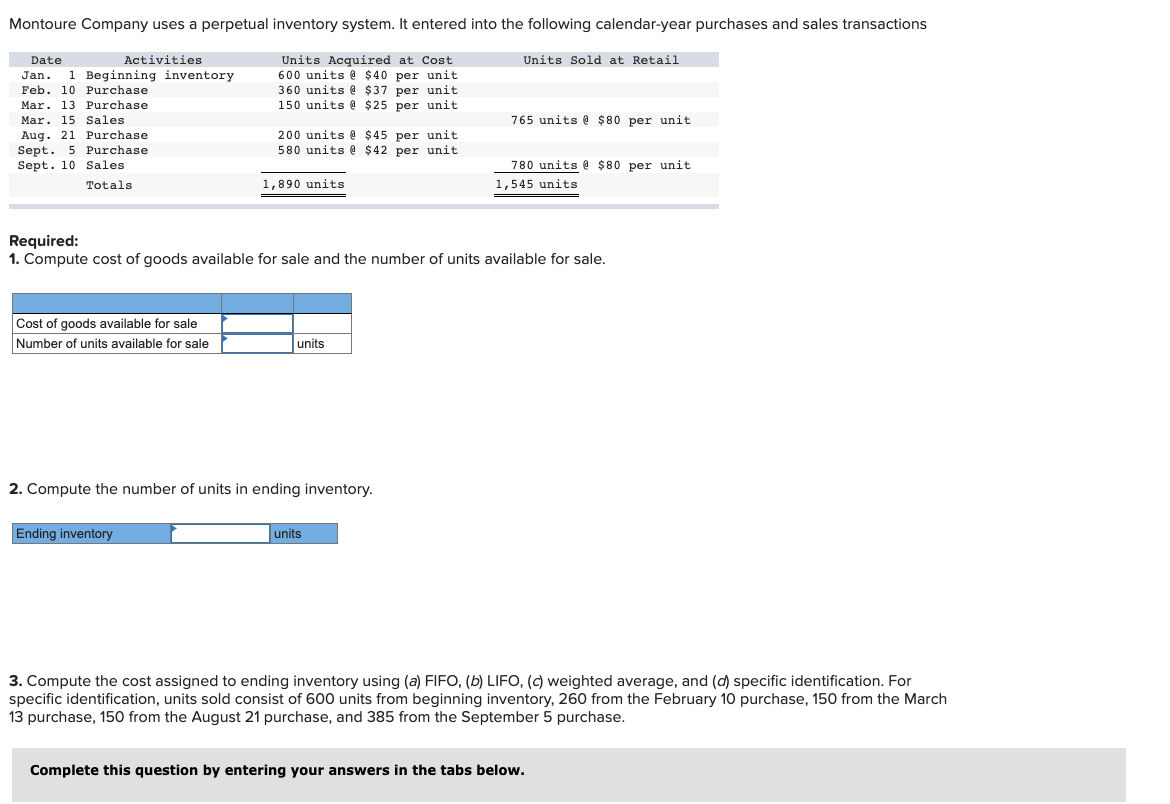

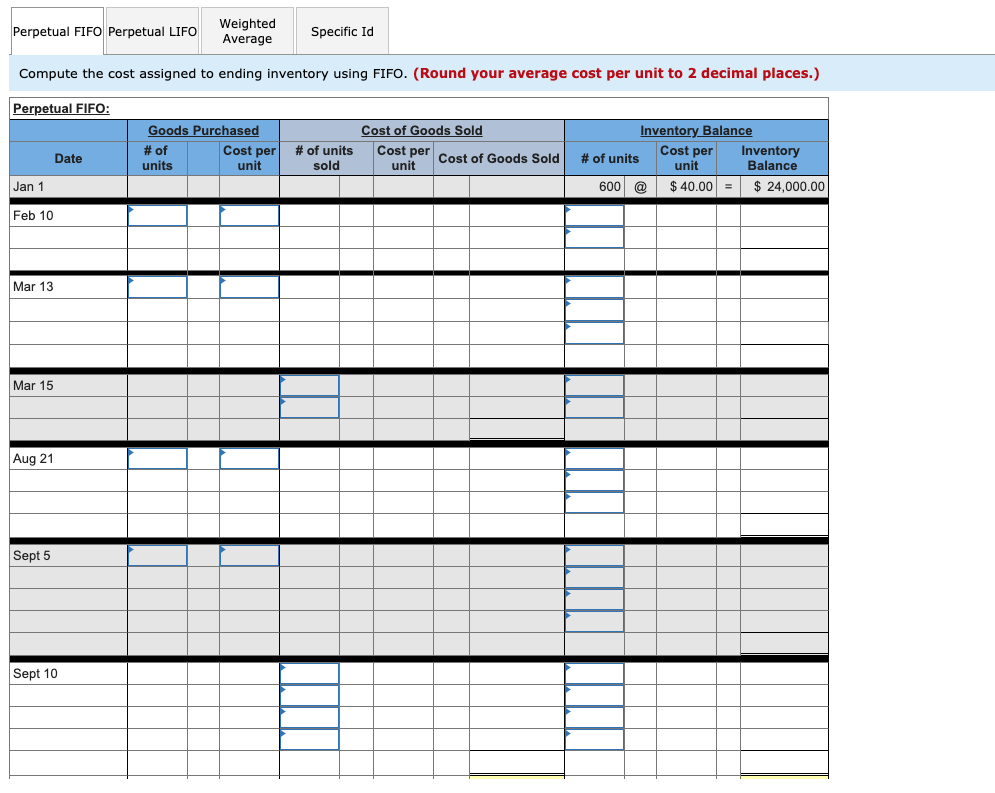

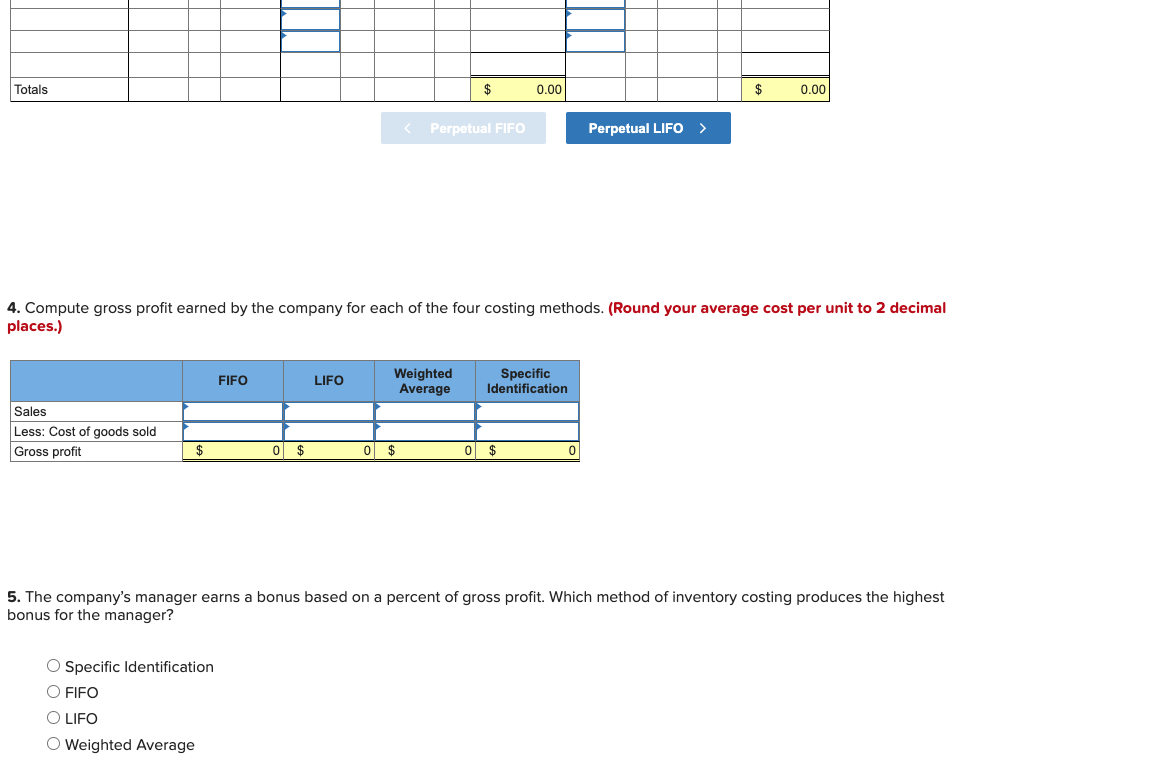

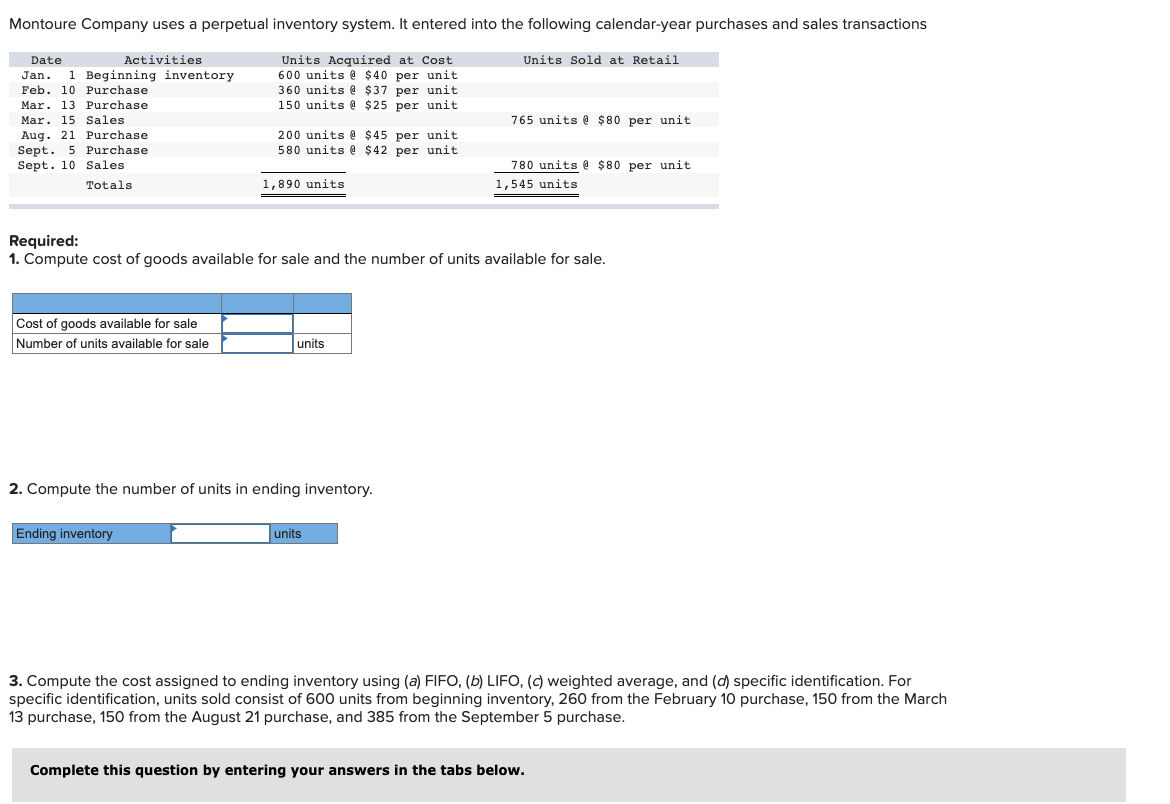

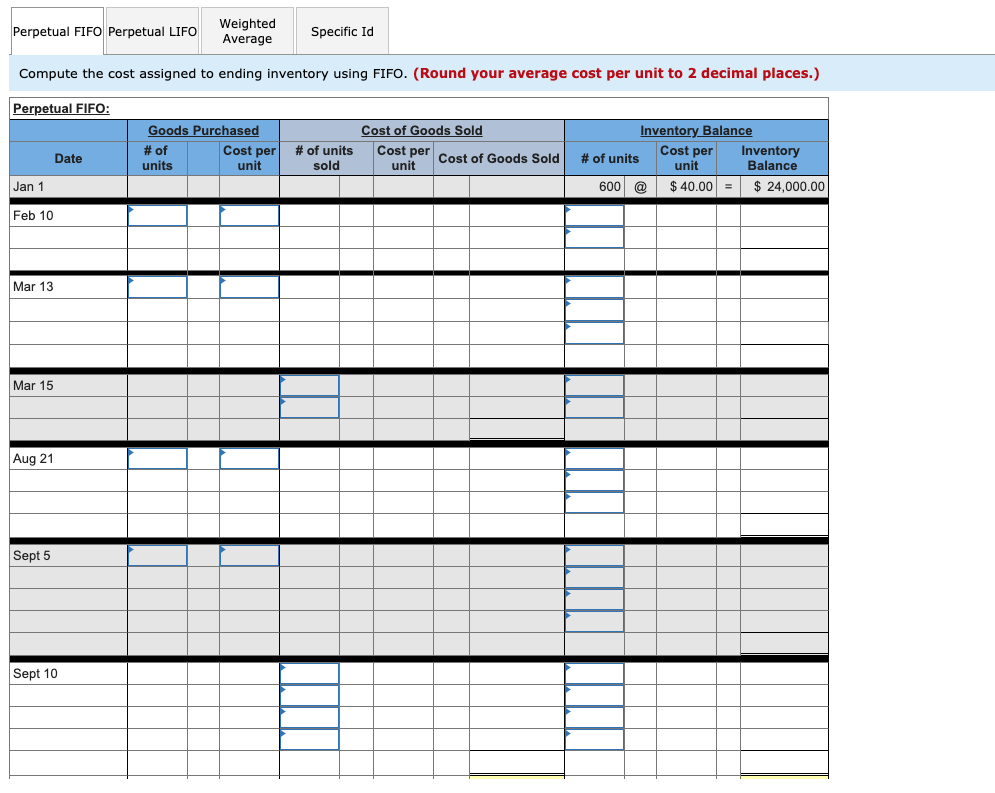

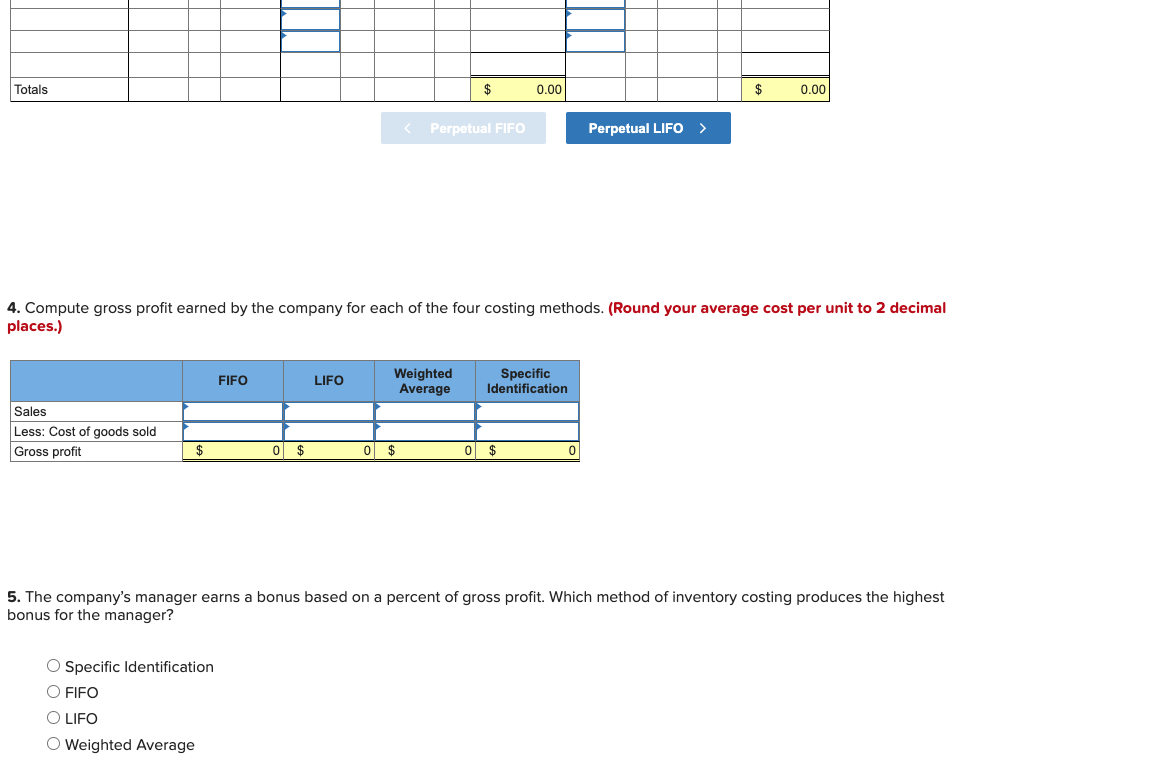

Montoure Company uses a perpetual inventory system. It entered into the following calendar-year purchases and sales transactions Units Sold at Retail Units Acquired at Cost 600 units @ $40 per unit 360 units @ $37 per unit 