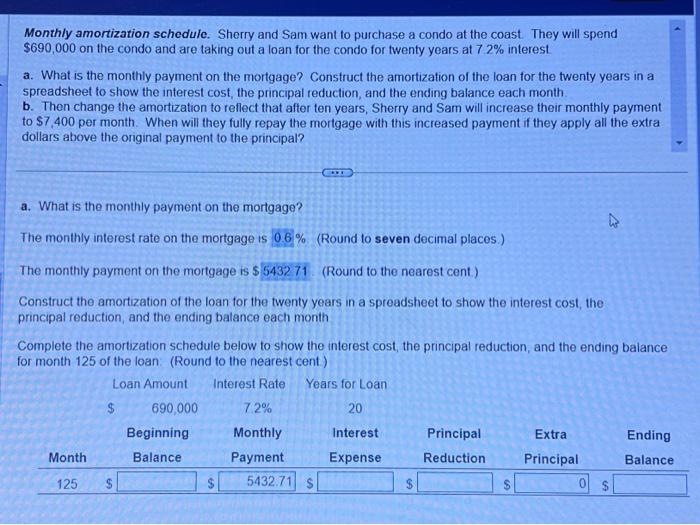

Monthly amortization schedule. Sherry and Sam want to purchase a condo at the coast. They will spend $690,000 on the condo and are taking out a loan for the condo for twenty years at 72% interest a. What is the monthly payment on the mortgage? Construct the amortization of the loan for the twenty years in a spreadsheet to show the interest cost, the principal reduction, and the ending balance each month. b. Then change the amortization to reflect that after ten years, Sherry and Sam will increase their monthly payment to $7,400 per month. When will they fully repay the mortgage with this increased payment if they apply all the extra dollars above the original payment to the principal? a. What is the monthly payment on the mortgage? The monthly interest rate on the mortgage is 0.6% (Round to seven decimal places.) The monthly payment on the mortgage is $543271. (Round to the nearest cent) Construct the amortization of the loan for the twenty years in a spreadsheet to show the interest cost, the principal reduction, and the ending balance each month Complete the amortization schedule below to show the interest cost, the principal reduction, and the ending balance for month 125 of the loan: (Round to the nearest cent) Monthly amortization schedule. Sherry and Sam want to purchase a condo at the coast. They will spend $690,000 on the condo and are taking out a loan for the condo for twenty years at 72% interest a. What is the monthly payment on the mortgage? Construct the amortization of the loan for the twenty years in a spreadsheet to show the interest cost, the principal reduction, and the ending balance each month. b. Then change the amortization to reflect that after ten years, Sherry and Sam will increase their monthly payment to $7,400 per month. When will they fully repay the mortgage with this increased payment if they apply all the extra dollars above the original payment to the principal? a. What is the monthly payment on the mortgage? The monthly interest rate on the mortgage is 0.6% (Round to seven decimal places.) The monthly payment on the mortgage is $543271. (Round to the nearest cent) Construct the amortization of the loan for the twenty years in a spreadsheet to show the interest cost, the principal reduction, and the ending balance each month Complete the amortization schedule below to show the interest cost, the principal reduction, and the ending balance for month 125 of the loan: (Round to the nearest cent)