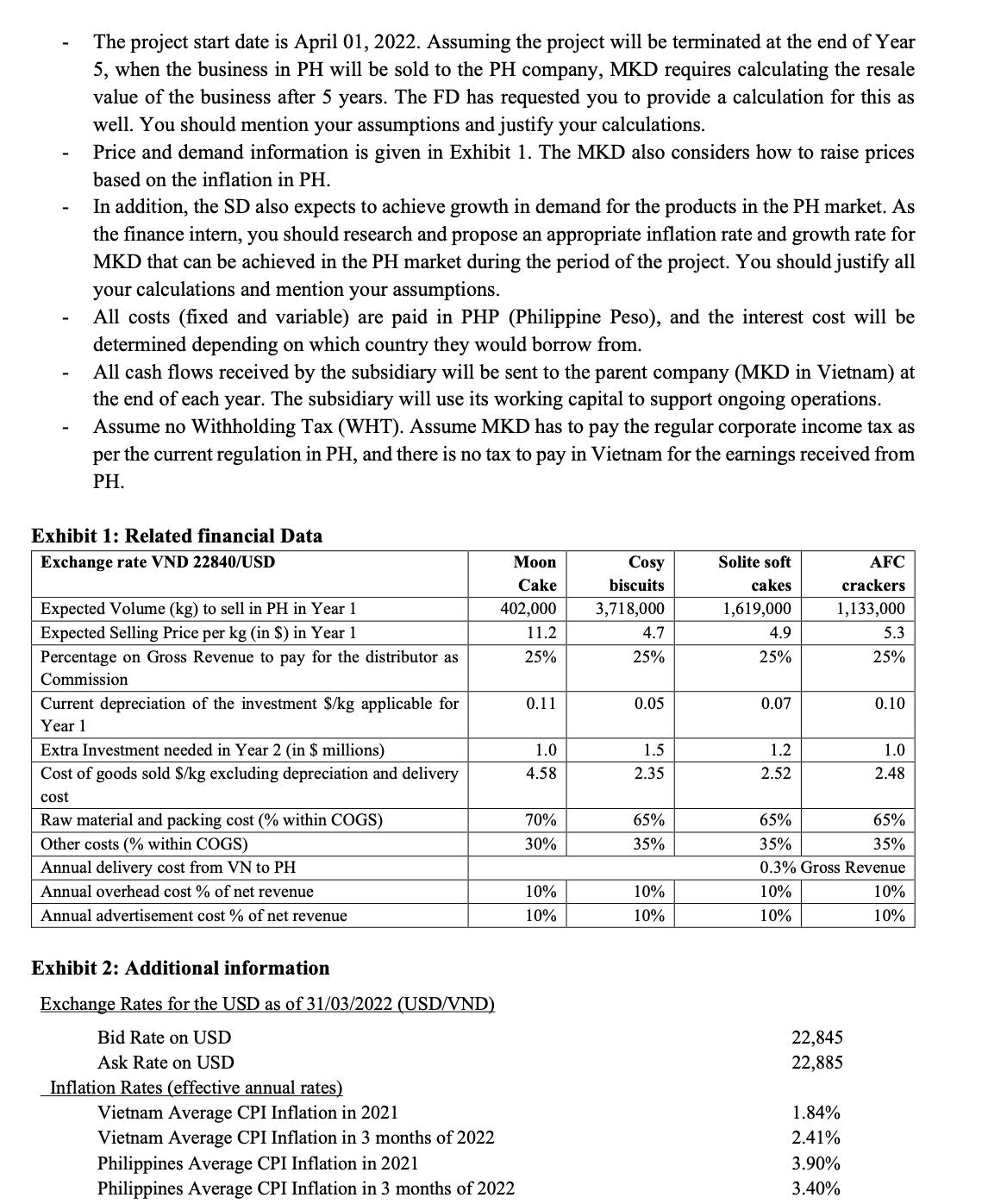

Mondelez International OREO Cadbury Solite COSY Mondelez Kinh Do Vietnam (MKD) is part of the Mondelz International family of companies, the world's largest snacking company. The Company launched in July 2015, after Mondelz International's acquisition of Vietnam's big Kinh Do snacks company. The business has manufacturing sites at Binh Duong and Hung Yen and a representative office in Ho Chi Minh City. Mondelez Kinh Do Vietnam owns a combined portfolio of leading snack brands of reputed Kinh Do moon cakes and biscuits, Cosy biscuits, Solite soft cakes, AFC crackers, and international brands such as Oreo cookies, Ritz crackers and Cadbury chocolate, candy, gum, and powdered beverages. AFC KINH DO RITZ LU ERONE HALLS TANG Trident The Sales Director (SD) of the Company met the Finance Director (FD) recently to obtain some financial advice. The Sales Director requires evaluating the decision to enter the international markets, especially setting up a distribution network for selling MKD unique Moon-cake, Cosy biscuits, Solite soft cakes, AFC crackers in the Philippines (PH). PH is the nearby market, and Filipinos also love sweet food, which MKD can consider expanding the footprint for extra revenue and profit from FY2022 onward. KinhDo MoonCake is the leading category for MKD with almost 70% market Share in VN, with the best quality and advanced production lines in both North and South plants. However, this product is generally sold from late July to early September every year. The Cosy biscuits, Solite soft cakes, and AFC crackers are also great products of MKD with almost 20% market share in Vietnam can be sold throughout the year in PH and sell more during the big festive seasons: Christmas and new year. Initially, the plan is to produce products in Vietnam, set up one representative office in PH, and find a few distributors in PH to set up the product-introduction-store and distribute the products in PH. The Sales Director and the Finance Director discussed the following financial elements together: The Company has sufficient capacity to accommodate the PH business expansion within the first 12 months. However, it still needs to allocate the depreciation cost to the PH business in the first year. Furthermore, the Company requires an extra investment of 4.7 million USD for a new production line in year 2. The Company's general practice is to depreciate any investment over 10 years using the straight-line depreciation method. The Company will need an initial working capital of 4 million USD to run the business in PH to cover the expenses to rent the office, hire employees, and advertise the product in PH. KD is considering borrowing the funds required for the working capital investment and the extra investment in year 2. As an intern of the Company, FD has requested you to analyse different alternatives and suggest the best market to borrow. Should the Company borrow from the VN market or the PH market? The project start date is April 01, 2022. Assuming the project will be terminated at the end of Year 5, when the business in PH will be sold to the PH company, MKD requires calculating the resale value of the business after 5 years. The FD has requested you to provide a calculation for this as well. You should mention your assumptions and justify your calculations. Price and demand information is given in Exhibit 1. The MKD also considers how to raise prices based on the inflation in PH. In addition, the SD also expects to achieve growth in demand for the products in the PH market. As the finance intern, you