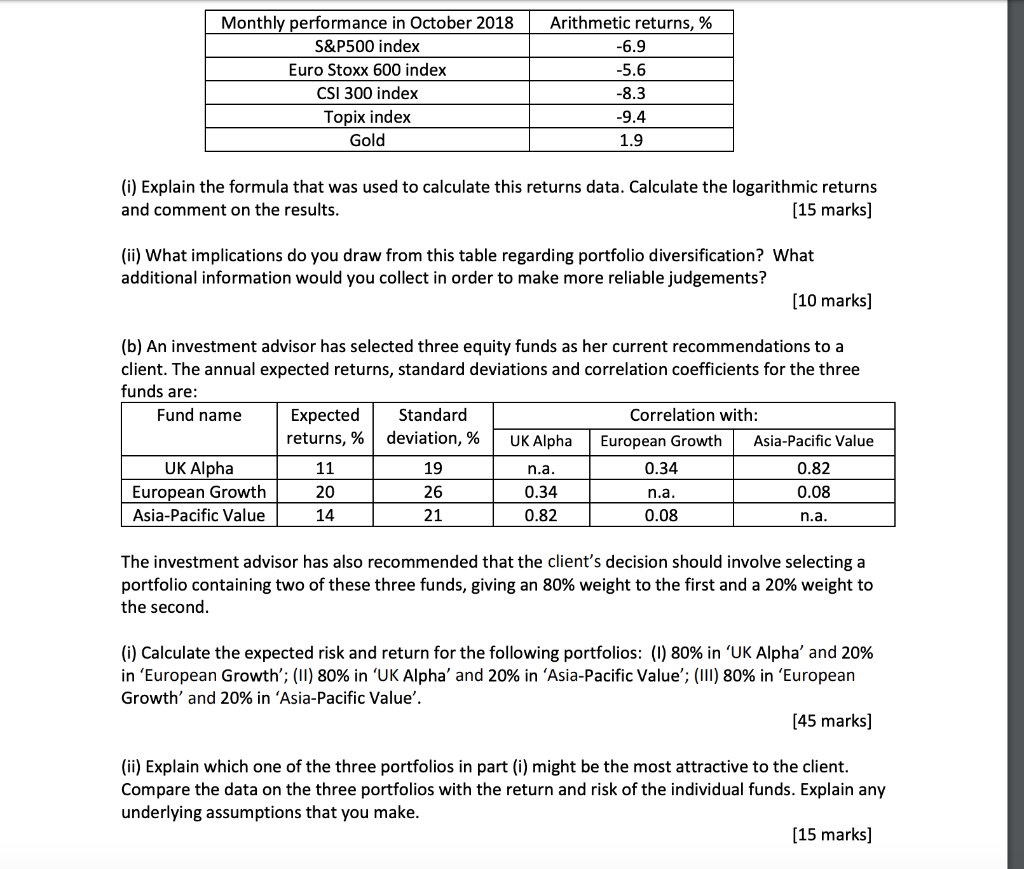

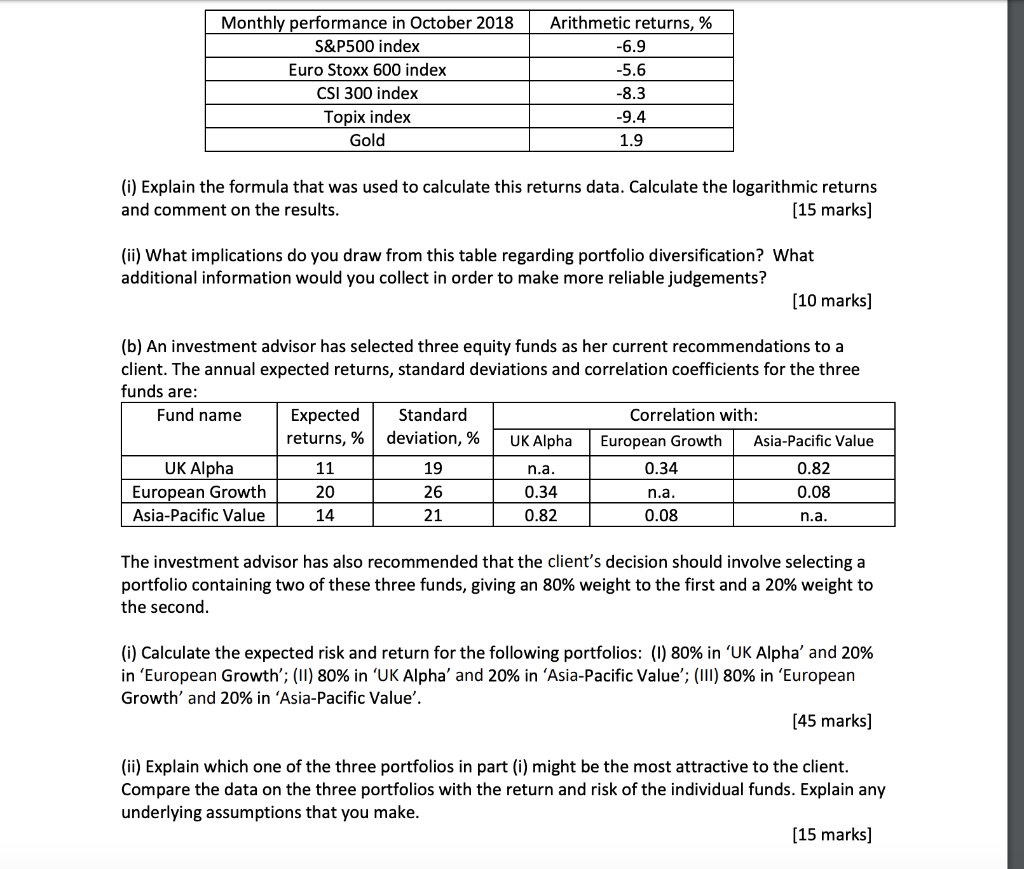

Monthly performance in October 2018 S&P500 index Euro Stoxx 600 index CSI 300 index Topix index Gold Arithmetic returns, % -6.9 -5.6 -8.3 -9.4 1.9 (i) Explain the formula that was used to calculate this returns data. Calculate the logarithmic returns and comment on the results. (15 marks] (ii) What implications do you draw from this table regarding portfolio diversification? What additional information would you collect in order to make more reliable judgements? (10 marks] (b) An investment advisor has selected three equity funds as her current recommendations to a client. The annual expected returns, standard deviations and correlation coefficients for the three funds are: Fund name Expected Standard Correlation with: returns, % deviation, % UK Alpha European Growth Asia-Pacific Value UK Alpha 11 19 n.a. 0.34 0.82 European Growth 20 26 0.34 n.a. Asia-Pacific Value 14 21 0.82 0.08 n.a. 0.08 The investment advisor has also recommended that the client's decision should involve selecting a portfolio containing two of these three funds, giving an 80% weight to the first and a 20% weight to the second. (i) Calculate the expected risk and return for the following portfolios: (1) 80% in 'UK Alpha' and 20% in 'European Growth'; (11) 80% in UK Alpha' and 20% in 'Asia-Pacific Value'; (III) 80% in 'European Growth' and 20% in 'Asia-Pacific Value'. (45 marks] (ii) Explain which one of the three portfolios in part (i) might be the most attractive to the client. Compare the data on the three portfolios with the return and risk of the individual funds. Explain any underlying