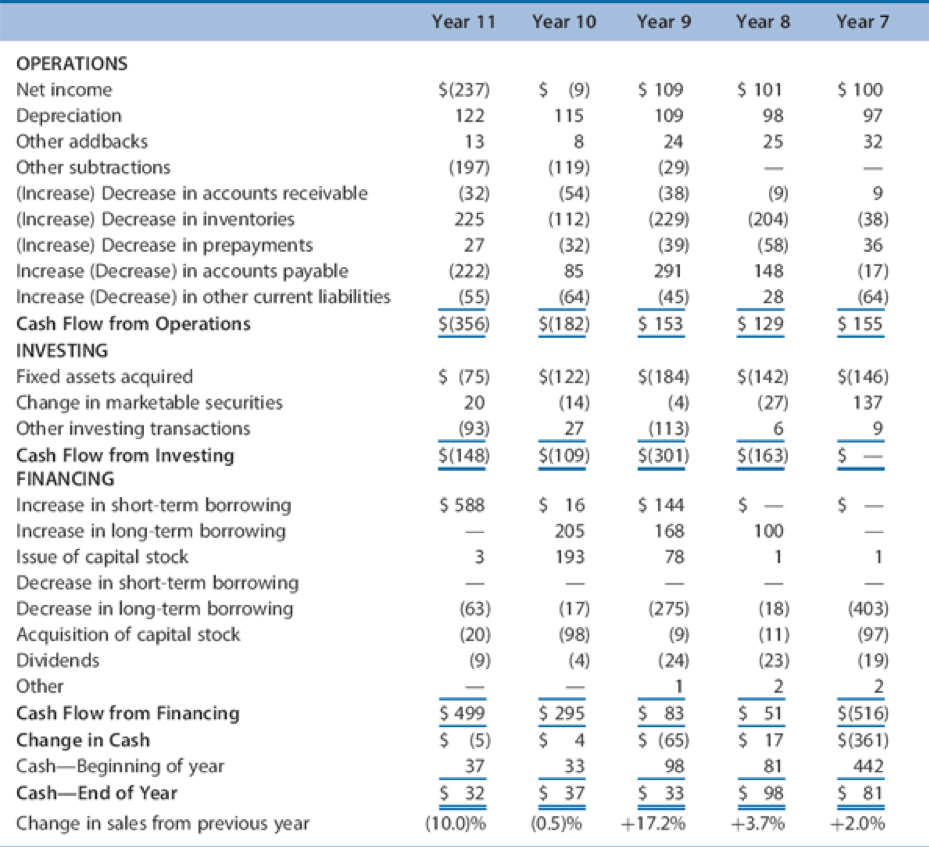

- Montgomery Ward operates a retail department store chain. - It filed for bankruptcy during the first quarter of Year 12. The Cash Flow Statement below presents a statement of cash flows for Montgomery Ward for Year 7 to Year 11. - The firm acquired Lechmere, a discount sporting goods/electronic retailer, during Year 9. - It acquired Amoco Enterprises, an automobile club, during Year 11. - During Year 10, it issued a new series of preferred stock and used part of the cash proceeds to repurchase a series of outstanding preferred stock. - The other subtractions Year 10 and 11 operating sections are reversals of deferred tax liabilities.

During Year 10, write a statement about each of the following:

1. Sales during the year and year-over-year trends

2. Net income of the year and year-over-year trends

3. Cash flow from operations of the year

4. Investing activity for the year

5. Financing activity for the year

6. Net income and cash flow from operations and among cash flows from operating, investing, and financing activities for the firm over the 5 year period

7. What were the signals of Montgomery Ward's difficulties that might have lead to its filing bankruptcy in 2012?

Year 11 Year 10 Year 9 Year 8 Year 7 $101 $100 $ 109 109 9? $(237] 122 13 (197) (32) 24 32 $ (9) 115 8 (119) {54 (112) (32) B5 (6) (29) (38) (229) 225 (38) (39) (204) (58) 14 27 (222) (55) $(356) 291 (45) $ 153 (17) (6) $ 155 5182) 129 $(122) (14) $(184) (4) $(142) (27) $146) 137 $ (75) 20 93) (148) 27 OPERATIONS Net income Depreciation Other addbacks Other subtractions (Increase) Decrease in accounts receivable (Increase) Decrease in inventories (Increase) Decrease in prepayments Increase (Decrease) in accounts payable Increase (Decrease) in other current liabilities Cash Flow from Operations INVESTING Fixed assets acquired Change in marketable securities Other investing transactions Cash Flow from Investing FINANCING Increase in short-term borrowing Increase in long-term borrowing Issue of capital stock Decrease in short-term borrowing Decrease in long-term borrowing Acquisition of capital stock Dividends Other Cash Flow from Financing Change in Cash Cash-Beginning of year Cash-End of Year Change in sales from previous year (113) * | 8 *[ *| | | | | |?] | *E 3 ] \! | | ] [ |el E ', lel | E @ la[E [8] $(109) $(301) $(163) $ 588 $ 16 205 193 $ 144 1683 (17) (20) (275) (9) (18) (111) (98) (403) (97) (19) 583 51 $499 $ (5) 37 $ (65) s{516) $(361] 442 $ 81 $ 4 33 $ 37 (0,5)% 38 $ 32 $ 33 +17,29% 31 $ 98 +3.7% (10.0)% +2-0% Year 11 Year 10 Year 9 Year 8 Year 7 $101 $100 $ 109 109 9? $(237] 122 13 (197) (32) 24 32 $ (9) 115 8 (119) {54 (112) (32) B5 (6) (29) (38) (229) 225 (38) (39) (204) (58) 14 27 (222) (55) $(356) 291 (45) $ 153 (17) (6) $ 155 5182) 129 $(122) (14) $(184) (4) $(142) (27) $146) 137 $ (75) 20 93) (148) 27 OPERATIONS Net income Depreciation Other addbacks Other subtractions (Increase) Decrease in accounts receivable (Increase) Decrease in inventories (Increase) Decrease in prepayments Increase (Decrease) in accounts payable Increase (Decrease) in other current liabilities Cash Flow from Operations INVESTING Fixed assets acquired Change in marketable securities Other investing transactions Cash Flow from Investing FINANCING Increase in short-term borrowing Increase in long-term borrowing Issue of capital stock Decrease in short-term borrowing Decrease in long-term borrowing Acquisition of capital stock Dividends Other Cash Flow from Financing Change in Cash Cash-Beginning of year Cash-End of Year Change in sales from previous year (113) * | 8 *[ *| | | | | |?] | *E 3 ] \! | | ] [ |el E ', lel | E @ la[E [8] $(109) $(301) $(163) $ 588 $ 16 205 193 $ 144 1683 (17) (20) (275) (9) (18) (111) (98) (403) (97) (19) 583 51 $499 $ (5) 37 $ (65) s{516) $(361] 442 $ 81 $ 4 33 $ 37 (0,5)% 38 $ 32 $ 33 +17,29% 31 $ 98 +3.7% (10.0)% +2-0%