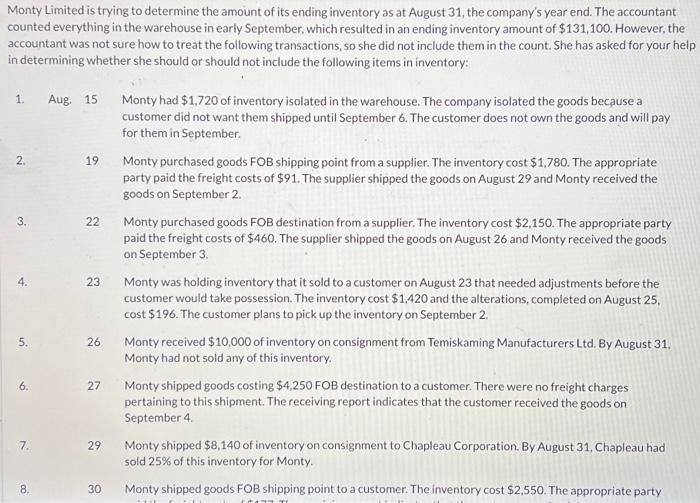

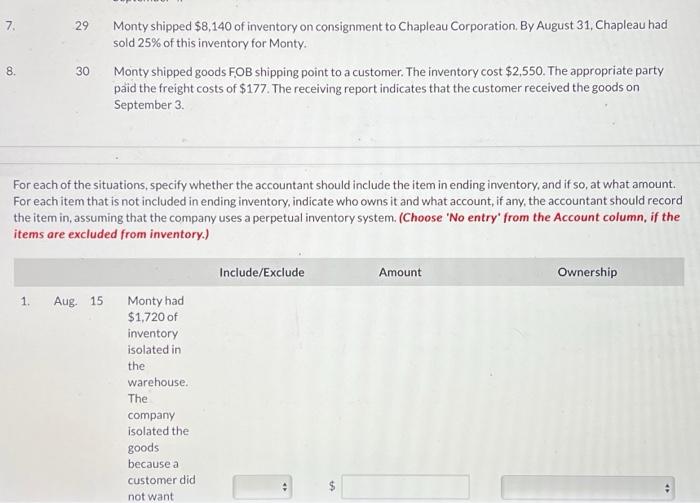

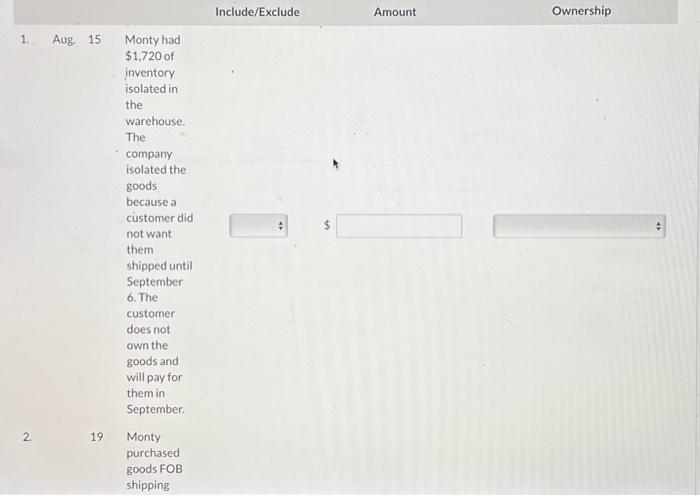

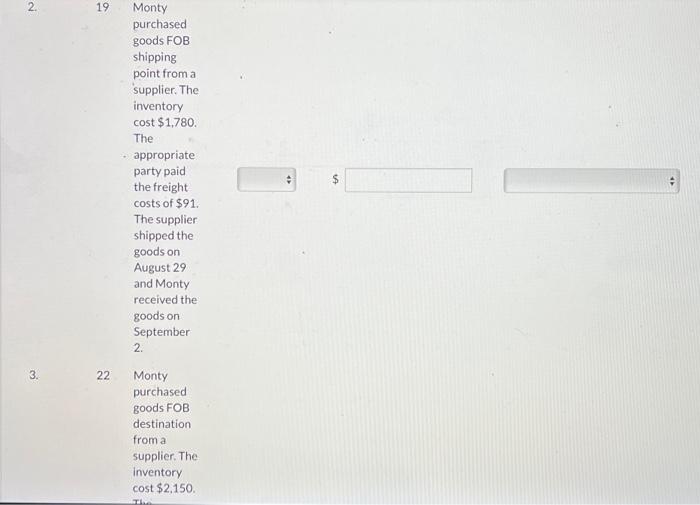

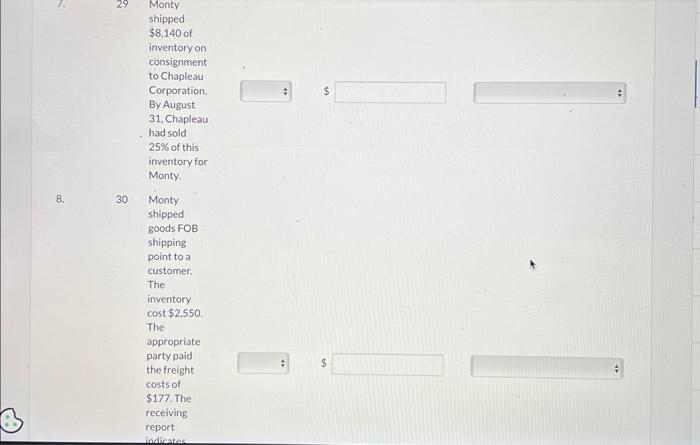

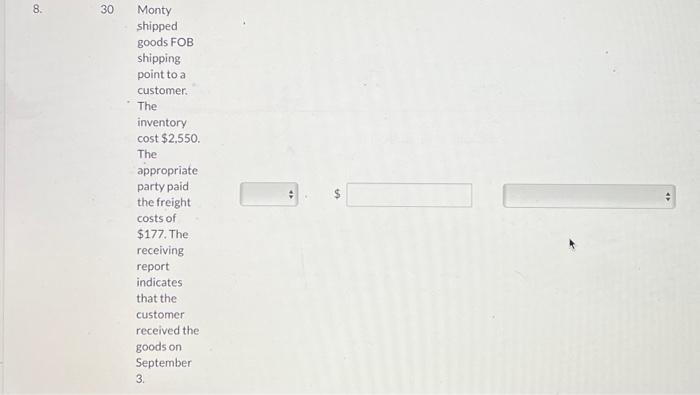

Monty Limited is trying to determine the amount of its ending inventory as at August 31, the company's year end. The accountant counted everything in the warehouse in early September, which resulted in an ending inventory amount of $131,100. However, the accountant was not sure how to treat the following transactions, so she did not include them in the count. She has asked for your help in determining whether she should or should not include the following items in inventory: 1. Aug. 15 Monty had $1,720 of inventory isolated in the warehouse. The company isolated the goods because a customer did not want them shipped until September 6. The customer does not own the goods and will pay for them in September. 2. 19 Monty purchased goods FOB shipping point from a supplier. The inventory cost $1,780. The appropriate party paid the freight costs of \$91. The supplier shipped the goods on August 29 and Monty received the goods on September 2. 3. 22 Monty purchased goods FOB destination from a supplier. The inventory cost $2,150. The appropriate party paid the freight costs of $460. The supplier shipped the goods on August 26 and Monty received the goods on September 3 . 4. 23 Monty was holding inventory that it sold to a customer on August 23 that needed adjustments before the customer would take possession. The inventory cost $1,420 and the alterations, completed on August 25 , cost $196. The customer plans to pick up the inventory on September 2. 5. 26 Monty received $10,000 of inventory on consignment from Temiskaming Manufacturers Ltd. By August 31 , Monty had not sold any of this inventory. 6. 27 Monty shipped goods costing $4,250 FOB destination to a customer. There were no freight charges pertaining to this shipment. The receiving report indicates that the customer received the goods on September 4 . 7. 29 Monty shipped $8,140 of inventory on consignment to Chapleau Corporation. By August 31, Chapleau had sold 25% of this inventory for Monty. 29 Monty shipped $8,140 of inventory on consignment to Chapleau Corporation. By August 31, Chapleau had sold 25% of this inventory for Monty. 