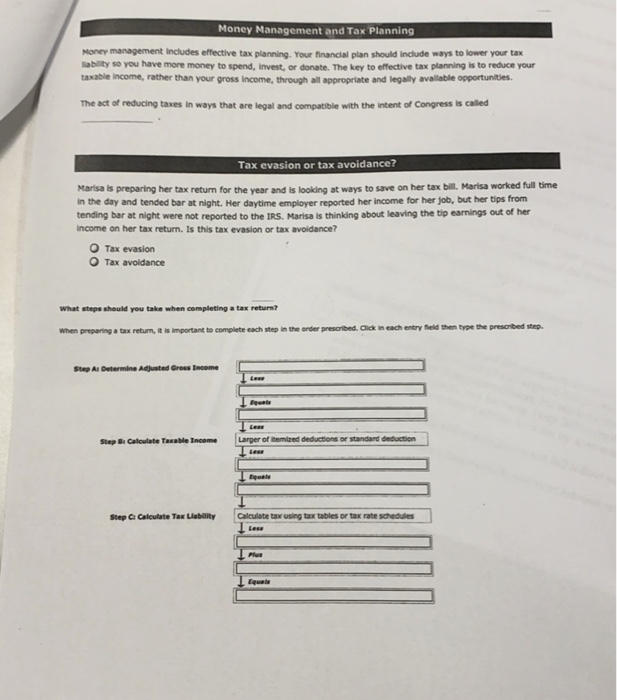

Money Management and Tax Planning Money management Includes effective tax planning Your financial plan should include ways to lower your tax sabity so you have more money to spend, Investor donate. The key to effective tax planning is to reduce your taxable income, rather than your gross income through all appropriate and legally available opportunities. The act of reducing taxes in ways that are legal and compatible with the intent of Congress is called Tax evasion or tax avoidance? Marisa is preparing her tax return for the year and is lookina at ways to save on her tax bill. Marisa worked full time in the day and tended bar at night. Her daytime employer reported her income for her job, but her tips from tending bar at night were not reported to the IRS. Marisa Is thinking about leaving the tip earnings out of her income on her tax return. Is this tax evasion or tax avoidance? Tax evasion Tax avoidance What steps should you take when completing a tax return? When preparing a tax return, it is important to complete each step in the order prescribed. Click in each entry Beld then type the prescribed ep. Step Ai Determine Adjusted Gross income Step . Calculate Table Income Step : Calculate Tax Liability Calculate tax tables or tax rate schedules Money Management and Tax Planning Money management Includes effective tax planning Your financial plan should include ways to lower your tax sabity so you have more money to spend, Investor donate. The key to effective tax planning is to reduce your taxable income, rather than your gross income through all appropriate and legally available opportunities. The act of reducing taxes in ways that are legal and compatible with the intent of Congress is called Tax evasion or tax avoidance? Marisa is preparing her tax return for the year and is lookina at ways to save on her tax bill. Marisa worked full time in the day and tended bar at night. Her daytime employer reported her income for her job, but her tips from tending bar at night were not reported to the IRS. Marisa Is thinking about leaving the tip earnings out of her income on her tax return. Is this tax evasion or tax avoidance? Tax evasion Tax avoidance What steps should you take when completing a tax return? When preparing a tax return, it is important to complete each step in the order prescribed. Click in each entry Beld then type the prescribed ep. Step Ai Determine Adjusted Gross income Step . Calculate Table Income Step : Calculate Tax Liability Calculate tax tables or tax rate schedules