Answered step by step

Verified Expert Solution

Question

1 Approved Answer

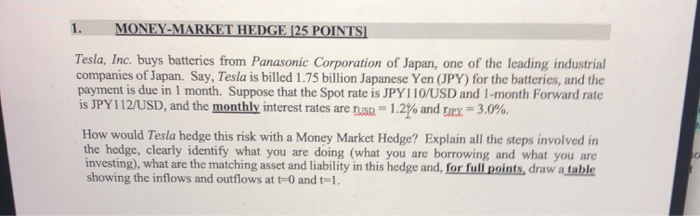

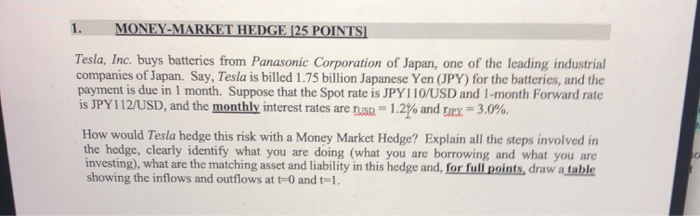

money market question 1. MONEY-MARKET HEDGE 125 POINTSI Tesla, Inc. buys batteries from Panasonic Corporation of Japan, one of the leading industrial companies of Japan.

money market question

1. MONEY-MARKET HEDGE 125 POINTSI Tesla, Inc. buys batteries from Panasonic Corporation of Japan, one of the leading industrial companies of Japan. Say, Tesla is billed 1.75 billion Japanese Yen (JPY) for the batteries, and the payment is due in 1 month. Suppose that the Spot rate is JPY 110/USD and 1-month Forward rate is JPY112/USD, and the monthly interest rates are use. - 1.2% and tex 3.0%. How would Tesla hedge this risk with a Money Market Hedge? Explain all the steps involved in the hedge, clearly identify what you are doing what you are borrowing and what you are investing), what are the matching asset and liability in this hedge and, for full points, draw a table showing the inflows and outflows at t=0 and t-1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started