Question

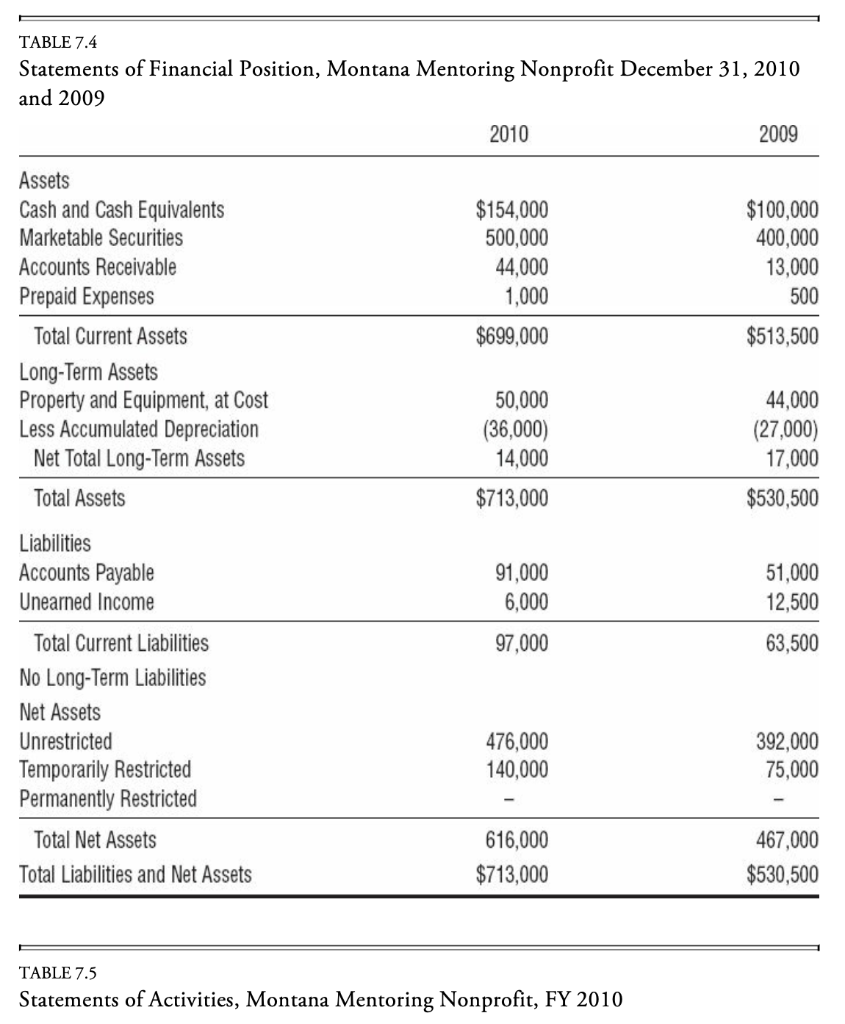

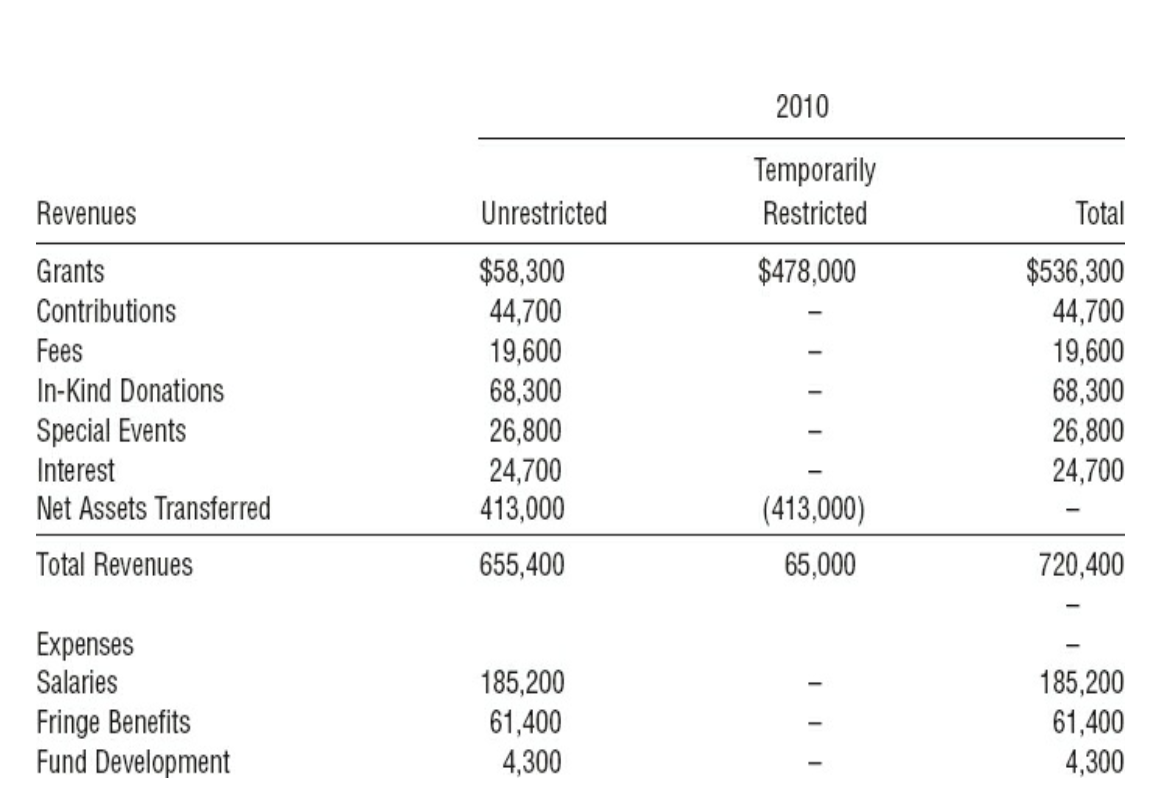

Montana Mentoring is a small nonprofit with no permanent endowment and no long-term debt. You know little about the nonprofit but you do have its

Montana Mentoring is a small nonprofit with no permanent endowment and no long-term debt. You know little about the nonprofit but you do have its financial statements. Conduct a financial analysis of this nonprofit using the financial statements provided below.

A. Complete the following ratios in Excel for FY 10: current, working capital, quick, debt-to-asset, debt-to-equity, asset-turnover, days-receivable, profit margin, return-on-assets, common size, and contributions. For each, write 1 sentence reporting the results and summarize what it means.

B. Write 2-3 paragraphs that explains the financial condition of the nonprofit organization, including any "red flags" that you identify.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started