Answered step by step

Verified Expert Solution

Question

1 Approved Answer

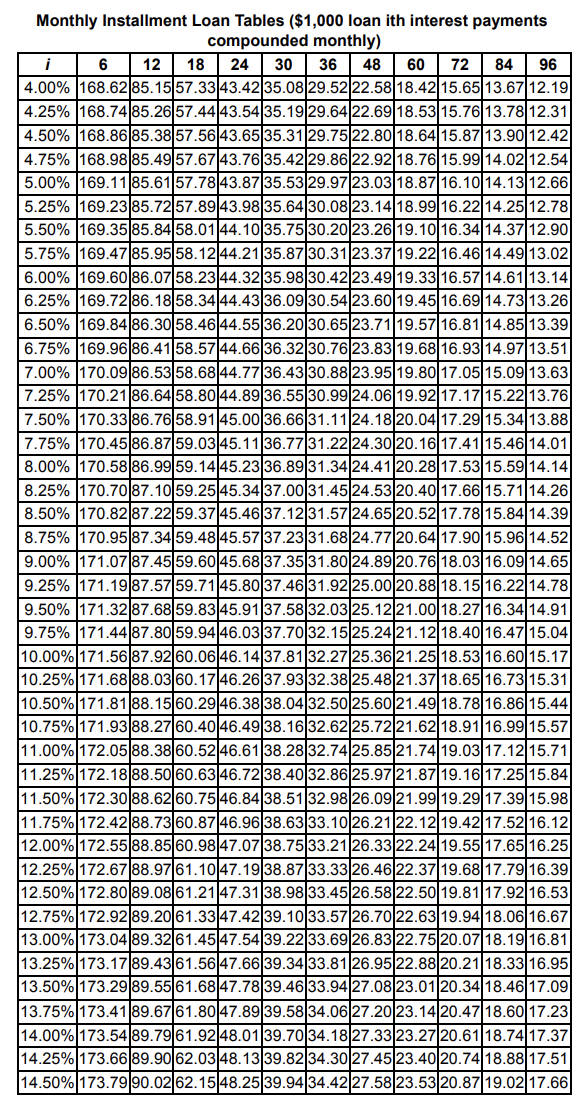

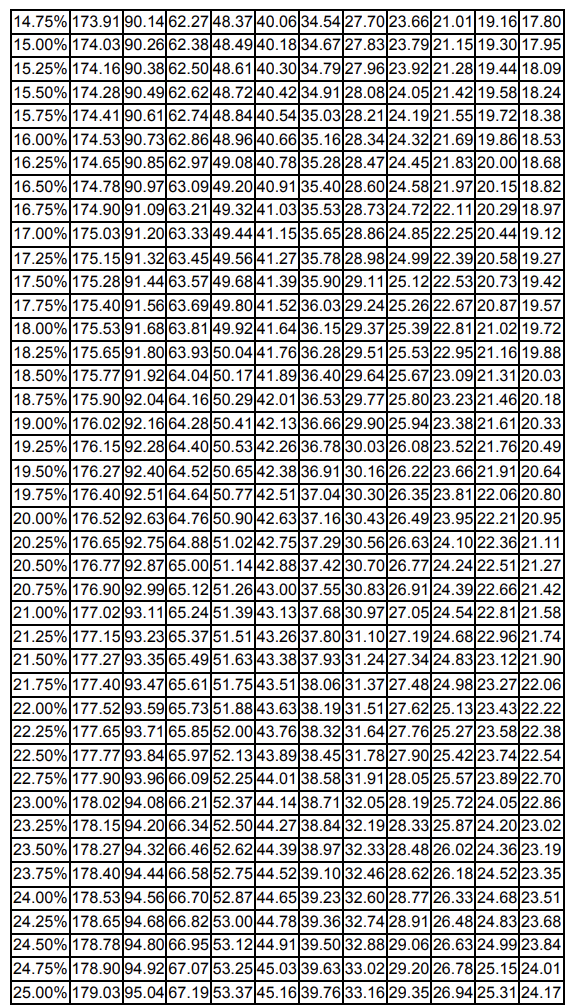

Monthly Installment Loan Tables ( mathbf{$ 1 , 0 0 0} ) loan ith interest payments compounded monthly) four years. Finally, calculate the payment for

