Answered step by step

Verified Expert Solution

Question

1 Approved Answer

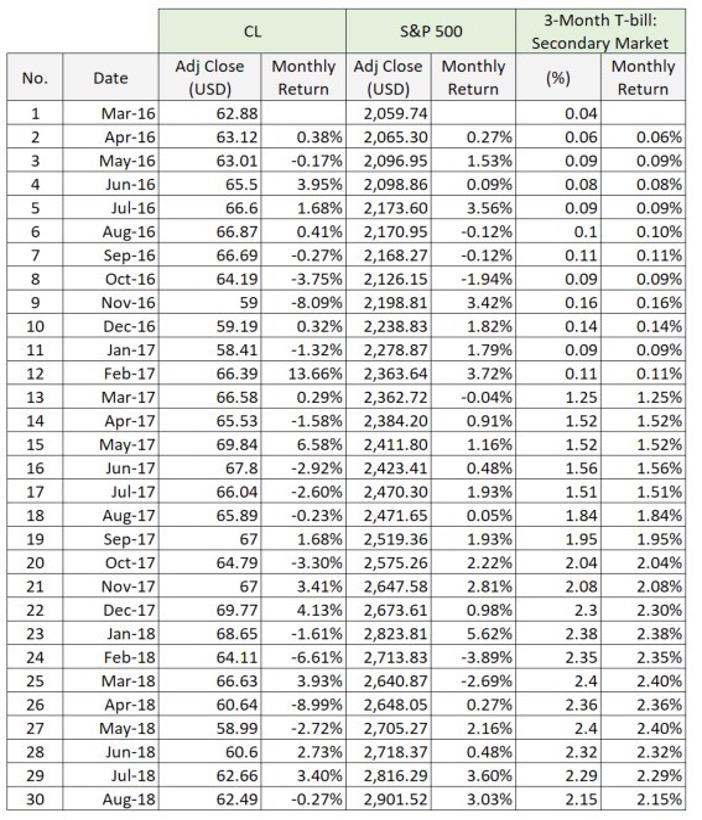

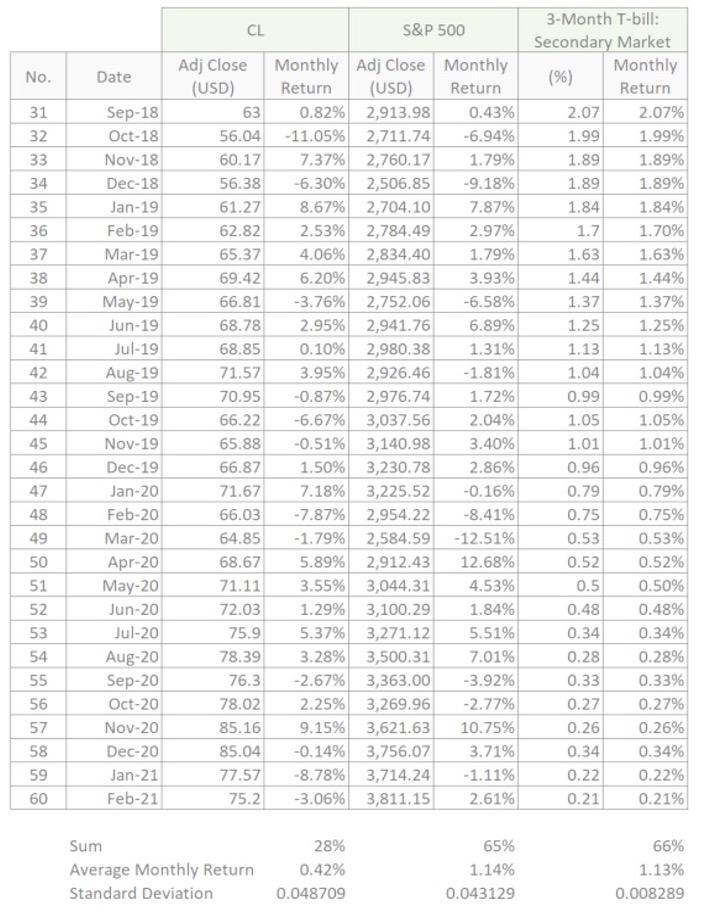

-Monthly returns, Average Monthly returns , and Standard Deviations for Colgate- Palmolive Stock, the three-month Treasury bill, and the S&P 500 for this period -Beta

