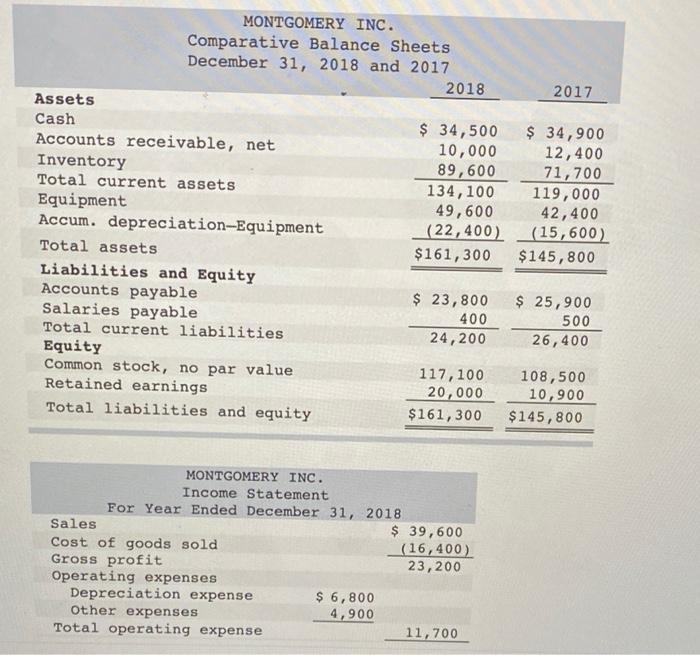

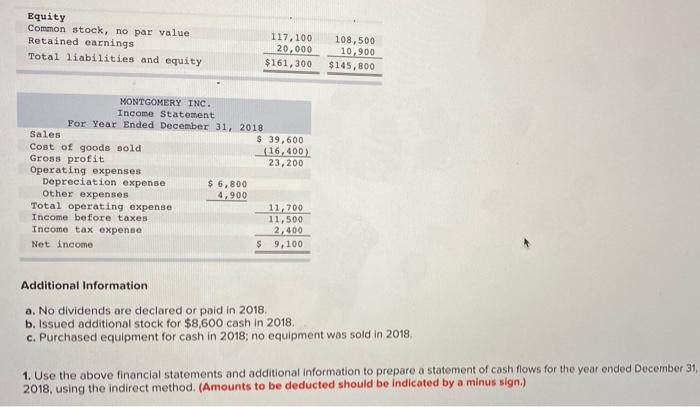

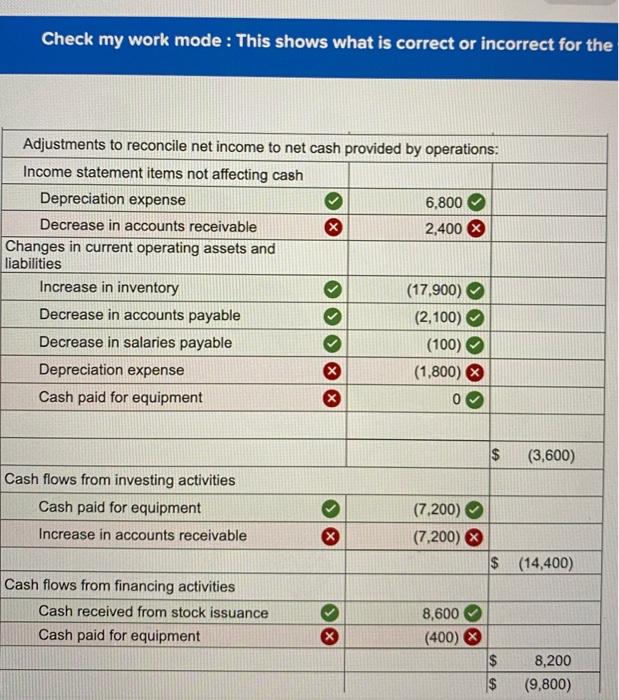

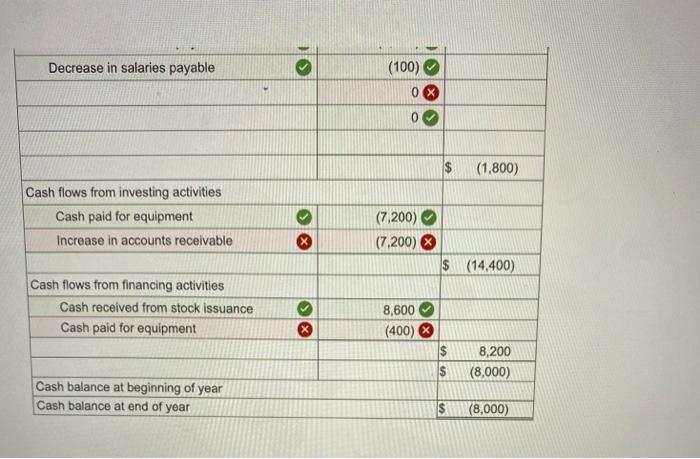

MONTGOMERY INC. Comparative Balance Sheets December 31, 2018 and 2017 2018 2017 Assets Cash $ 34,500 $ 34,900 Accounts receivable, net 10,000 12,400 Inventory 89,600 71,700 Total current assets 134,100 119,000 Equipment 49,600 42,400 Accum. depreciation-Equipment (22,400) (15,600) Total assets $161,300 $145,800 Liabilities and Equity Accounts payable $ 23,800 $ 25,900 Salaries payable 400 500 Total current liabilities 24,200 26,400 Equity Common stock, no par value 117, 100 108,500 Retained earnings 20,000 10,900 Total liabilities and equity $161,300 $145,800 MONTGOMERY INC. Income Statement For Year Ended December 31, 2018 Sales $ 39,600 Cost of goods sold (16,400) Gross profit 23, 200 Operating expenses Depreciation expense $ 6,800 Other expenses 4,900 Total operating expense 11,700 Equity Common stock, no par value Retained earnings Total liabilities and equity 117,100 20,000 $161,300 108,500 10,900 $145,800 MONTGOMERY INC. Income Statement For Year Ended December 31, 2018 Sales $ 39,600 Cost of goods sold (16,400) Gross profit 23,200 Operating expenses Depreciation expense $ 6,800 Other expenses 4,900 Total operating expense 11,700 Income before taxes 11,500 Income tax expense 2,400 $ Net income 9,100 Additional Information a. No dividends are declared