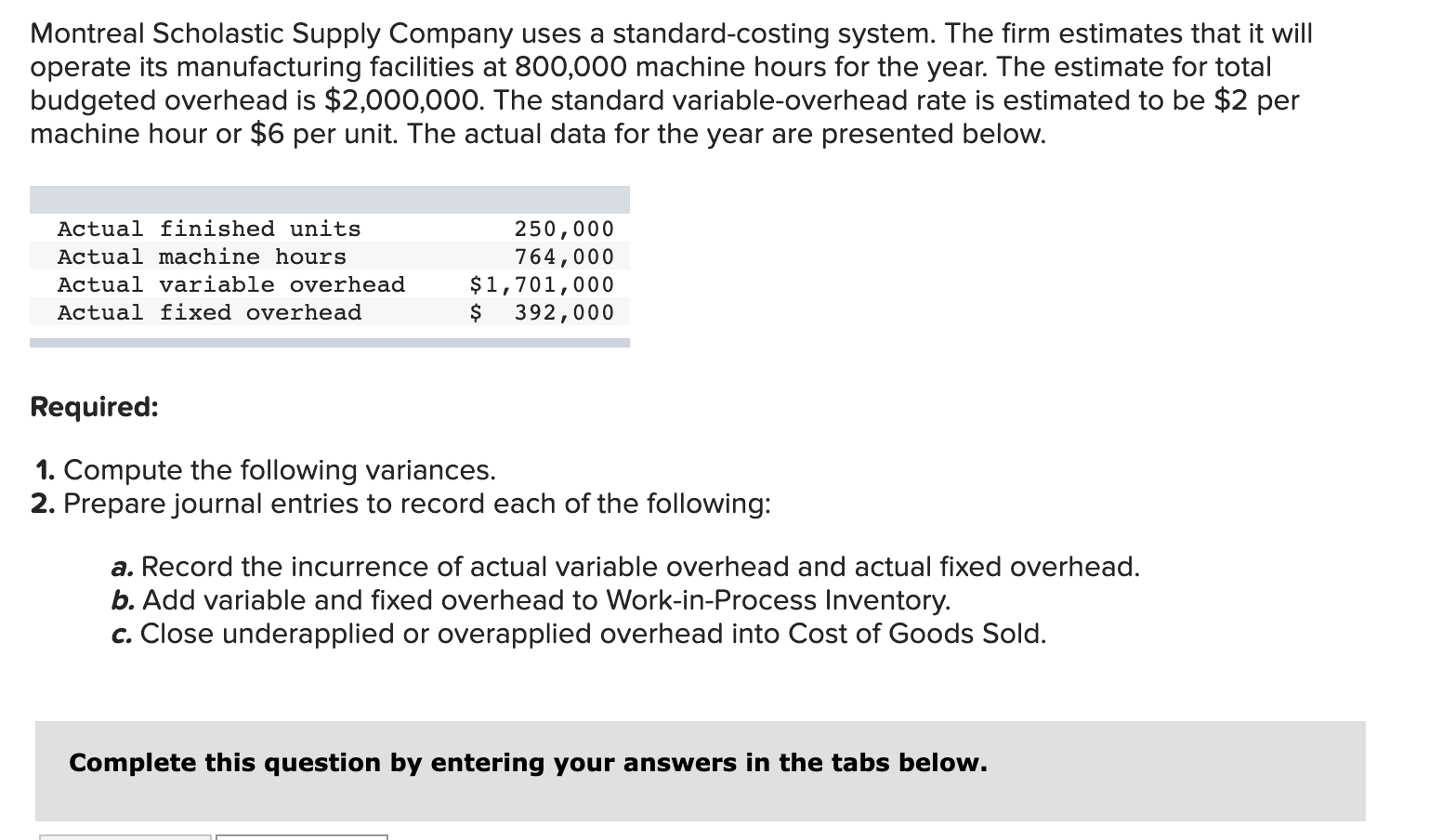

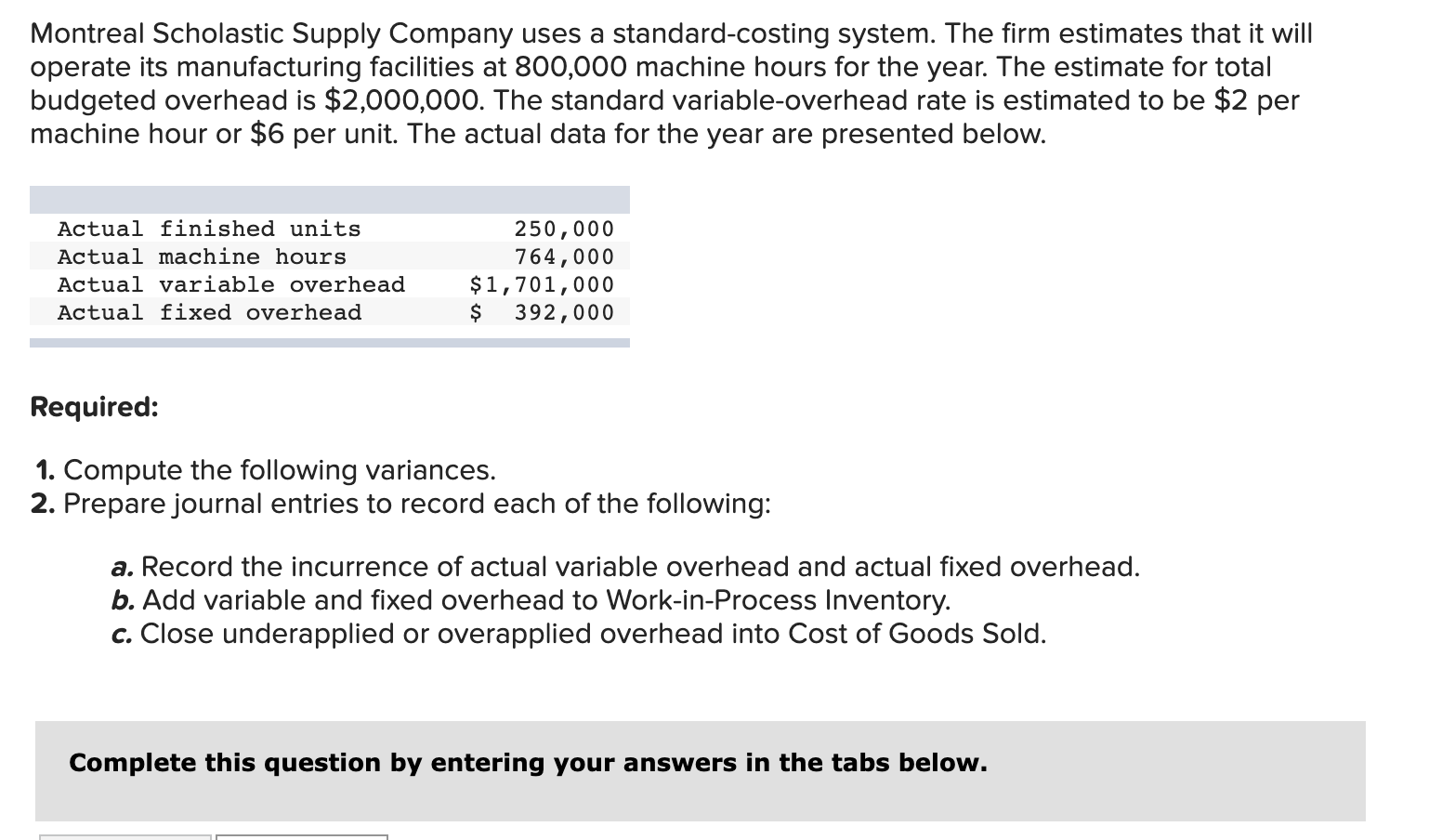

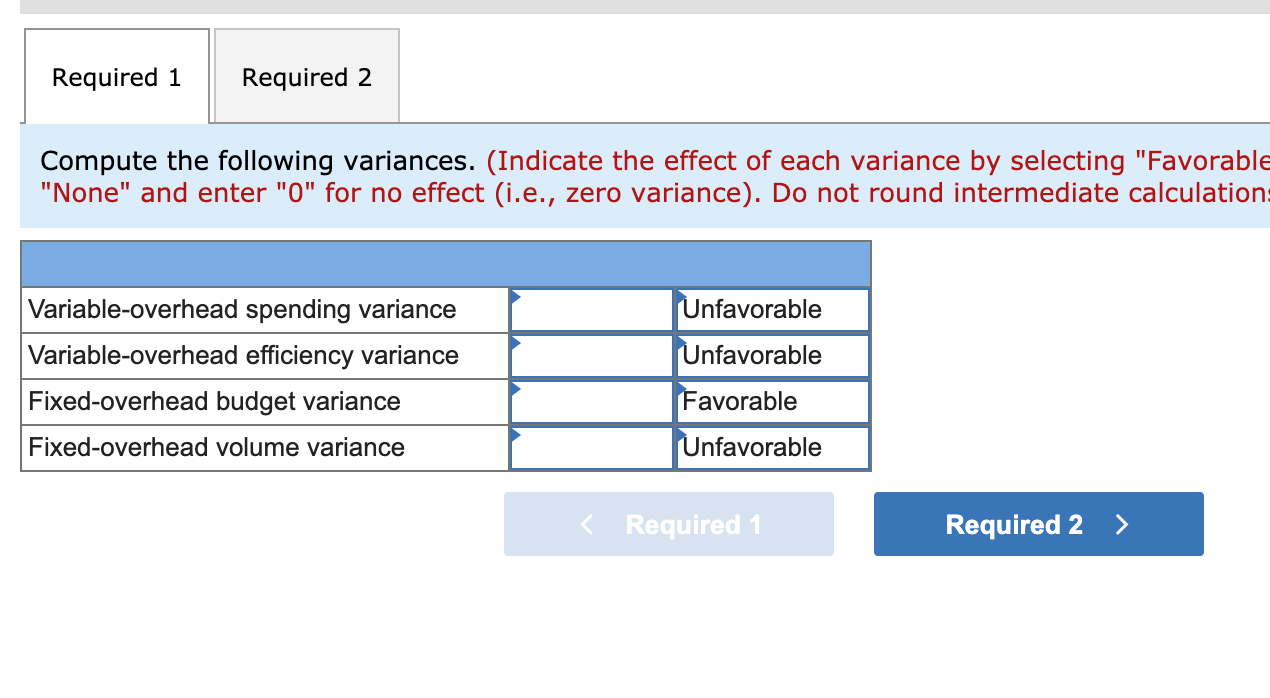

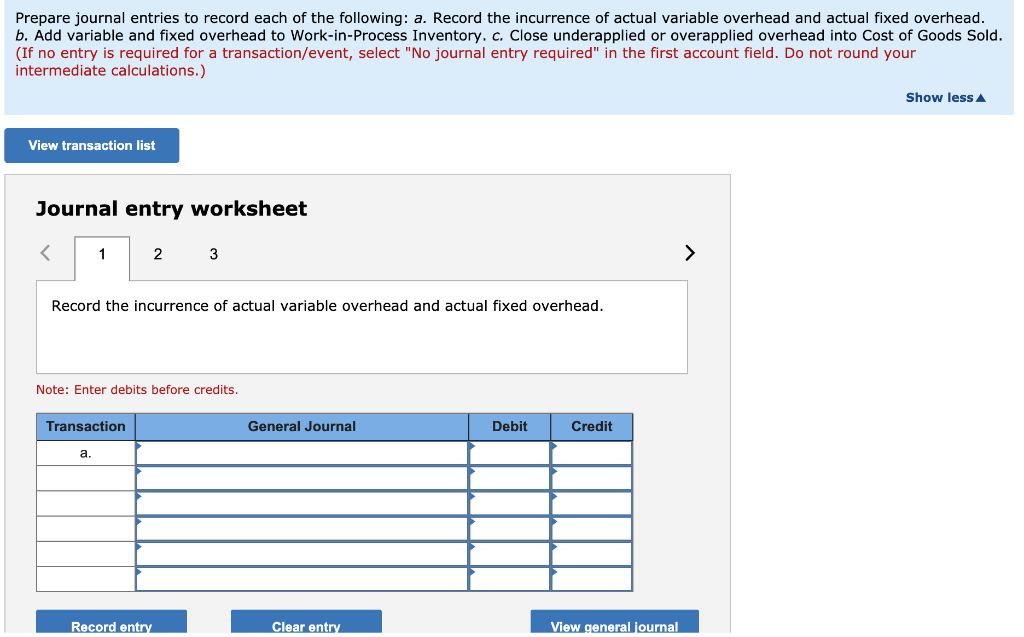

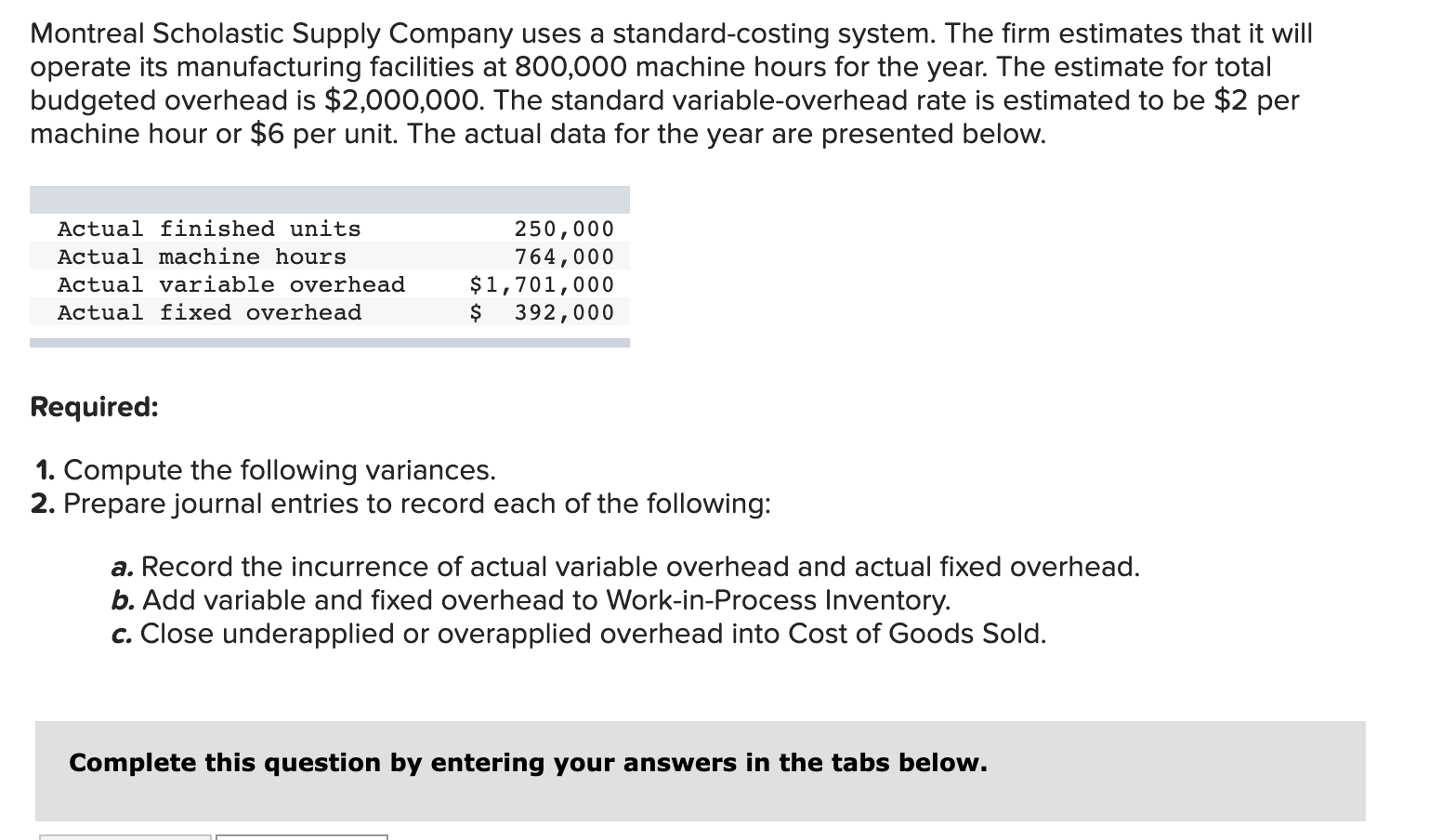

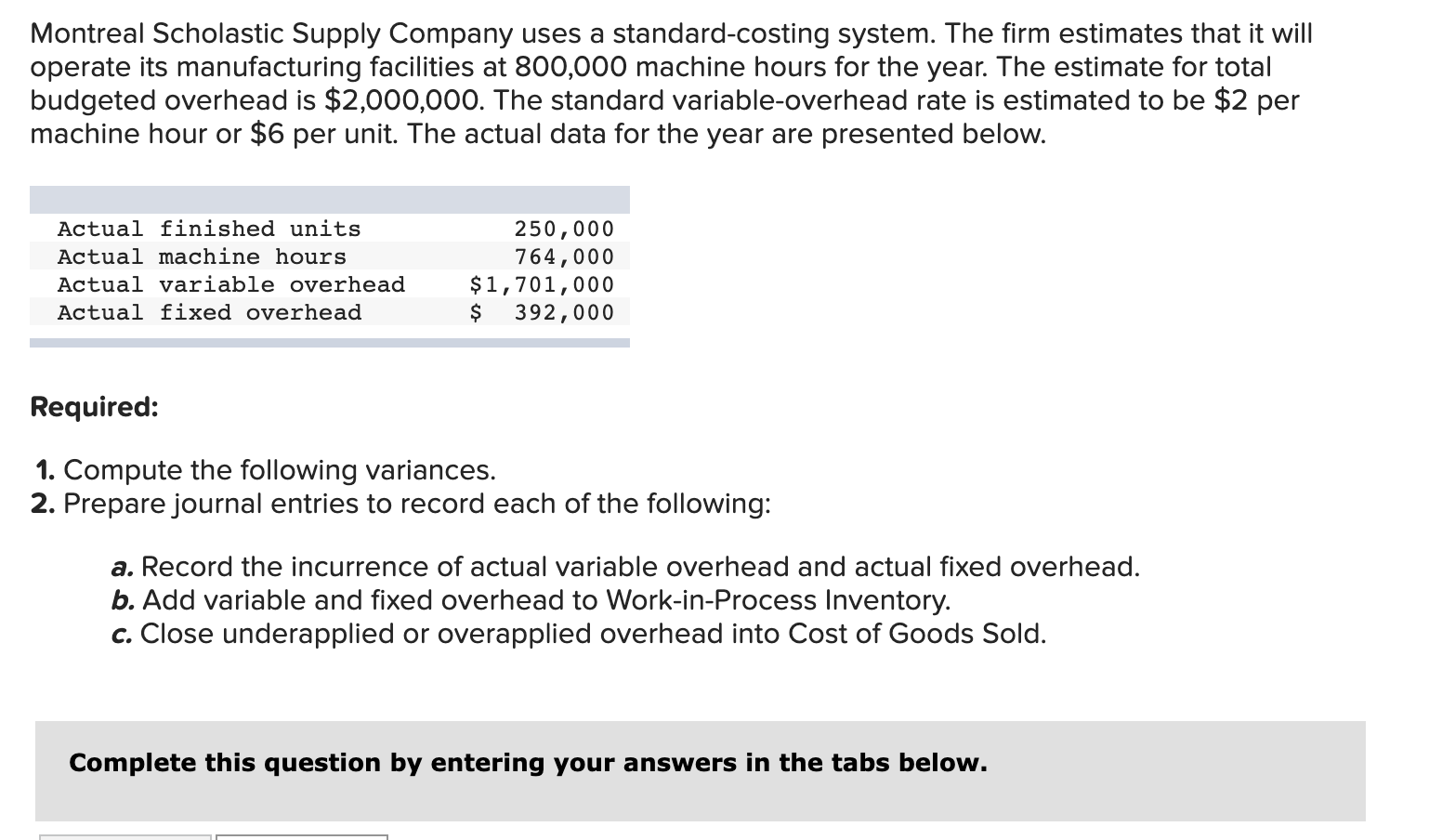

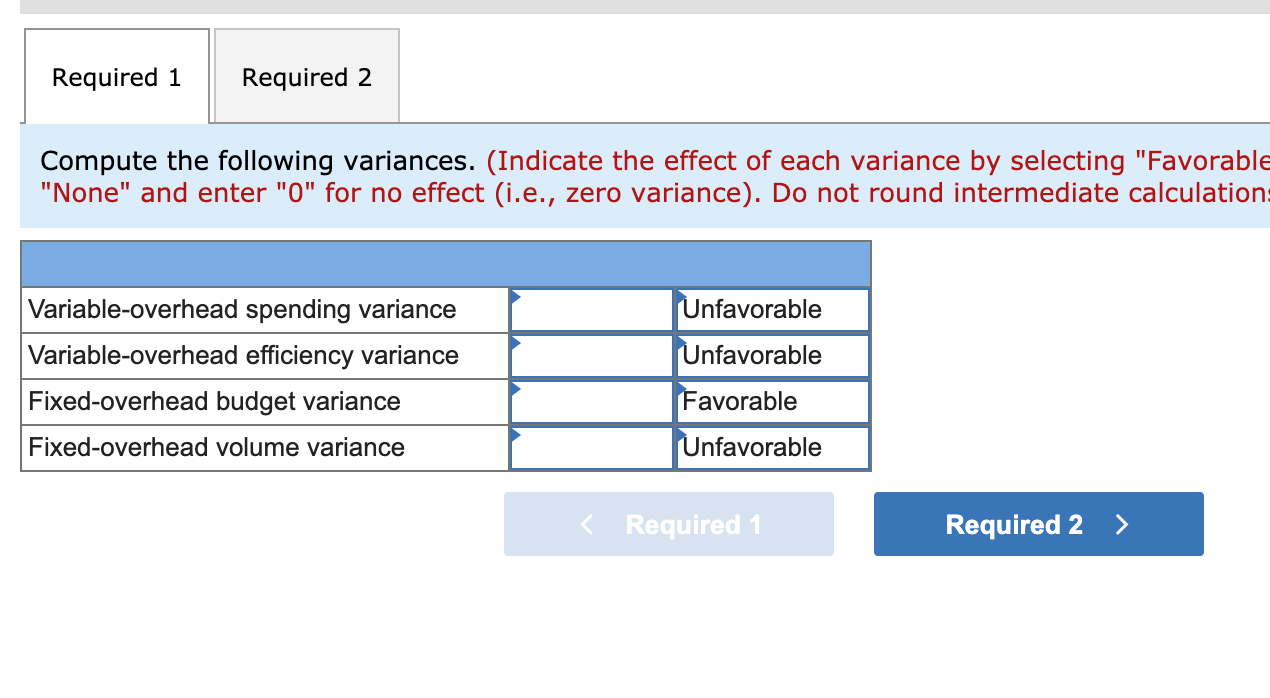

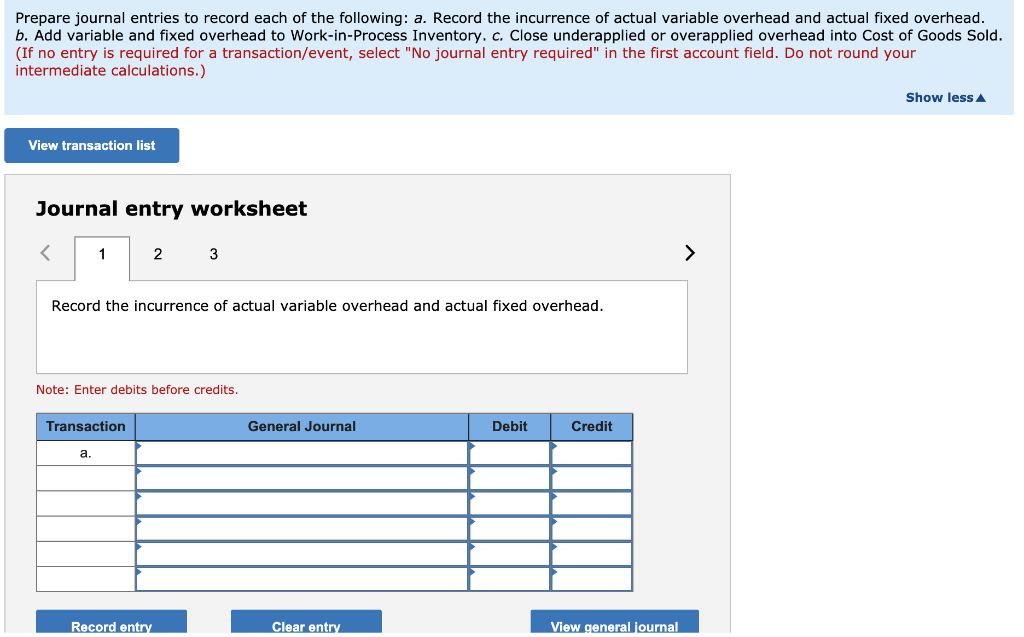

Montreal Scholastic Supply Company uses a standard-costing system. The firm estimates that it will