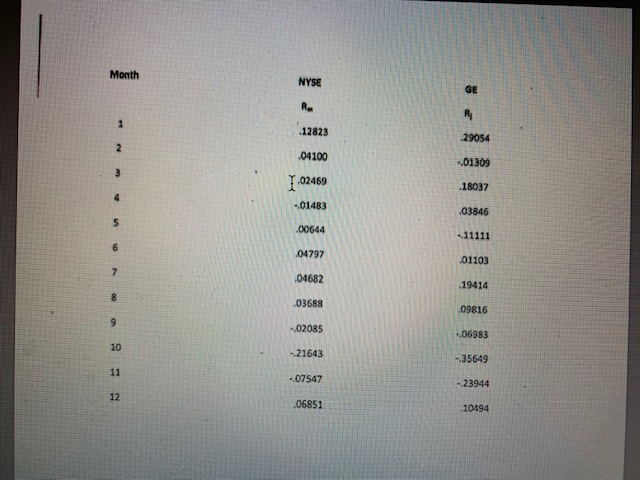

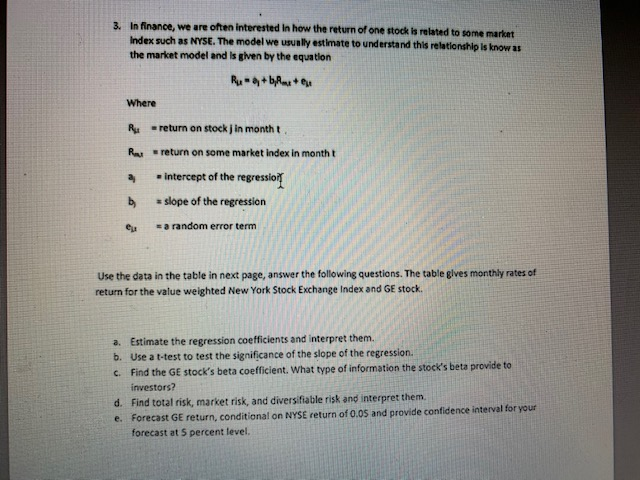

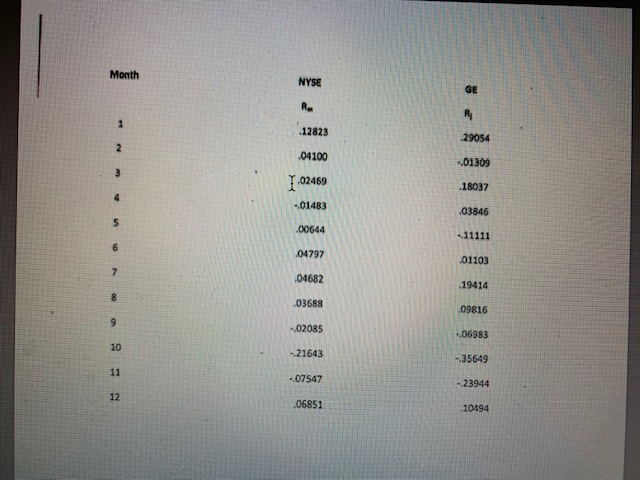

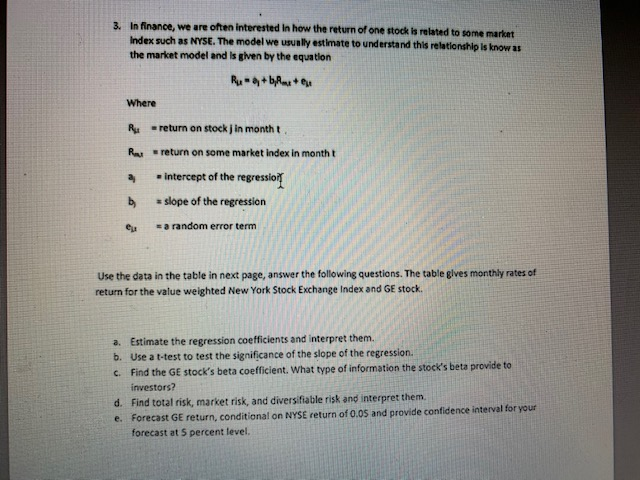

Month NYSE R. .12823 29054 WN - ,04100 01309 T.02469 .18037 -01483 .03846 .00644 -11111 .04797 .01103 04682 19414 .03688 09816 -02085 4,06983 -21643 -35649 --07547 - 23944 .06851 10494 3. In finance, we are often interested in how the return of one stock is related to some market Index such as NYSE. The model we usually estimate to understand this relationship is know as the market model and is given by the equation Rua+bAtten Where R = return on stock j in month r eturn on some market index in montht R = intercept of the regression slope of the regression by = a random error term Use the data in the table in next page, answer the following questions. The table return for the value weighted New York Stock Exchange Index and GE stock. a. Estimate the regression coefficients and interpret them. b. Use a t-test to test the significance of the slope of the regression. C. Find the GE stock's beta coefficient. What type of information the stock's beta provide to investors? d. Find total risk, market risk, and diversifiable risk and interpret them e. Forecast GE return, conditional on NYSE return of 0.05 and provide confidence interval for your forecast at 5 percent level. Month NYSE R. .12823 29054 WN - ,04100 01309 T.02469 .18037 -01483 .03846 .00644 -11111 .04797 .01103 04682 19414 .03688 09816 -02085 4,06983 -21643 -35649 --07547 - 23944 .06851 10494 3. In finance, we are often interested in how the return of one stock is related to some market Index such as NYSE. The model we usually estimate to understand this relationship is know as the market model and is given by the equation Rua+bAtten Where R = return on stock j in month r eturn on some market index in montht R = intercept of the regression slope of the regression by = a random error term Use the data in the table in next page, answer the following questions. The table return for the value weighted New York Stock Exchange Index and GE stock. a. Estimate the regression coefficients and interpret them. b. Use a t-test to test the significance of the slope of the regression. C. Find the GE stock's beta coefficient. What type of information the stock's beta provide to investors? d. Find total risk, market risk, and diversifiable risk and interpret them e. Forecast GE return, conditional on NYSE return of 0.05 and provide confidence interval for your forecast at 5 percent level