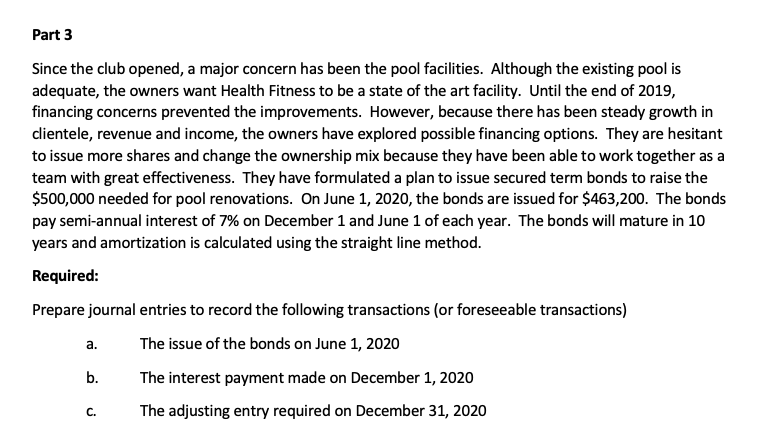

Monique and her two colleagues, Jim and Roz, are personal trainers at an upscale health spa in Kingston, ON. They want to start a health club that specializes in plans for people in the 50+ age group. The growing population in this age group and strong consumer interest in the health benefits of physical activity have convinced them they can profitably operate their own club. After deciding to incorporate, each of the three receives 20,000 no par value common shares on June 12, 2018, in exchange for their co-owned building ($180,000 market value) and the $120,000 total cash they contributed to the business. Monique, Jim and Roz now need to decide how to obtain financing for renovations, and equipment. They understand the difference between equity securities and debt securities, but do not understand the income tax, net income and EPS consequences of equity versus debt financing on the future of their business. Required: You have been hired as a consultant for the Health Spa. You have been asked to prepare notes for discussion with the three entrepreneurs in which you will compare the consequences of using equity versus debt financing. As part of your notes, show the differences in interest and income tax expense assuming $1,400,000 is financed. Assume 140,000 shares will be issued at $10 per in order to raise capital. Also assume the rate on the debt is 9%, the income tax rate is 30%, and income earned before tax is $160,000. This comparison can be completed using a table. Part 2 During the discussion about financing, Roz mentions that one of her clients, Tony, has approached her about buying a significant interest in the new club. Having an interested investor convinces the three to issue equity to provide the financing they need. On July 21, 2018, Tony buys 140,000 shares at a price of $10 per share. The club, Health Fitness, opens on January 12, 2019, and after a slow start, begins to produce the revenue desired by the owners. The owners decide to pay themselves a stock dividend, since cash has been less than abundant since they opened their doors. The 5% stock dividend is declared on July 27, 2019. The market value of the shares is $1.50 on the declaration date. The date of record in July 31, 2019 (there are no changes in ownership), and the issue date is August 15, 2019. By the middle of the fourth quarter of 2019, the cash flow has improved to the point where the owners feel ready to pay themselves a cash dividend. They declare a $0.10 cash dividend on December 4, 2019. The record date is December 14, 2019 and the payment date is December 24, 2019. Required Record all of the transactions related to the common shares of Health Fitness during the years 2011 and 2012. Also, indicate the total number of shares issues after the stock dividend is issued. Part 3 Since the club opened, a major concern has been the pool facilities. Although the existing pool is adequate, the owners want Health Fitness to be a state of the art facility. Until the end of 2019, financing concerns prevented the improvements. However, because there has been steady growth in clientele, revenue and income, the owners have explored possible financing options. They are hesitant to issue more shares and change the ownership mix because they have been able to work together as a team with great effectiveness. They have formulated a plan to issue secured term bonds to raise the $500,000 needed for pool renovations. On June 1, 2020, the bonds are issued for $463,200. The bonds pay semi-annual interest of 7% on December 1 and June 1 of each year. The bonds will mature in 10 years and amortization is calculated using the straight line method. Required: Prepare journal entries to record the following transactions (or foreseeable transactions) The issue of the bonds on June 1, 2020 b. The interest payment made on December 1, 2020 The adjusting entry required on December 31, 2020 a. C. Monique and her two colleagues, Jim and Roz, are personal trainers at an upscale health spa in Kingston, ON. They want to start a health club that specializes in plans for people in the 50+ age group. The growing population in this age group and strong consumer interest in the health benefits of physical activity have convinced them they can profitably operate their own club. After deciding to incorporate, each of the three receives 20,000 no par value common shares on June 12, 2018, in exchange for their co-owned building ($180,000 market value) and the $120,000 total cash they contributed to the business. Monique, Jim and Roz now need to decide how to obtain financing for renovations, and equipment. They understand the difference between equity securities and debt securities, but do not understand the income tax, net income and EPS consequences of equity versus debt financing on the future of their business. Required: You have been hired as a consultant for the Health Spa. You have been asked to prepare notes for discussion with the three entrepreneurs in which you will compare the consequences of using equity versus debt financing. As part of your notes, show the differences in interest and income tax expense assuming $1,400,000 is financed. Assume 140,000 shares will be issued at $10 per in order to raise capital. Also assume the rate on the debt is 9%, the income tax rate is 30%, and income earned before tax is $160,000. This comparison can be completed using a table. Part 2 During the discussion about financing, Roz mentions that one of her clients, Tony, has approached her about buying a significant interest in the new club. Having an interested investor convinces the three to issue equity to provide the financing they need. On July 21, 2018, Tony buys 140,000 shares at a price of $10 per share. The club, Health Fitness, opens on January 12, 2019, and after a slow start, begins to produce the revenue desired by the owners. The owners decide to pay themselves a stock dividend, since cash has been less than abundant since they opened their doors. The 5% stock dividend is declared on July 27, 2019. The market value of the shares is $1.50 on the declaration date. The date of record in July 31, 2019 (there are no changes in ownership), and the issue date is August 15, 2019. By the middle of the fourth quarter of 2019, the cash flow has improved to the point where the owners feel ready to pay themselves a cash dividend. They declare a $0.10 cash dividend on December 4, 2019. The record date is December 14, 2019 and the payment date is December 24, 2019. Required Record all of the transactions related to the common shares of Health Fitness during the years 2011 and 2012. Also, indicate the total number of shares issues after the stock dividend is issued. Part 3 Since the club opened, a major concern has been the pool facilities. Although the existing pool is adequate, the owners want Health Fitness to be a state of the art facility. Until the end of 2019, financing concerns prevented the improvements. However, because there has been steady growth in clientele, revenue and income, the owners have explored possible financing options. They are hesitant to issue more shares and change the ownership mix because they have been able to work together as a team with great effectiveness. They have formulated a plan to issue secured term bonds to raise the $500,000 needed for pool renovations. On June 1, 2020, the bonds are issued for $463,200. The bonds pay semi-annual interest of 7% on December 1 and June 1 of each year. The bonds will mature in 10 years and amortization is calculated using the straight line method. Required: Prepare journal entries to record the following transactions (or foreseeable transactions) The issue of the bonds on June 1, 2020 b. The interest payment made on December 1, 2020 The adjusting entry required on December 31, 2020 a. C