Answered step by step

Verified Expert Solution

Question

1 Approved Answer

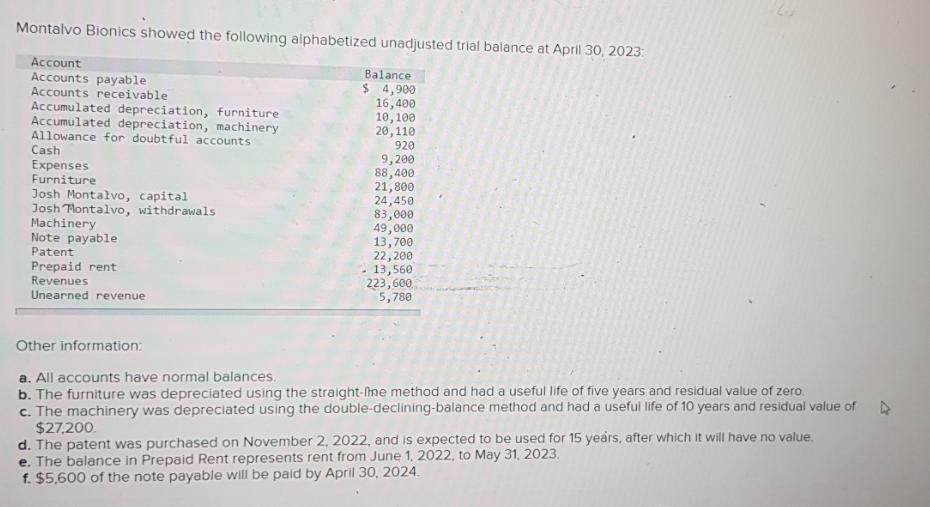

Montalvo Bionics showed the following alphabetized unadjusted trial balance at April 30, 2023: Account Accounts payable Accounts receivable Accumulated depreciation, furniture Accumulated depreciation, machinery