assumptions that you make. (15 marks] Monthly performance in October 2018 S&P500 index Euro Stoxx 600 index CSI 300 index Topix index Gold Arithmetic returns, % -6.9 -5.6 -8.3 -9.4 1.9 (i) Explain the formula that was used to calculate this returns data. Calculate the logarithmic returns and comment on the results. (15 marks] (ii) What implications do you draw from this table regarding portfolio diversification? What additional information would you collect in order to make more reliable judgements? (10 marks] (b) An investment advisor has selected three equity funds as her current recommendations to a client. The annual expected returns, standard deviations and correlation coefficients for the three funds are: Fund name Expected Standard Correlation with: returns, % deviation, % UK Alpha European Growth Asia-Pacific Value UK Alpha 11 19 n.a. 0.34 0.82 European Growth 20 26 0.34 n.a. Asia-Pacific Value 14 21 0.82 0.08 n.a. 0.08 The investment advisor has also recommended that the client's decision should involve selecting a portfolio containing two of these three funds, giving an 80% weight to the first and a 20% weight to the second. (i) Calculate the expected risk and return for the following portfolios: (1) 80% in 'UK Alpha' and 20% in 'European Growth'; (11) 80% in UK Alpha' and 20% in 'Asia-Pacific Value'; (III) 80% in 'European Growth' and 20% in 'Asia-Pacific Value'. (45 marks] (ii) Explain which one of the three portfolios in part (i) might be the most attractive to the client. Compare the data on the three portfolios with the return and risk of the individual funds. Explain any underlying assumptions that you make. (15 marks]