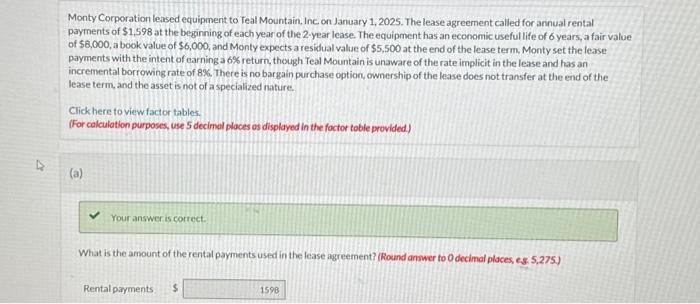

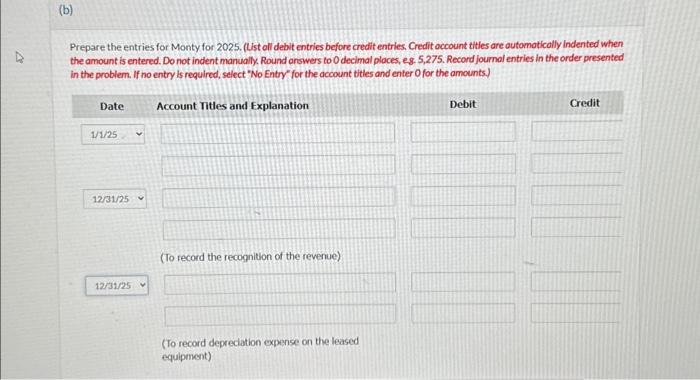

Monty Corporation lensed equipment to Teal Mountain, Inc on January 1, 2025. The lease agreement called for annual rental payments of $1,598 at the begsinning of each year of the 2-year lcase. The equipment has an economic usefut life of 6 years, a fair value of $8,000, a book value of $6,000, and Monty expects a residual value of $5,500 at the end of the lease term. Monty set the lease payments with the intent of carning a 6% return, though Teal Mountain is unaware of the rate implicit in the lease and has an incremental borrowing rate of 8%. There is no bargain purchase option, ownership of the lease does not transfer at the end of the lease term, and the asset is not of a specialized nature. Clickhere to view factor tables. (For calculation purposes, use 5 decimal places os displayed in the foctor toble provided.) (a) Your answer is correct. What is the amount of the rental payments used in the lease agreement? (Round answer to o decimal places, es 5,275.) Prepare the entries for Monty for 2025. (List oll debit entries before credit entries, Credit occount tities are automotically indented when the amount is entered. Do not indent manually. Round arowers to 0 decimal places, eg, 5,275. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account tities and enter O for the amounts.) Monty Corporation lensed equipment to Teal Mountain, Inc on January 1, 2025. The lease agreement called for annual rental payments of $1,598 at the begsinning of each year of the 2-year lcase. The equipment has an economic usefut life of 6 years, a fair value of $8,000, a book value of $6,000, and Monty expects a residual value of $5,500 at the end of the lease term. Monty set the lease payments with the intent of carning a 6% return, though Teal Mountain is unaware of the rate implicit in the lease and has an incremental borrowing rate of 8%. There is no bargain purchase option, ownership of the lease does not transfer at the end of the lease term, and the asset is not of a specialized nature. Clickhere to view factor tables. (For calculation purposes, use 5 decimal places os displayed in the foctor toble provided.) (a) Your answer is correct. What is the amount of the rental payments used in the lease agreement? (Round answer to o decimal places, es 5,275.) Prepare the entries for Monty for 2025. (List oll debit entries before credit entries, Credit occount tities are automotically indented when the amount is entered. Do not indent manually. Round arowers to 0 decimal places, eg, 5,275. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account tities and enter O for the amounts.)