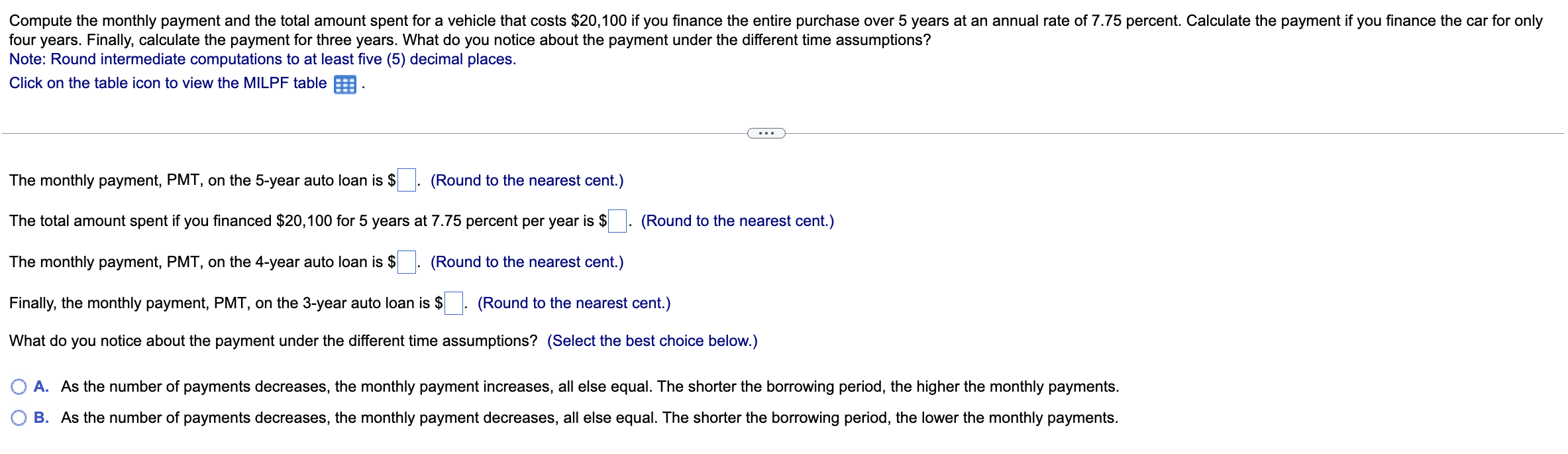

Monthly Installment Loan Tables \\( \\mathbf{\\$ 1 , 0 0 0} \\) loan ith interest payments compounded monthly) four years. Finally, calculate the payment for three years. What do you notice about the payment under the different time assumptions? Note: Round intermediate computations to at least five (5) decimal places. Click on the table icon to view the MILPF table The monthly payment, PMT, on the 5-year auto loan is \\( \\$ \\quad \\) (Round to the nearest cent.) The total amount spent if you financed \\( \\$ 20,100 \\) for 5 years at 7.75 percent per year is \\( \\$ \\quad \\). (Round to the nearest cent.) The monthly payment, PMT, on the 4-year auto loan is \\( \\$ \\quad \\) (Round to the nearest cent.) Finally, the monthly payment, PMT, on the 3-year auto loan is \\( \\$ \\square \\). (Round to the nearest cent.) What do you notice about the payment under the different time assumptions? (Select the best choice below.) A. As the number of payments decreases, the monthly payment increases, all else equal. The shorter the borrowing period, the higher the monthly payments. B. As the number of payments decreases, the monthly payment decreases, all else equal. The shorter the borrowing period, the lower the monthly payments

Monthly Installment Loan Tables \\( \\mathbf{\\$ 1 , 0 0 0} \\) loan ith interest payments compounded monthly) four years. Finally, calculate the payment for three years. What do you notice about the payment under the different time assumptions? Note: Round intermediate computations to at least five (5) decimal places. Click on the table icon to view the MILPF table The monthly payment, PMT, on the 5-year auto loan is \\( \\$ \\quad \\) (Round to the nearest cent.) The total amount spent if you financed \\( \\$ 20,100 \\) for 5 years at 7.75 percent per year is \\( \\$ \\quad \\). (Round to the nearest cent.) The monthly payment, PMT, on the 4-year auto loan is \\( \\$ \\quad \\) (Round to the nearest cent.) Finally, the monthly payment, PMT, on the 3-year auto loan is \\( \\$ \\square \\). (Round to the nearest cent.) What do you notice about the payment under the different time assumptions? (Select the best choice below.) A. As the number of payments decreases, the monthly payment increases, all else equal. The shorter the borrowing period, the higher the monthly payments. B. As the number of payments decreases, the monthly payment decreases, all else equal. The shorter the borrowing period, the lower the monthly payments Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started