should research and propose an appropriate inflation rate and growth rate for MKD that can be achieved in the PH market during the period of the project. You should justify all your calculations and mention your assumptions. All costs (fixed and variable) are paid in PHP (Philippine Peso), and the interest cost will be determined depending on which country they would borrow from. All cash flows received by the subsidiary will be sent to the parent company (MKD in Vietnam) at the end of each year. The subsidiary will use its working capital to support ongoing operations. Assume no Withholding Tax (WHT). Assume MKD has to pay the regular corporate income tax as per the current regulation in PH, and there is no tax to pay in Vietnam for the earnings received from PH. Exhibit 1: Related financial Data Exchange rate VND 22840/USD Expected Volume (kg) to sell in PH in Year 1 Expected Selling Price per kg (in $) in Year 1 Percentage on Gross Revenue to pay for the distributor as Commission Current depreciation of the investment $/kg applicable for Year 1 Extra Investment needed in Year 2 (in $ millions) Cost of goods sold $/kg excluding depreciation and delivery cost Raw material and packing cost (% within COGS) Other costs (% within COGS) Annual delivery cost from VN to PH Annual overhead cost % of net revenue Annual advertisement cost % of net revenue Exhibit 2: Additional information Exchange Rates for the USD as of 31/03/2022 (USD/VND) Bid Rate on USD Ask Rate on USD Inflation Rates (effective annual rates) Moon Cake 402,000 11.2 25% Vietnam Average CPI Inflation in 2021 Vietnam Average CPI Inflation in 3 months of 2022 Philippines Average CPI Inflation in 2021 Philippines Average CPI Inflation in 3 months of 2022 0.11 1.0 4.58 70% 30% 10% 10% Cosy biscuits 3,718,000 4.7 25% 0.05 1.5 2.35 65% 35% 10% 10% Solite soft cakes 1,619,000 4.9 25% 0.07 1.2 2.52 AFC crackers 1,133,000 22,845 22,885 5.3 25% 1.84% 2.41% 3.90% 3.40% 0.10 65% 35% 0.3% Gross Revenue. 10% 10% 1.0 2.48 65% 35% 10% 10% Questions Since you are a Finance intern at MKD and have studied the International Finance course, the FD requires you to do the following calculations and analyse this project. 1. You have studied different models (PPP, IRP, IFE, Macro model, Composite model) to predict the exchange rate. You must select one of these models and forecast the necessary exchange rates to convert the cash flows from the PH project into the parent company currency. (Hint: Mondelez International prepares financial statements in USD). You are required to research and find the required data for this calculation. You need to explain your assumptions and data and mention the data sources used. (10 marks) 2. Determine the net present value (NPV) of this project from the parent company's perspective and assume the Company will remain unhedged. Should MKD proceed with this project? You should clearly state your assumptions and justify your assumptions with valid research-based evidence and additional data and information. (20 marks) 3. The FD requires you to prepare a risk management plan for this project using your knowledge of Risk Management Strategies. You should compare different hedging strategies and unhedged positions and provide a conclusion. You should find the required data for the calculations and justify your decisions. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Mondelez Kinh Do Vietnam MKD is a subsidiary of Mondelz International a multinational food and beverage company headquartered in Illinois United State...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started