operate its manufacturing facilities at 800,000 machine hours for the year. The estimate for total budgeted overhead is $2,000,000. The standard variable-overhead rate is estimated to be $2 per machine hour or $6 per unit. The actual data for the year are presented below. Actual finished units Actual machine hours Actual variable overhead Actual fixed overhead 250,000 764,000 $1,701,000 $ 392,000 Required: 1. Compute the following variances. 2. Prepare journal entries to record each of the following: a. Record the incurrence of actual variable overhead and actual fixed overhead. b. Add variable and fixed overhead to Work-in-Process Inventory. C. Close underapplied or overapplied overhead into Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Montreal Scholastic Supply Company uses a standard-costing system. The firm estimates that it will operate its manufacturing facilities at 800,000 machine hours for the year. The estimate for total budgeted overhead is $2,000,000. The standard variable-overhead rate is estimated to be $2 per machine hour or $6 per unit. The actual data for the year are presented below. Actual finished units Actual machine hours Actual variable overhead Actual fixed overhead 250,000 764,000 $1,701,000 $ 392,000 Required: 1. Compute the following variances. 2. Prepare journal entries to record each of the following: a. Record the incurrence of actual variable overhead and actual fixed overhead. b. Add variable and fixed overhead to Work-in-Process Inventory. C. Close underapplied or overapplied overhead into Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the following variances. (Indicate the effect of each variance by selecting "Favorable "None" and enter "O" for no effect (i.e., zero variance). Do not round intermediate calculation Unfavorable Unfavorable Variable-overhead spending variance Variable-overhead efficiency variance Fixed-overhead budget variance Fixed-overhead volume variance Favorable Unfavorable Required 1 Required 2 > Prepare journal entries to record each of the following: a. Record the incurrence of actual variable overhead and actual fixed overhead. b. Add variable and fixed overhead to Work-in-Process Inventory. c. Close underapplied or overapplied overhead into Cost of Goods Sold. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round your intermediate calculations.) Show less A View transaction list Journal entry worksheet Record the incurrence of actual variable overhead and actual fixed overhead. Note: Enter debits before credits. Transaction General Journal Debit Credit a. Record entry Clear entry View general journal