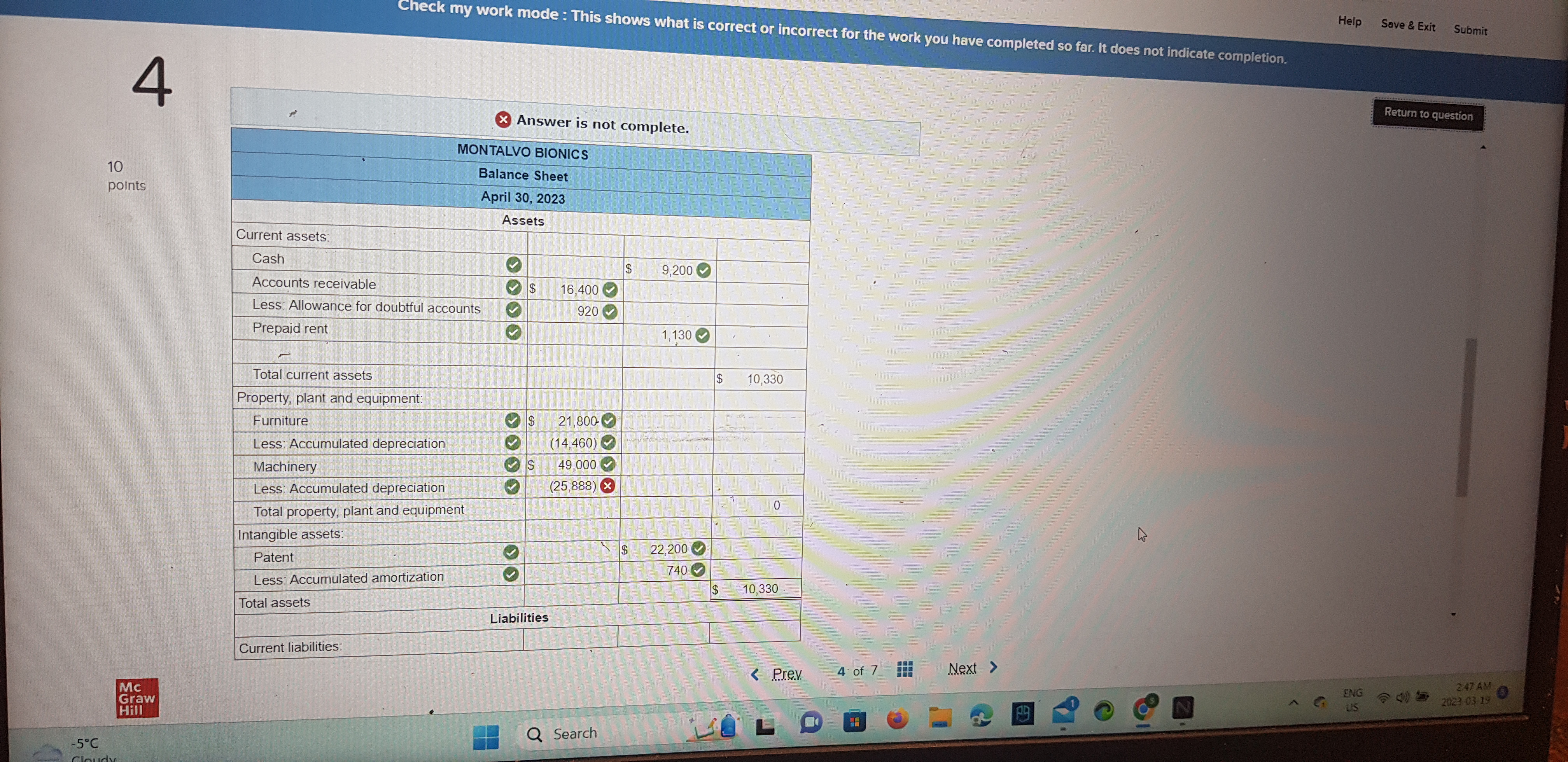

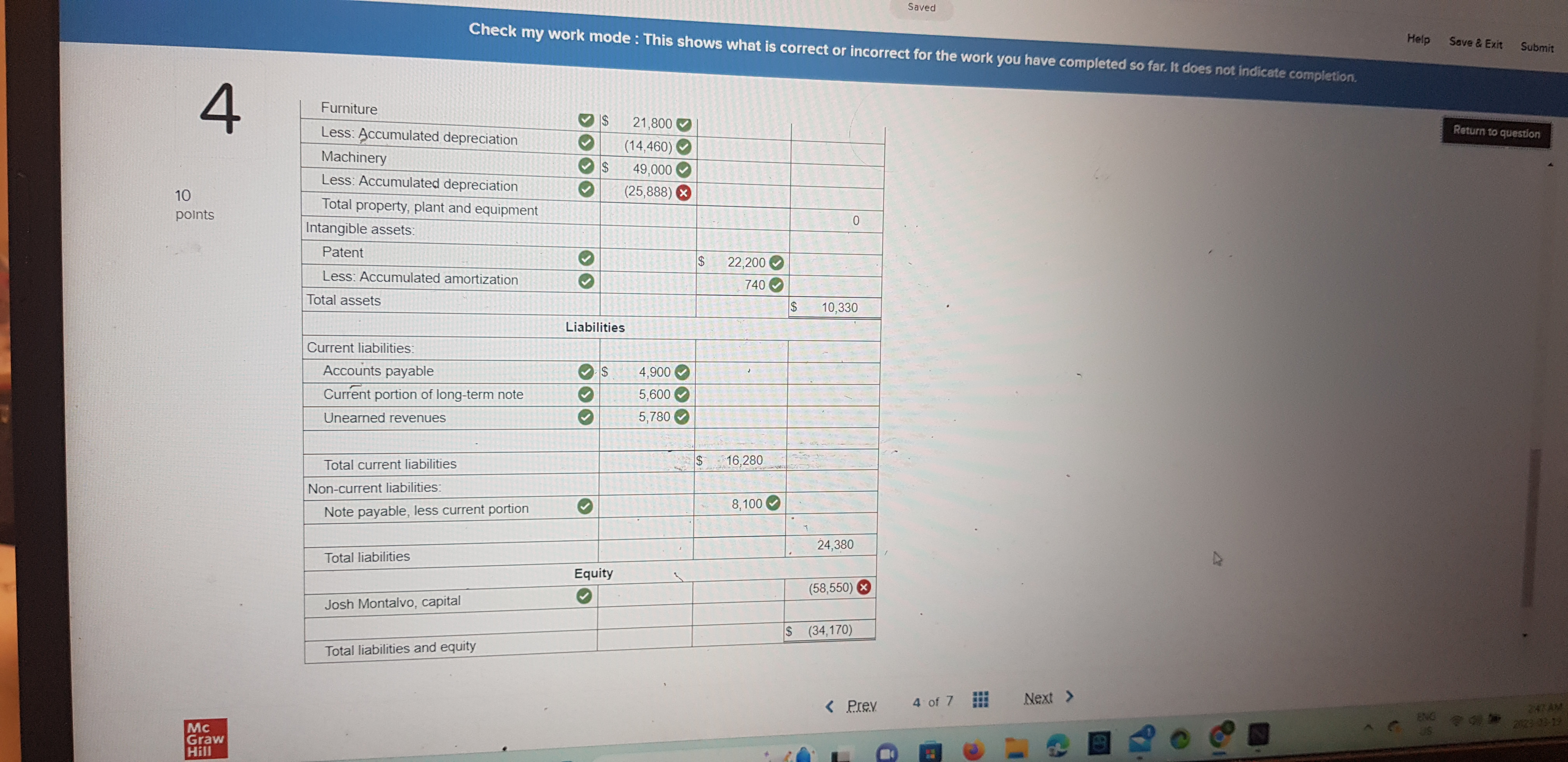

Montalvo Bionics showed the following alphabetized unadjusted trial balance at April 30, 2023: Account Accounts payable Accounts receivable Accumulated depreciation, furniture Accumulated depreciation, machinery Allowance for doubtful accounts Cash Expenses Furniture Josh Montalvo, capital Josh Montalvo, withdrawals Machinery Note payable Patent Prepaid rent Revenues Unearned revenue Balance $ 4,900 16,400 10,100 20,110 920 9,200 88,400 21,800 24,450 83,000 49,000 13,700 22,200 - 13,560 223,600 5,780 Other information: a. All accounts have normal balances. b. The furniture was depreciated using the straight-line method and had a useful life of five years and residual value of zero. c. The machinery was depreciated using the double-declining-balance method and had a useful life of 10 years and residual value of $27,200. d. The patent was purchased on November 2, 2022, and is expected to be used for 15 years, after which it will have no value. e. The balance in Prepaid Rent represents rent from June 1, 2022, to May 31, 2023. f. $5,600 of the note payable will be paid by April 30, 2024. 