Answered step by step

Verified Expert Solution

Question

1 Approved Answer

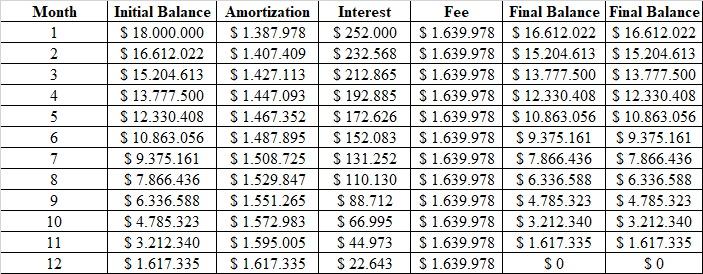

monthly rate 1.4 % Duration 12 months Value 18000.000 In capital. A construction company required a loan of 18 million dollars for 12 months, as

monthly rate 1.4 %

Duration 12 months

Value 18000.000 In capital.

A construction company required a loan of 18 million dollars for 12 months, as the attached information can be seen in the table. However, it was decided to make an extra payment in the sixth installment corresponding to 2 million dollars in order to reduce the value of the remaining installments, which will all be of the same value. Of what value would these fees be? Make a table with the new information.

Month 1 2 3 4 5 6 7 8 9 10 11 12 Initial Balance Amortization $ 18.000.000 $ 1.387.978 $ 16.612.022 $ 1.407.409 S 15.204.613 S 1.427.113 S 13.777.500 $ 1.447.093 $ 12.330.408 $ 1.467.352 S 10.863.056 S 1.487.895 $ 9.375.161 S 1.508.725 S 7.866.436 $ 1.529.847 $ 6.336.588 $ 1.551.265 S 4.785.323 $ 1.572.983 $ 3.212.340 $ 1.595.005 S 1.617.335 S 1.617.335 Interest $ 252.000 $ 232.568 S 212.865 S 192.885 $ 172.626 S 152.083 S 131.252 S 110.130 S 88.712 S 66.995 $ 44.973 S 22.643 Fee Final Balance Final Balance $ 1.639.978 S 16.612.022 S 16.612.022 $ 1.639.978 $ 15.204.613 S 15.204.613 $ 1.639.978 S 13.777.500 S 13.777.500 $ 1.639.978 S 12.330.408 S 12.330.408 $ 1.639.978 S 10.863.056 S 10.863.056 $ 1.639.978 S 9.375.161 S 9.375.161 $ 1.639.978 $ 7.866.436 S 7.866.436 S 1.639.978 S 6.336.588 $ 6.336.588 $ 1.639.978 $ 4.785.323 $ 4.785.323 S 1.639.978 S 3.212.340 $ 3.212.340 $ 1.639.978 S 1.617.335 S 1.617.335 $ 1.639.978 SO SO Month 1 2 3 4 5 6 7 8 9 10 11 12 Initial Balance Amortization $ 18.000.000 $ 1.387.978 $ 16.612.022 $ 1.407.409 S 15.204.613 S 1.427.113 S 13.777.500 $ 1.447.093 $ 12.330.408 $ 1.467.352 S 10.863.056 S 1.487.895 $ 9.375.161 S 1.508.725 S 7.866.436 $ 1.529.847 $ 6.336.588 $ 1.551.265 S 4.785.323 $ 1.572.983 $ 3.212.340 $ 1.595.005 S 1.617.335 S 1.617.335 Interest $ 252.000 $ 232.568 S 212.865 S 192.885 $ 172.626 S 152.083 S 131.252 S 110.130 S 88.712 S 66.995 $ 44.973 S 22.643 Fee Final Balance Final Balance $ 1.639.978 S 16.612.022 S 16.612.022 $ 1.639.978 $ 15.204.613 S 15.204.613 $ 1.639.978 S 13.777.500 S 13.777.500 $ 1.639.978 S 12.330.408 S 12.330.408 $ 1.639.978 S 10.863.056 S 10.863.056 $ 1.639.978 S 9.375.161 S 9.375.161 $ 1.639.978 $ 7.866.436 S 7.866.436 S 1.639.978 S 6.336.588 $ 6.336.588 $ 1.639.978 $ 4.785.323 $ 4.785.323 S 1.639.978 S 3.212.340 $ 3.212.340 $ 1.639.978 S 1.617.335 S 1.617.335 $ 1.639.978 SO SOStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started