Answered step by step

Verified Expert Solution

Question

1 Approved Answer

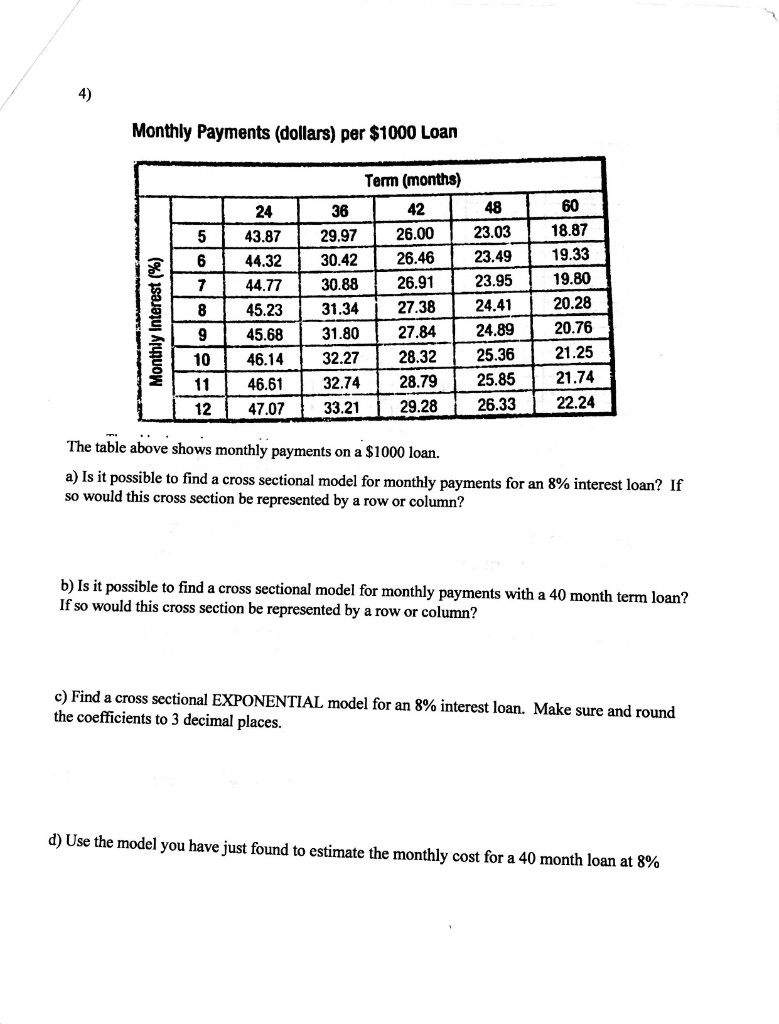

Monthly Payments (dollars) per $1000 Loan Monthly Interest (%) Term (months) 24 36 42 48 60 5 4 3.87 29.97 26.00 23.03 18.87 6 44.3230.42