4 10 points Mc Graw Hill -5C Cloudy Current assets: Cash Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Help Save & Exit Answer is not complete. MONTALVO BIONICS Balance Sheet April 30, 2023 Assets Accounts receivable Less: Allowance for doubtful accounts Prepaid rent Total current assets S $ 9,200 16,400 920 1,130 Property, plant and equipment: Furniture $ 21,800 Less: Accumulated depreciation Machinery (14,460) $ 49,000 Less: Accumulated depreciation (25,888) x Total property, plant and equipment Intangible assets: Patent Less: Accumulated amortization Total assets Current liabilities: Liabilities $ 10,330 0 $ 22,200 740 $ 10,330 < Prev 4 of 7 Next > Q Search L 13 Submit Return to question ENG 2:47 AM US 2023-03 19 Saved Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. 4 Furniture Less: Accumulated depreciation Machinery Less: Accumulated depreciation 10 points Total property, plant and equipment Intangible assets: Patent Mc Graw Hill Less: Accumulated amortization Total assets Current liabilities: 69 $ 21,800 (14,460) $ 49,000 (25,888) Liabilities Accounts payable $ 4,900 Current portion of long-term note 5,600 Unearned revenues 5,780 Total current liabilities Non-current liabilities: Note payable, less current portion Total liabilities Equity Josh Montalvo, capital Total liabilities and equity 0 $ 22,200 740 $ 10,330 69 $ 16,280 8,100 24,380 (58,550) X $ (34,170) < Prev 4 of 7 Next > 47 Help Save & Exit Submit Return to question ENG 247AM 2123 33-19

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started