Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Money Bank Coffee Company Ltd. (MBCCL) has $7 million in current assets which consists of cash $2 million, inventory of $1million and the balance

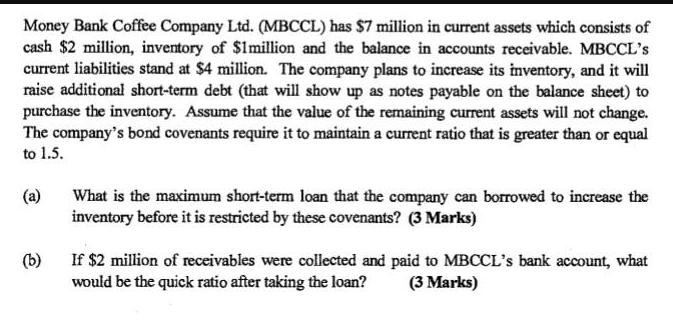

Money Bank Coffee Company Ltd. (MBCCL) has $7 million in current assets which consists of cash $2 million, inventory of $1million and the balance in accounts receivable. MBCCL's current liabilities stand at $4 million. The company plans to increase its inventory, and it will raise additional short-term debt (that will show up as notes payable on the balance sheet) to purchase the inventory. Assume that the value of the remaining current assets will not change. The company's bond covenants require it to maintain a current ratio that is greater than or equal to 1.5. (a) (b) What is the maximum short-term loan that the company can borrowed to increase the inventory before it is restricted by these covenants? (3 Marks) If $2 million of receivables were collected and paid to MBCCL's bank account, what would be the quick ratio after taking the loan? (3 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Current Ratio Current Assets Current Liabilities Given Current Assets Cash 2m Inventory 1m Receiva...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started