-Monthly returns, Average Monthly returns , and Standard Deviations for Colgate- Palmolive Stock, the three-month Treasury bill, and the S&P 500 for this period

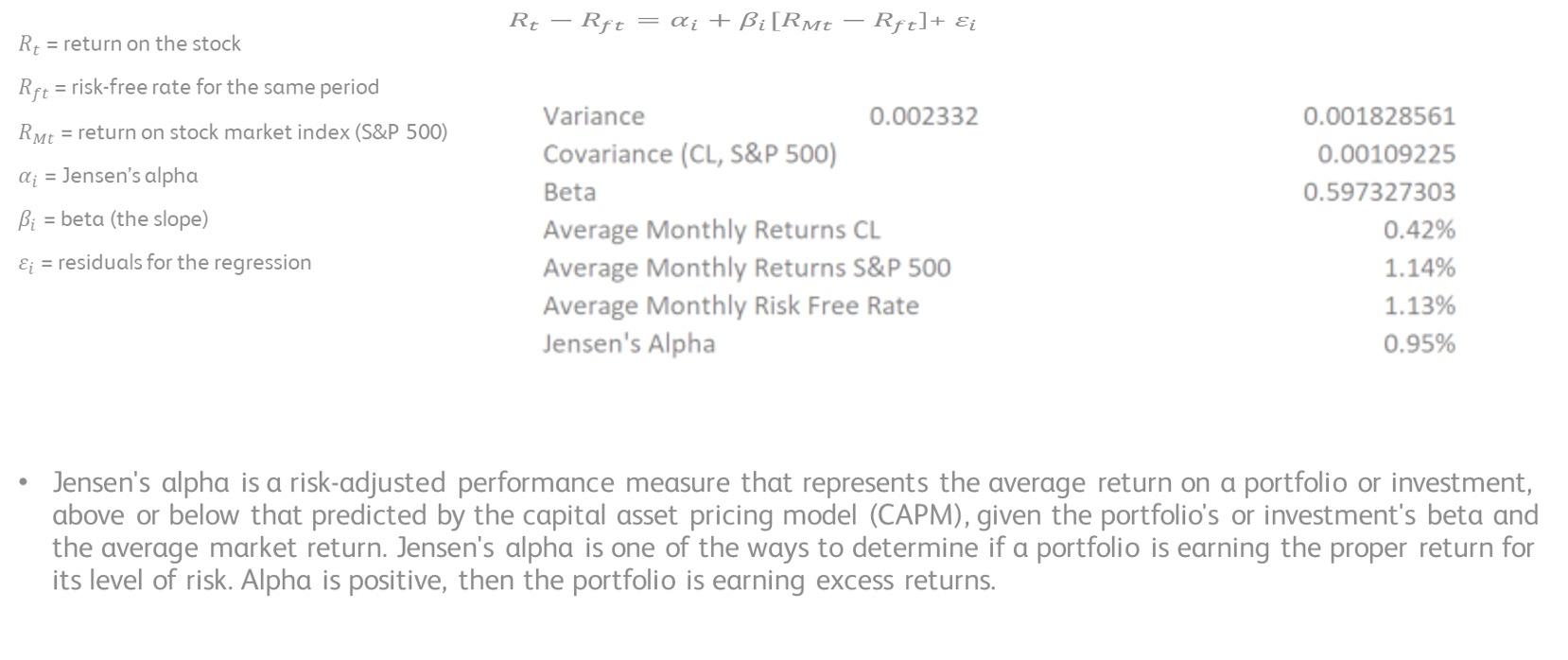

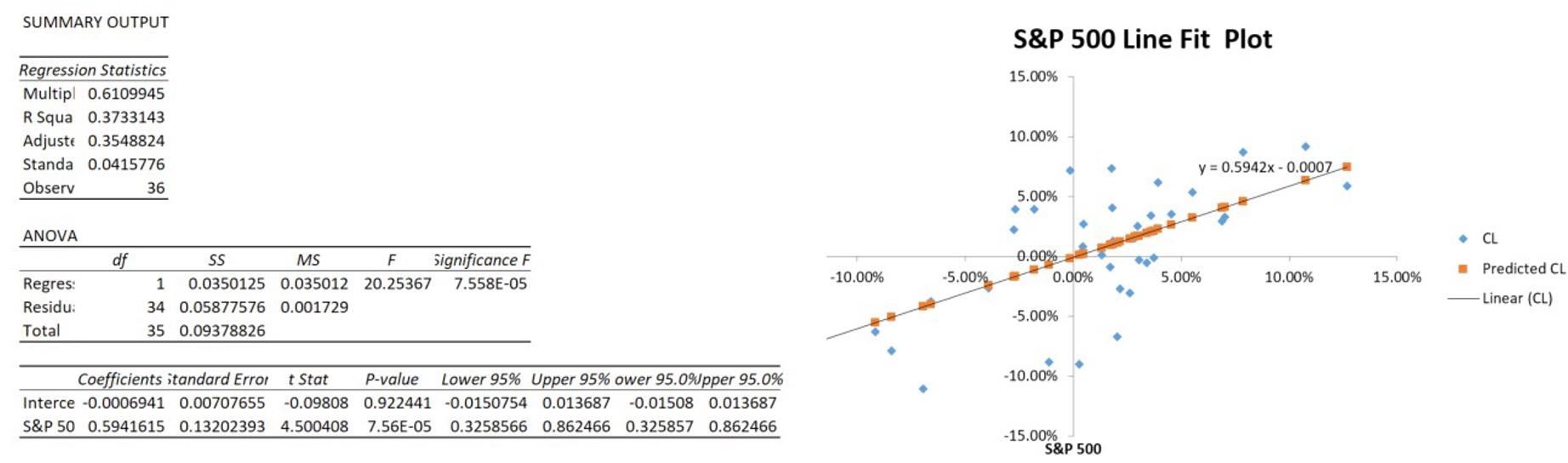

-Beta motivation, Jenses’s alpha measure, Plot respect to the SML, financial interpretation of the residual

-Beta Market Model for CL (36 months), Monthly return plot against index and fitted line

No. 1 123 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Date Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17 May-17 Jun-17 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Adj Close (USD) CL 62.88 63.12 63.01 Monthly Return (USD) 2,059.74 0.38% 2,065.30 0.27% -0.17% 2,096.95 1.53% 3.95% 2,098.86 0.09% 65.5 66.6 1.68% 2,173.60 3.56% 66.87 0.41% 2,170.95 -0.12% 66.69 -0.27% 2,168.27 -0.12% 64.19 -3.75% 2,126.15 -1.94% 59 -8.09% 2,198.81 3.42% 59.19 0.32% 2,238.83 1.82% 58.41 -1.32% 2,278.87 1.79% 66.39 13.66% 2,363.64 66.58 0.29% 2,362.72 