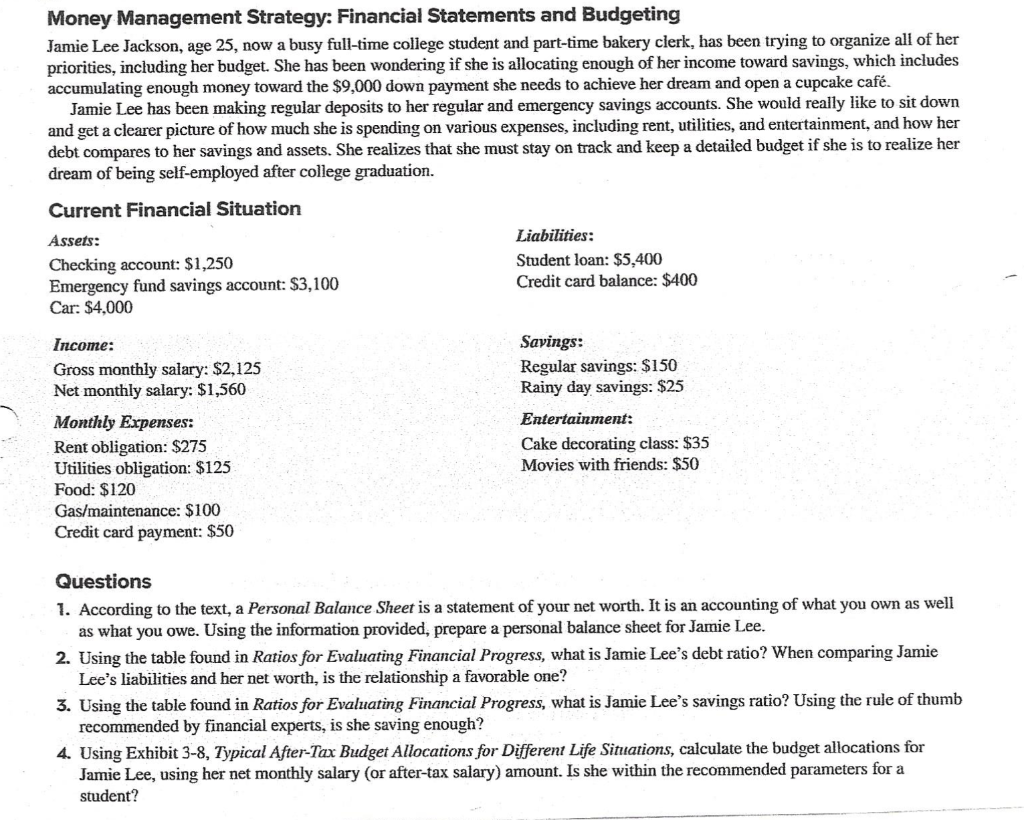

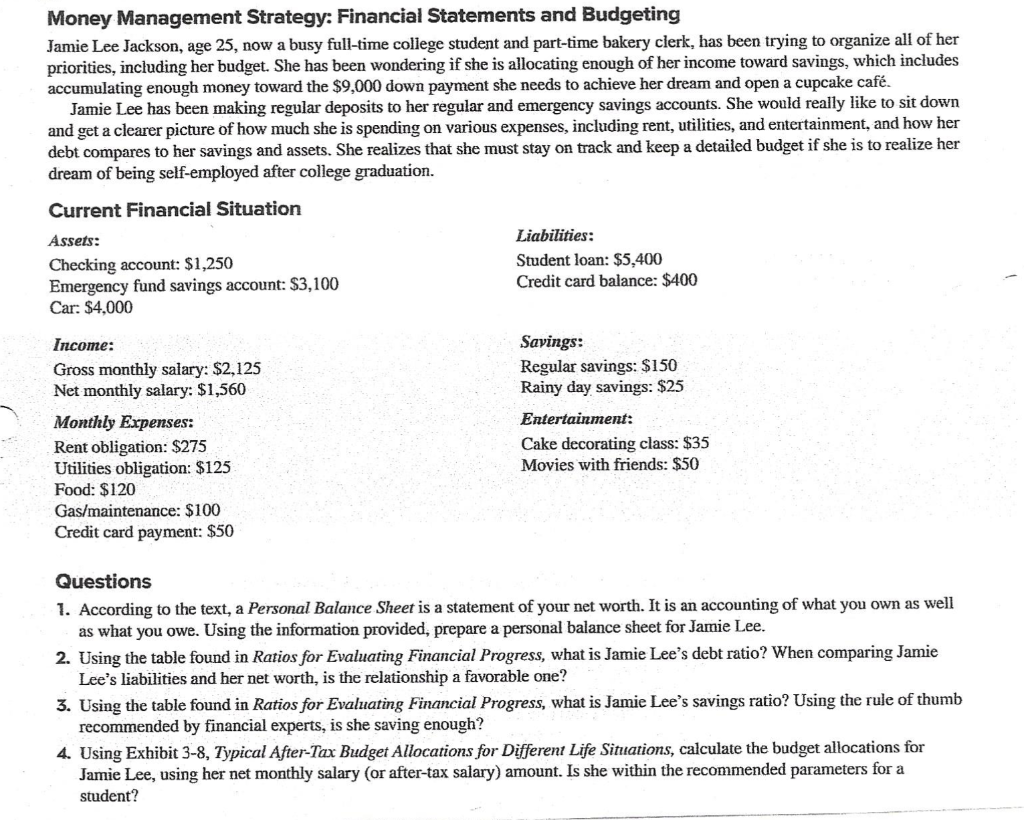

Money Management Strategy: Financial Statements and Budgeting Jamie Lee Jackson, age 25, now a busy full-time college student and part-time bakery clerk, has been trying to organize all of her priorities, including her budget. She has been wondering if she is allocating enough of her income toward savings, which includes accumulating enough money toward the $9,000 down payment she needs to achieve her dream and open a cupcake caf. Jamie Lee has been making regular deposits to her regular and emergency savings accounts. She would really like to sit down and get a clearer picture of how much she is spending on various expenses, including rent, utilities, and entertainment, and how her debt compares to her savings and assets. She realizes that she must stay on track and keep a detailed budget if she is to realize her dream of being self-employed after college graduation. Questions 1. According to the text, a Personal Balance Sheet is a statement of your net worth. It is an accounting of what you own as well as what you owe. Using the information provided, prepare a personal balance sheet for Jamie Lee. 2. Using the table found in Ratios for Evaluating Financial Progress, what is Jamie Lee's debt ratio? When comparing Jamie Lee's liabilities and her net worth, is the relationship a favorable one? 3. Using the table found in Ratios for Evaluating Financial Progress, what is Jamie Lee's savings ratio? Using the rule of thumb recommended by financial experts, is she saving enough? 