Question

MONTGOMERY INCORPORATEDComparative Balance SheetsAt December 31Current YearPrior Year Assets Cash$ 33,200$ 33,400Accounts receivable, net12,10014,700Inventory108,50084,900Total current assets153,800133,000Equipment60,10050,200Accumulated depreciationEquipment(27,100)(18,500)Total assets$ 186,800$ 164,700 Liabilities and Equity Accounts payable$

MONTGOMERY INCORPORATEDComparative Balance SheetsAt December 31Current YearPrior YearAssets Cash$ 33,200$ 33,400Accounts receivable, net12,10014,700Inventory108,50084,900Total current assets153,800133,000Equipment60,10050,200Accumulated depreciationEquipment(27,100)(18,500)Total assets$ 186,800$ 164,700Liabilities and Equity Accounts payable$ 28,800$ 30,700Salaries payable600700Total current liabilities29,40031,400Equity Common stock, no par value130,000118,100Retained earnings27,40015,200Total liabilities and equity$ 186,800$ 164,700MONTGOMERY INCORPORATEDIncome StatementFor Current Year Ended December 31Sales$ 53,500Cost of goods sold(22,200)Gross profit31,300Salaries expense6,600Depreciation expense8,600Income before taxes16,100Income tax expense3,900Net income$ 12,200

Additional Information on Current-Year Transactions

- No dividends are declared or paid.

- Issued additional stock for $11,900 cash.

- Purchased equipment for cash; no equipment was sold.

