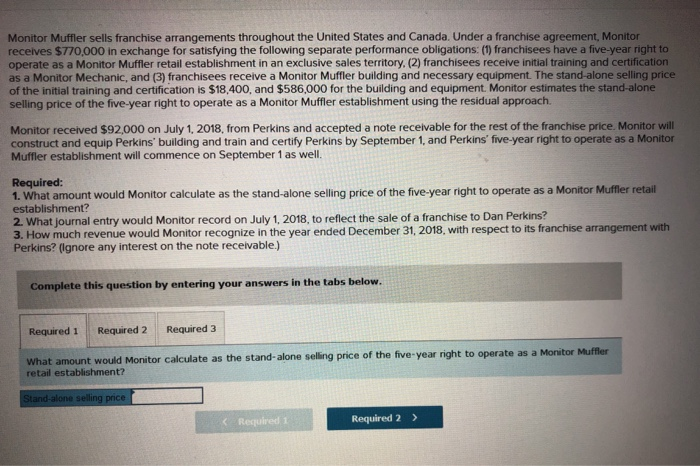

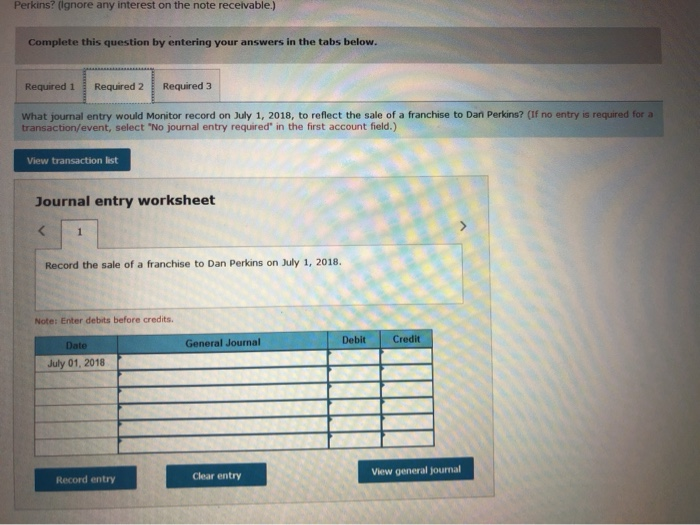

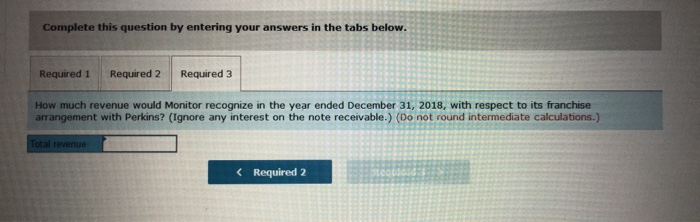

Monitor Muffler sells franchise arrangements throughout the United States and Canada. Under a franchise agreement. Monitor receives 5770.000 in exchange for satisfying the following separate performance obligations: (1) franchisees have a five-year right to operate as a Monitor Muffler retail establishment in an exclusive sales territory, (2) franchisees receive initial training and certification as a Monitor Mechanic, and (3) franchisees receive a Monitor Muffler building and necessary equipment. The stand-alone selling price of the initial training and certification is $18,400, and $586,000 for the building and equipment. Monitor estimates the stand-alone selling price of the five-year right to operate as a Monitor Muffler establishment using the residual approach. Monitor received $92,000 on July 1, 2018, from Perkins and accepted a note receivable for the rest of the franchise price Monitor will construct and equip Perkins' building and train and certify Perkins by September 1, and Perkins' five-year right to operate as a Monitor Muffier establishment will commence on September 1 as well Required: 1. What amount would Monitor calculate as the stand-alone selling price of the five-year right to operate as a Monitor Muffler retail establishment? 2. What journal entry would Monitor record on July 1, 2018. to reflect the sale of a franchise to Dan Perkins? 3. How much revenue would Monitor recognize in the year ended December 31, 2018, with respect to its franchise arrangement with Perkins? (Ignore any interest on the note receivable.) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What amount would Monitor calculate as the stand-alone selling price of the five-year right to operate as a Monitor Muffler retail establishment? Stand-alone selling price Required Required 2 > Perkins? (Ignore any interest on the note receivable.) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What journal entry would Monitor record on July 1, 2018, to reflect the sale of a franchise to Dan Perkins? (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet Record the sale of a franchise to Dan Perkins on July 1, 2018. Note: Enter debits before credits General Journal Debit Credit Date July 01, 2018 Clear entry View general journal Record entry