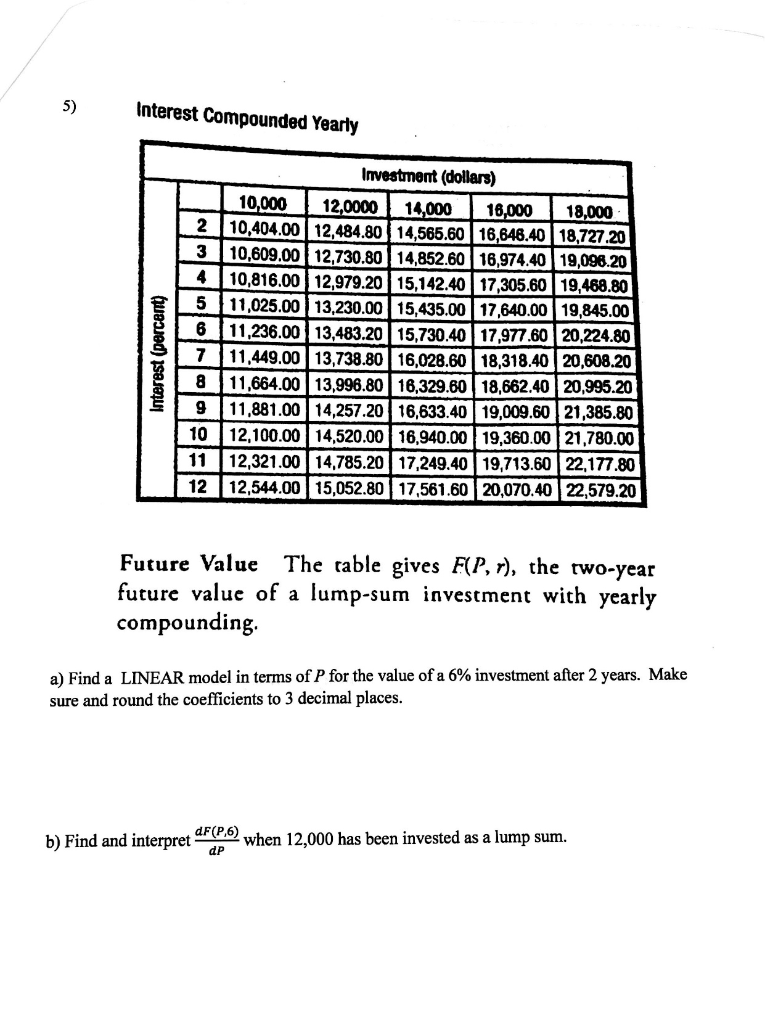

Monthly Payments (dollars) per $1000 Loan Monthly Interest (%) Term (months) 24 36 42 48 60 5 4 3.87 29.97 26.00 23.03 18.87 6 44.3230.42 26.46 23.4919.33 7 44.77 30.88 26.9123.9519.80 8 45.2331.34 27.38 24.41 20.28 91 45.68 31.80 27.84 24.89 20.76 10 46.14 3 2.27 28.32 25.36 21.25 11 46.61 32.74 28.79 25.85 21.74 12 47.07 33.2129.28 26.33 22.24 Blon U The table above shows monthly payments on a $1000 loan. a) Is it possible to find a cross sectional model for monthly payments for an 8% interest loan? If so would this cross section be represented by a row or column? b) Is it possible to find a cross sectional model for monthly payments with a 40 month term loan? If so would this cross section be represented by a row or column? c) Find a cross sectional EXPONENTIAL model for an 8% interest loan. Make sure and round the coefficients to 3 decimal places. d) Use the model you have just found to estimate the monthly cost for a 40 month loan at 8% Interest Compounded Yearly Interest (percent) Investment (dollars) 10,000 12,0000 14,000 16,000 18,000 2 10,404.00 12,484.80 14,565.60 16,646.40 18,727.20 3 10,609.00 12,730.80 14,852.60 16,974.40 19,096.20 4 10,816.00 12,979.20 15,142.40 17,305.60 19,468.80 5 11,025.00 13,230.00 15,435.00 17,640.00 19,845.00 16 | 11,236.00 13,483.20 15.730.40 17,977.6020,224.80 1711,449.00 13,738.80 16,028.60 18,318.40 20,608.20 8 11,664.00 13,996.8016,329.60 18,662.40 20,995.20 9 11,881.00 14,257.2016,633.40 19,009.60 21,385.80 10 12,100.00 14,520.00 16,940.00 19,360.00 21,780.00 11 | 12,321.00 14.785.20 17,249.4019,713.60 22,177.80 12 12,544.00 15,052.80 17,561.60 20,070.40 22,579.20 Future Value The cable gives F(P, r), the two-year future value of a lump-sum investment with yearly compounding. a) Find a LINEAR model in terms of P for the value of a 6% investment after 2 years. Make sure and round the coefficients to 3 decimal places. b) Find and interpret F2.0 when 12,000 has been invested as a lump sum. Monthly Payments (dollars) per $1000 Loan Monthly Interest (%) Term (months) 24 36 42 48 60 5 4 3.87 29.97 26.00 23.03 18.87 6 44.3230.42 26.46 23.4919.33 7 44.77 30.88 26.9123.9519.80 8 45.2331.34 27.38 24.41 20.28 91 45.68 31.80 27.84 24.89 20.76 10 46.14 3 2.27 28.32 25.36 21.25 11 46.61 32.74 28.79 25.85 21.74 12 47.07 33.2129.28 26.33 22.24 Blon U The table above shows monthly payments on a $1000 loan. a) Is it possible to find a cross sectional model for monthly payments for an 8% interest loan? If so would this cross section be represented by a row or column? b) Is it possible to find a cross sectional model for monthly payments with a 40 month term loan? If so would this cross section be represented by a row or column? c) Find a cross sectional EXPONENTIAL model for an 8% interest loan. Make sure and round the coefficients to 3 decimal places. d) Use the model you have just found to estimate the monthly cost for a 40 month loan at 8% Interest Compounded Yearly Interest (percent) Investment (dollars) 10,000 12,0000 14,000 16,000 18,000 2 10,404.00 12,484.80 14,565.60 16,646.40 18,727.20 3 10,609.00 12,730.80 14,852.60 16,974.40 19,096.20 4 10,816.00 12,979.20 15,142.40 17,305.60 19,468.80 5 11,025.00 13,230.00 15,435.00 17,640.00 19,845.00 16 | 11,236.00 13,483.20 15.730.40 17,977.6020,224.80 1711,449.00 13,738.80 16,028.60 18,318.40 20,608.20 8 11,664.00 13,996.8016,329.60 18,662.40 20,995.20 9 11,881.00 14,257.2016,633.40 19,009.60 21,385.80 10 12,100.00 14,520.00 16,940.00 19,360.00 21,780.00 11 | 12,321.00 14.785.20 17,249.4019,713.60 22,177.80 12 12,544.00 15,052.80 17,561.60 20,070.40 22,579.20 Future Value The cable gives F(P, r), the two-year future value of a lump-sum investment with yearly compounding. a) Find a LINEAR model in terms of P for the value of a 6% investment after 2 years. Make sure and round the coefficients to 3 decimal places. b) Find and interpret F2.0 when 12,000 has been invested as a lump sum

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started