or paid in 2018. b. Issued additional stock for $8,600 cash in 2018 c. Purchased equipment for cash in 2018; no equipment was sold in 2018 1. Use the above financial statements and additional information to prepare a statement of cash flows for the year ended December 31, 2018, using the indirect method. (Amounts to be deducted should be indicated by a minus sign.) Check my work mode : This shows what is correct or incorrect for the Adjustments to reconcile net income to net cash provided by operations: Income statement items not affecting cash Depreciation expense 6.800 Decrease in accounts receivable X 2.400 X Changes in current operating assets and liabilities Increase in inventory (17,900) Decrease in accounts payable (2,100) Decrease in salaries payable (100) Depreciation expense X (1,800) Cash paid for equipment $ (3,600) Cash flows from investing activities Cash paid for equipment Increase in accounts receivable (7.200) (7,200) X $ (14,400) Cash flows from financing activities Cash received from stock issuance Cash paid for equipment 8,600 (400) $ $ 8,200 (9,800) Decrease in salaries payable (100) 0 (1,800) Cash flows from investing activities Cash paid for equipment Increase in accounts receivable (7.200) (7.200) $ (14,400) Cash flows from financing activities Cash received from stock issuance Cash paid for equipment 8,600 (400) $ $ 8,200 (8,000) Cash balance at beginning of year Cash balance at end of year $ (8,000)