150 units @ $25 per unit Date Activities Jan. 1 Beginning inventory Feb. 10 Purchase Mar. 13 Purchase Mar. 15 Sales Aug. 21 Purchase Sept. 5 Purchase Sept. 10 Sales Totals 765 units @ $80 per unit 200 units @ $45 per unit 580 units @ $42 per unit 780 units @ $80 per unit 1,545 units 1,890 units Required: 1. Compute cost of goods available for sale and the number of units available for sale. Cost of goods available for sale Number of units available for sale units 2. Compute the number of units in ending inventory. Ending inventory units 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (C) weighted average, and (d) specific identification. For specific identification, units sold consist of 600 units from beginning inventory, 260 from the February 10 purchase, 150 from the March 13 purchase, 150 from the August 21 purchase, and 385 from the September 5 purchase. Complete this question by entering your answers in the tabs below. Perpetual FIFO Perpetual LIFO Weighted Average Specific Id Compute the cost assigned to ending inventory using FIFO. (Round your average cost per unit to 2 decimal places.) Perpetual FIFO: Goods Purchased # of Cost per units unit Cost of Goods Sold Cost per Cost of Goods Sold unit # of units sold Date Inventory Balance Cost per Inventory # of units unit Balance 600 @ $ 40.00 = $ 24,000.00 Jan 1 Feb 10 Mar 13 Mar 15 Aug 21 Sept 5 Sept 10 Totals $ 0.00 $ 0.00 Perpetual FIFO Perpetual LIFO 4. Compute gross profit earned by the company for each of the four costing methods. (Round your average cost per unit to 2 decimal places.) FIFO LIFO Weighted Average Specific Identification Sales Less: Cost of goods sold Gross profit $ 0 $ 0 $ 0 $ 5. The company's manager earns bonus for the manager? bonus based on a percent of gross profit. Which method of inventory costing produces the highest Specific Identification O FIFO O LIFO O Weighted Average