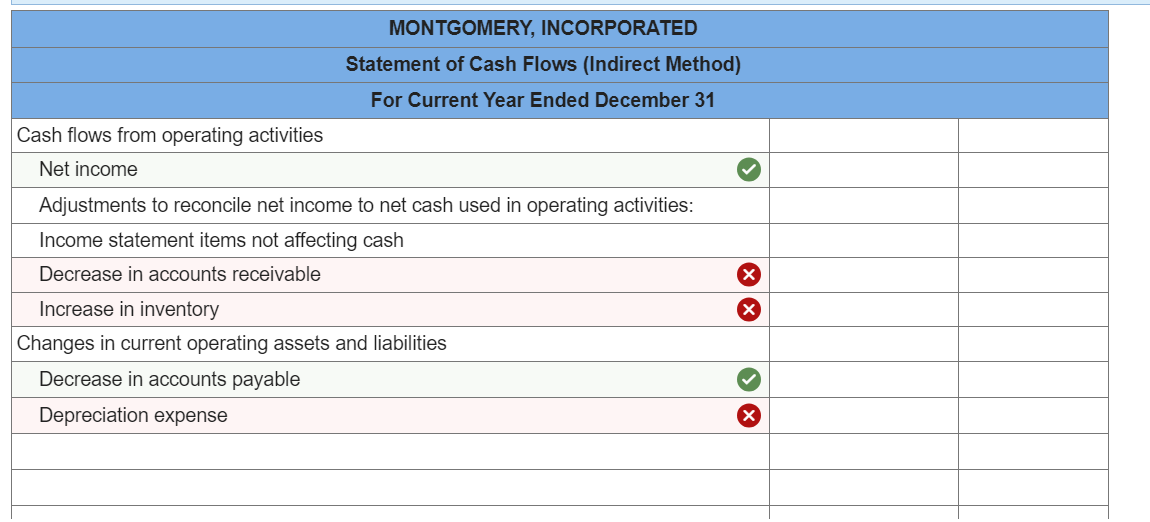

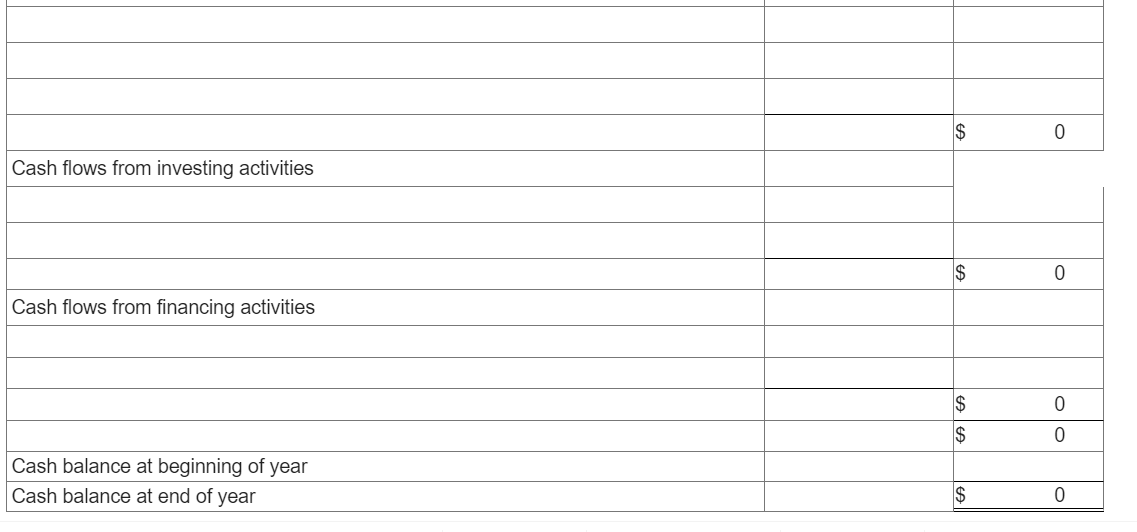

\\begin{tabular}{|l|l|l|} \\hline \\multicolumn{1}{|c|}{ MONTGOMERY, INCORPORATED } \\\\ \\multicolumn{1}{|c|}{ For Current Year Ended December 31 } & \\\\ \\hline Cash flows from operating activities & & \\\\ \\hline Net income & & \\\\ \\hline Adjustments to reconcile net income to net cash used in operating activities: & & \\\\ \\hline Income statement items not affecting cash & & \\\\ \\hline Decrease in accounts receivable & & \\\\ \\hline Increase in inventory & & \\\\ \\hline Changes in current operating assets and liabilities & & \\\\ \\hline Decrease in accounts payable & & \\\\ \\hline Depreciation expense & & \\\\ \\hline \\end{tabular} \\begin{tabular}{|l|l|l|} \\hline & & \\\\ \\hline & & \\( \\$ \\) \\\\ \\hline & & \\\\ \\hline & & \\\\ \\hline & & \\( \\$ \\) \\\\ \\hline Cash flows from financing activities & & \\\\ \\hline & & \\\\ \\hline & & \\\\ \\hline Cash balance at beginning of year & & \\( \\$ \\) \\\\ \\hline Cash balance at end of year & & \\( \\$ \\) \\\\ \\hline \\end{tabular}

\\begin{tabular}{|l|l|l|} \\hline \\multicolumn{1}{|c|}{ MONTGOMERY, INCORPORATED } \\\\ \\multicolumn{1}{|c|}{ For Current Year Ended December 31 } & \\\\ \\hline Cash flows from operating activities & & \\\\ \\hline Net income & & \\\\ \\hline Adjustments to reconcile net income to net cash used in operating activities: & & \\\\ \\hline Income statement items not affecting cash & & \\\\ \\hline Decrease in accounts receivable & & \\\\ \\hline Increase in inventory & & \\\\ \\hline Changes in current operating assets and liabilities & & \\\\ \\hline Decrease in accounts payable & & \\\\ \\hline Depreciation expense & & \\\\ \\hline \\end{tabular} \\begin{tabular}{|l|l|l|} \\hline & & \\\\ \\hline & & \\( \\$ \\) \\\\ \\hline & & \\\\ \\hline & & \\\\ \\hline & & \\( \\$ \\) \\\\ \\hline Cash flows from financing activities & & \\\\ \\hline & & \\\\ \\hline & & \\\\ \\hline Cash balance at beginning of year & & \\( \\$ \\) \\\\ \\hline Cash balance at end of year & & \\( \\$ \\) \\\\ \\hline \\end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started