65.53 -1.58% 2,384.20 69.84 6.58% 2,411.80 67.8 -2.92% 2,423.41 66.04 -2.60% 2,470.30 65.89 -0.23% 2,471.65 67 1.68% 2,519.36 64.79 -3.30% 2,575.26 67 69.77 68.65 64.11 66.63 60.64 58.99 60.6 62.66 62.49 S&P 500 Adj Close Monthly Return 3.41% 2,647.58 4.13% 2,673.61 -1.61% 2,823.81 -6.61% 2,713.83 3.93% 2,640.87 -8.99 % 2,648.05 -2.72% 2,705.27 2.73% 2,718.37 3.40% 2,816.29 -0.27% 2,901.52 3.72% -0.04% 0.91% 1.16% 0.48% 1.93% 0.05% 1.93% 2.22% 2.81% 0.98% 5.62% -3.89% -2.69% 0.27% 2.16% 0.48% 3.60% 3.03% 3-Month T-bill: Secondary Market Monthly (%) Return 0.04 0.06 0.09 0.08 0.09 0.1 0.11 0.09 0.16 0.14 0.09 0.11 1.25 1.52 1.52 1.56 1.51 1.84 1.95 2.04 2.08 2.3 2.38 2.35 2.4 2.36 2.4 2.32 2.29 2.15 0.06% 0.09% 0.08% 0.09% 0.10% 0.11% 0.09% 0.16% 0.14% 0.09% 0.11% 1.25% 1.52% 1.52% 1.56% 1.51% 1.84% 1.95% 2.04% 2.08% 2.30% 2.38% 2.35% 2.40% 2.36% 2.40% 2.32% 2.29% 2.15%

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Market ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started