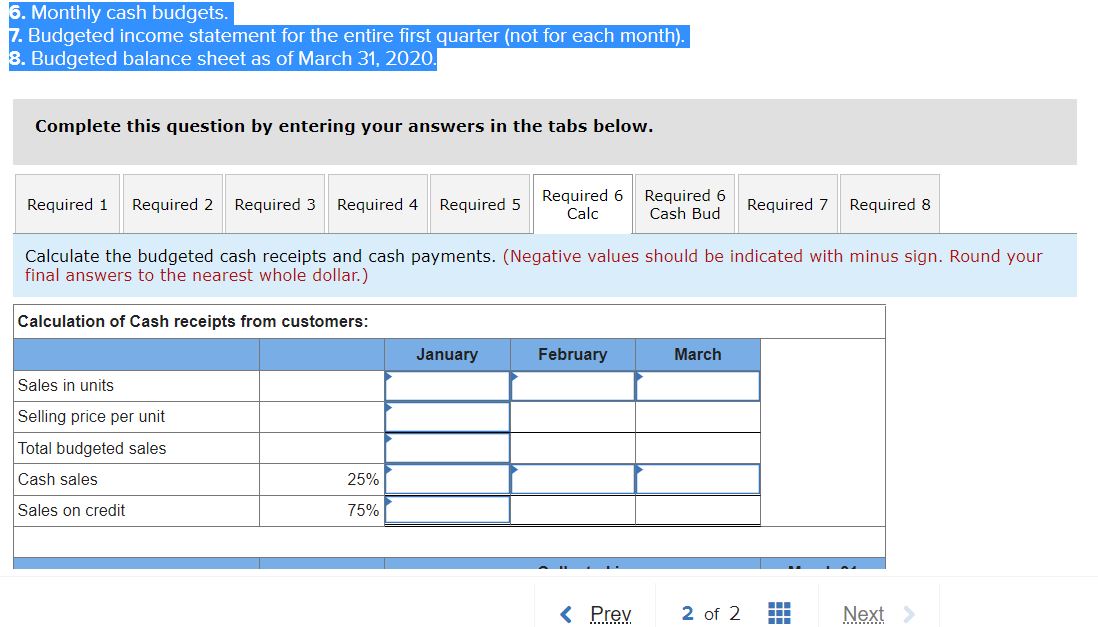

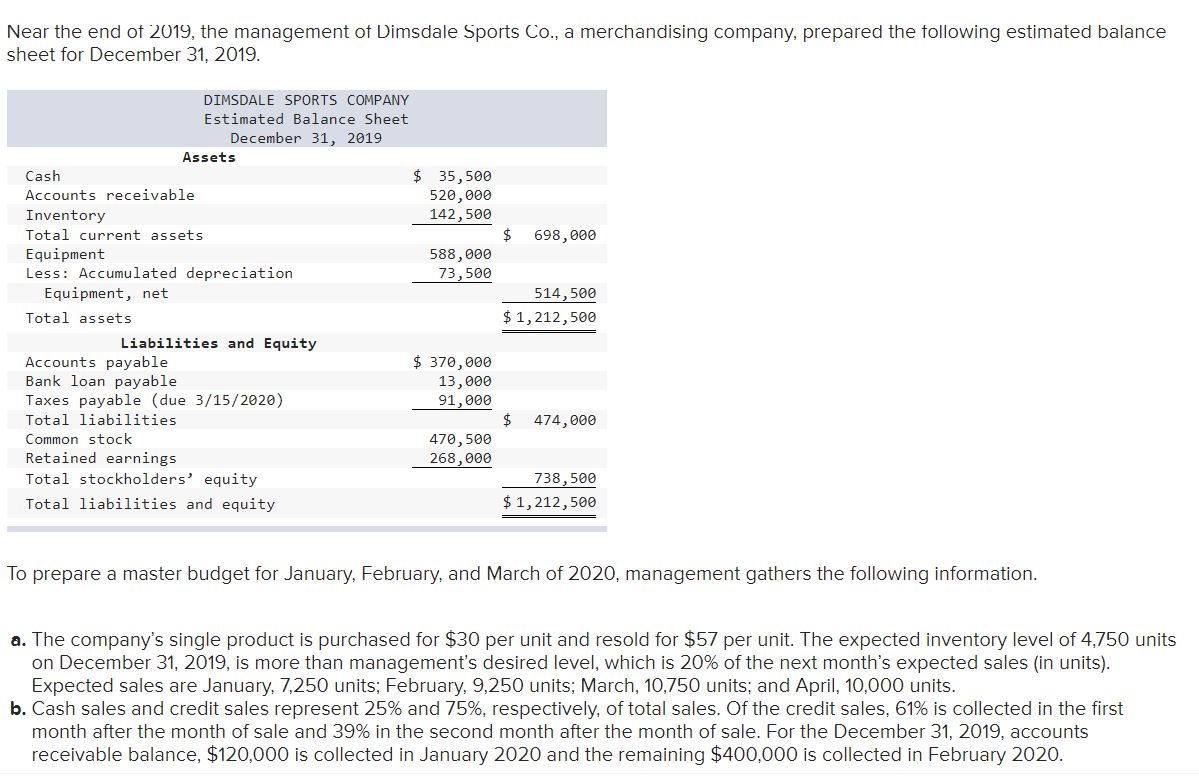

- . Monthly cash budgets. . Budgeted income statement for the entire first quatter (not for each month). '= Budgeted balance sheet as of March 31, 2020. Complete-this question-by entering-your answers; in the-mkshelow. Required 6 Calc Required 6 Required 4 ReqUired 5 Cash Bud Required 1 Required 2 Required 3 Required ? Required 8 Calculate the budgeted cash receipts and cash payments. (NegatiVe values should be indicated with minus sign. Round your final answers to the nearest whole dollar.)- Calculation of Cash receipts from customers: Sales in units Selling price per unit Total budgeted sales Cash sales 25% Sales on credit 75% Near the end of 2019, the management of Dimsdale Sports (30., a merchandising company, prepared the following estimated balance sheet for December 31, 2019. DIHSDALE SPORTS COMPANY Estimated Balance Sheet December~31J 2919 Assets Cash 1 35,539 Accounts receivable 529,966 Inventory 142,566 Total current assets $ 698,699 Equipment 588,966 Less: Accumulated depreciation 73,566 Equipment, net 514,599 Total assets $ 1,212,599 Liabilities and Equity Accounts payable $ 379,966 Bank loan payable 13,966 Taxes payable (due 3/15/2929) 91,966 Total liabilities $ 474,699 Common stock 479,566 Retained earnings 268,966 Total stockholders' equity 738,599 Total liabilities and equity $1,212,599 To prepare a master budget for January, February, and March of 2020, management gathers the following information. a. The company's single product is purchased for $30 per unit and resold for $57 per unit. The expected inventory level of 4,750 units on December 31, 2019, is more than management's desired level, which is 20% ofthe next month's expected sales {in units). Expected sales are January, 7,250 units; February, 9,250 units; March, 10,750 units; and April, 10,000 units. b. Cash sales and credit sales represent 25% and 75%, respectively, of total sales. Of the credit sales, 61% is collected in the first month atter the month of sale and 39% in the second month after the month of sale. For the December 31, 2019, accounts receivable balance, $120,000 is collected in January 2020 and the remaining $400,000 is collected in February 2020