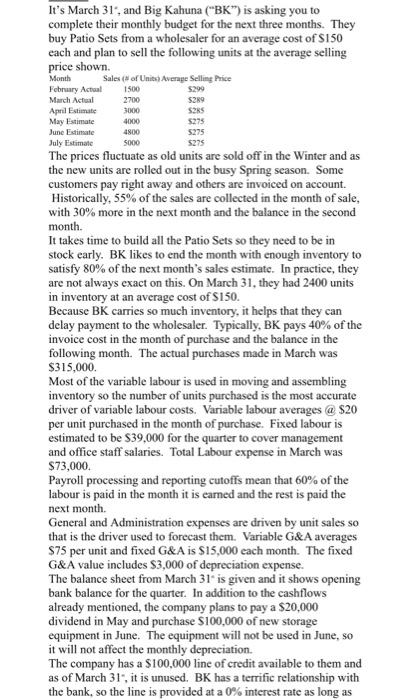

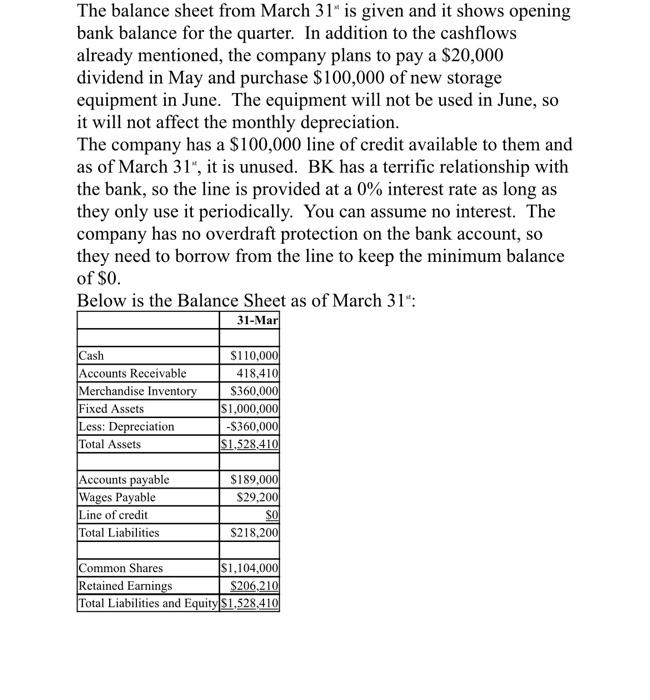

Month It's March 31, and Big Kahuna ("BK") is asking you to complete their monthly budget for the next three months. They buy Patio Sets from a wholesaler for an average cost of $150 each and plan to sell the following units at the average selling price shown. Sales (or Units Average Selling Price February Actual 1500 5290 March Actual 2700 $289 April Estimate 3000 SORS May Estimate 4000 June Estimate 4800 5275 July Estimate 5000 The prices fluctuate as old units are sold off in the Winter and as the new units are rolled out in the busy Spring season. Some customers pay right away and others are invoiced on account. Historically, 55% of the sales are collected in the month of sale, with 30% more in the next month and the balance in the second month. It takes time to build all the Patio Sets so they need to be in stock early. BK likes to end the month with enough inventory to satisfy 80% of the next month's sales estimate. In practice, they are not always exact on this. On March 31, they had 2400 units in inventory at an average cost of $150. Because BK carries so much inventory, it helps that they can delay payment to the wholesaler. Typically, BK pays 40% of the invoice cost in the month of purchase and the balance in the following month. The actual purchases made in March was $315,000. Most of the variable labour is used in moving and assembling inventory so the number of units purchased is the most accurate driver of variable labour costs. Variable labour averages @ $20 per unit purchased in the month of purchase. Fixed labour is estimated to be $39,000 for the quarter to cover management and office staff salaries. Total Labour expense in March was $73,000 Payroll processing and reporting cutoffs mean that 60% of the labour is paid in the month it is earned and the rest is paid the next month. General and Administration expenses are driven by unit sales so that is the driver used to forecast them. Variable G&A averages $75 per unit and fixed G&A is $15,000 each month. The fixed G&A value includes $3,000 of depreciation expense. The balance sheet from March 31* is given and it shows opening bank balance for the quarter. In addition to the cashflows already mentioned, the company plans to pay a $20,000 dividend in May and purchase $100,000 of new storage equipment in June. The equipment will not be used in June, so it will not affect the monthly depreciation. The company has a $100.000 line of credit available to them and as of March 31, it is unused. BK has a terrific relationship with the bank, so the line is provided at a 0% interest rate as long as The balance sheet from March 31" is given and it shows opening bank balance for the quarter. In addition to the cashflows already mentioned, the company plans to pay a $20,000 dividend in May and purchase $100,000 of new storage equipment in June. The equipment will not be used in June, so it will not affect the monthly depreciation. The company has a $100,000 line of credit available to them and as of March 31", it is unused. BK has a terrific relationship with the bank, so the line is provided at a 0% interest rate as long as they only use it periodically. You can assume no interest. The company has no overdraft protection on the bank account, so they need to borrow from the line to keep the minimum balance of $0. Below is the Balance Sheet as of March 31": 31-Mar Cash Accounts Receivable Merchandise Inventory Fixed Assets Less: Depreciation Total Assets $110,000 418,4101 $360,000 $1,000,000 -$360,000 $1,528.410 Accounts payable Wages Payable Line of credit Total Liabilities $189,000 $29,200 SO $218,200 Common Shares $1,104,000 Retained Earnings $206,210 Total Liabilities and Equity $1,528,410