Question

Monterey Company owns a majority voting interest in Del Rey, Inc. On January 1, 2017, Monterey issued $1,000,000 of 8 percent 10-year bonds at $935,823.42

Monterey Company owns a majority voting interest in Del Rey, Inc. On January 1, 2017, Monterey issued $1,000,000 of 8 percent 10-year bonds at $935,823.42 to yield 9 percent. On January 1, 2019, Del Rey purchased all of these bonds in the open market at a price of $946,650.74 with an effective yield of 10 percent.

Requirements:

Using the template on the "Template" tab in the provided Excel file, complete the following:

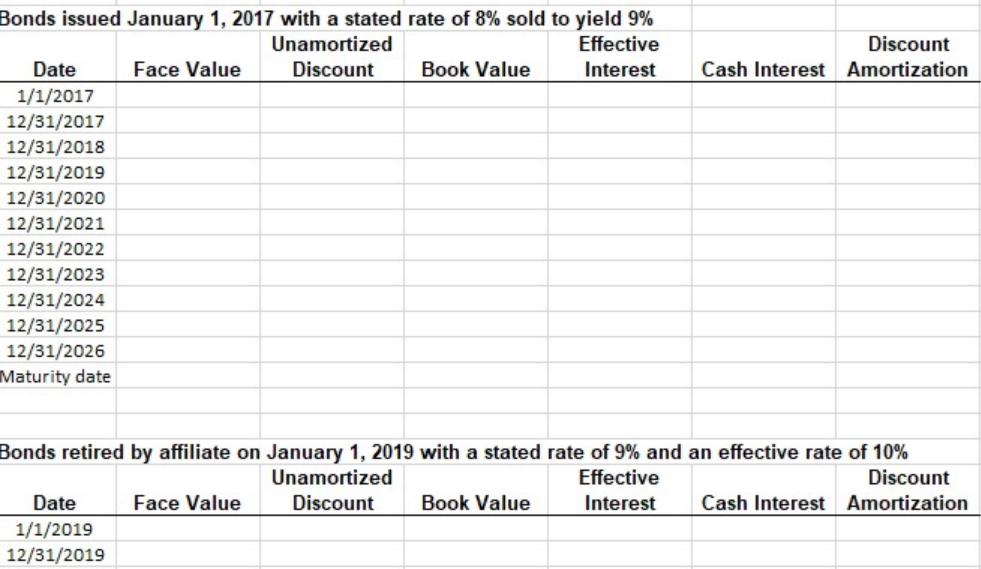

1. In the space provided, prepare amortization schedules for the Monterey Company bonds payable and the Investment in Monterey Bonds for Del Rey, Inc.

2. In the space provided, prepare consolidation worksheet entry "B" required at December 31, 2019 to reflect the effective retirement of the Monterey bonds.

Bonds issued January 1, 2017 with a stated rate of 8% sold to yield 9% Unamortized Face Value Discount Book Value Date 1/1/2017 12/31/2017 12/31/2018 12/31/2019 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2024 12/31/2025 12/31/2026 Maturity date Bonds retired by affiliate on January 1, 2019 with a stated rate of 9% and an effective rate of 10% Effective Discount Interest Cash Interest Amortization Date 1/1/2019 12/31/2019 Face Value Unamortized Discount Effective Discount Interest Cash Interest Amortization Book Value

Step by Step Solution

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Year Price at the beginning of year Yield 9 Interest 8 on 1000000 Price at closing of the year 2017 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started