4. Using Exhibit 3-8, Typical After-Tax Budget Allocations for Different Life Situations, calculate the budget allocations for Jamie Lee, using her net monthly salary (or after-tax salary) amount. Is she within the recommended parameters for a student? Money Management Strategy: Financial Statements and Budgeting Jamie Lee Jackson, age 25, now a busy full-time college student and part-time bakery clerk, has been trying to organize all of her priorities, including her budget. She has been wondering if she is allocating enough of her income toward savings, which includes accumulating enough money toward the $9,000 down payment she needs to achieve her dream and open a cupcake caf. Jamie Lee has been making regular deposits to her regular and emergency savings accounts. She would really like to sit down and get a clearer picture of how much she is spending on various expenses, including rent, utilities, and entertainment, and how her debt compares to her savings and assets. She realizes that she must stay on track and keep a detailed budget if she is to realize her dream of being self-employed after college graduation. Questions 1. According to the text, a Personal Balance Sheet is a statement of your net worth. It is an accounting of what you own as well as what you owe. Using the information provided, prepare a personal balance sheet for Jamie Lee. 2. Using the table found in Ratios for Evaluating Financial Progress, what is Jamie Lee's debt ratio? When comparing Jamie Lee's liabilities and her net worth, is the relationship a favorable one? 3. Using the table found in Ratios for Evaluating Financial Progress, what is Jamie Lee's savings ratio? Using the rule of thumb recommended by financial experts, is she saving enough? 4. Using Exhibit 3-8, Typical After-Tax Budget Allocations for Different Life Situations, calculate the budget allocations for Jamie Lee, using her net monthly salary (or after-tax salary) amount. Is she within the recommended parameters for a student