30 Monty shipped goods F,OB shipping point to a customer. The inventory cost $2,550. The appropriate party paid the freight costs of $177. The receiving report indicates that the customer received the goods on September 3. For each of the situations, specify whether the accountant should include the item in ending inventory, and if so, at what amount. For each item that is not included in ending inventory, indicate who owns it and what account, if any, the accountant should record the item in, assuming that the company uses a perpetual inventory system. (Choose 'No entry' from the Account column, if the items are excluded from inventory.) 1. Aug. Include/Exclude $1,720 of inventory isolated in the warehouse. The company isolated the goods because a customer did not want them shipped until September 6. The customer does not own the goods and will pay for them in September. Monty purchased goods FoB shipping Include/Exclude Amount Ownership 1. Aug. 15 Montyhad $1,720 of inventory isolated in the warehouse. The company isolated the goods because a customer did not want them shipped until September 6. The customer does not own the goods and will pay for them in September. 2. 19 Monty purchased goods FOB shipping Monty purchased goods FOB destination from a supplier. The inventory cost $2,150. August 23 4. 23 Monty was holding inventory that it sold to a customer on August 23 that needed adjustments before the customer would take possession. The inventory cost $1,420 and the alterations, completed on August 25, cost \$196. The customer plans to pick up the inventory on September 2. 5. 26 Monty purchased 6 27 Monty shipped goods costing $4,250 FOB destination to a customer. There were no freight charges pertaining to this shipment. The receiving report indicates that the customer received the goods on September 4. 7. 29 Monty shipped $8,140 of inventory on consignment to Chapleau Corporation. Monty shipped $8,140 of inventory on consignment to Chapleau Corporation. By August 31, Chapleau had sold 25% of this inventory for Monty. 8. 30 Monty shipped goods FOB shipping point to a customer. The inventory cost $2,550 The appropriate party paid the freight costs of $ \$177. The receiving report indicotes 8. 30 Monty shipped goods FOB shipping point to a customer. The inventory cost $2,550. The appropriate party paid the freight $ costs of \$177. The receiving report indicates that the customer received the goods on September 3