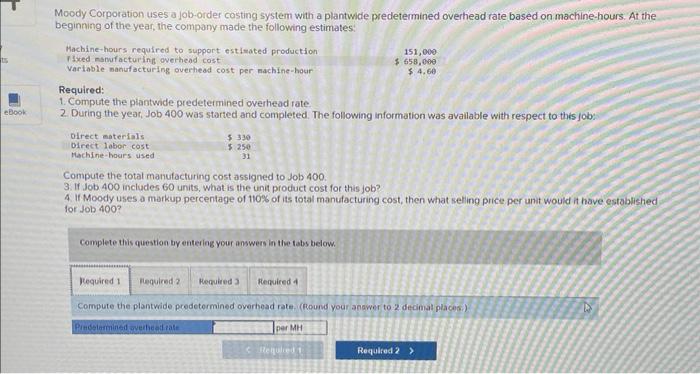

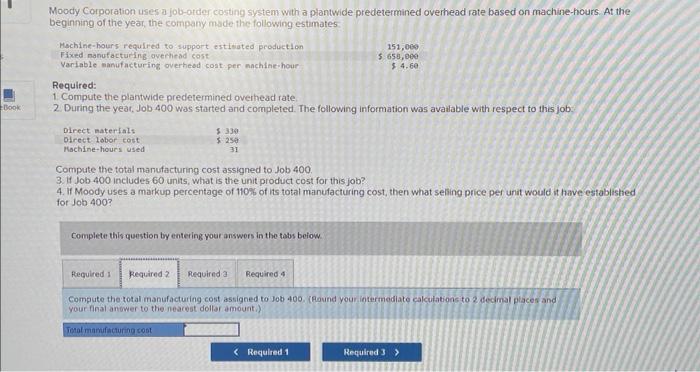

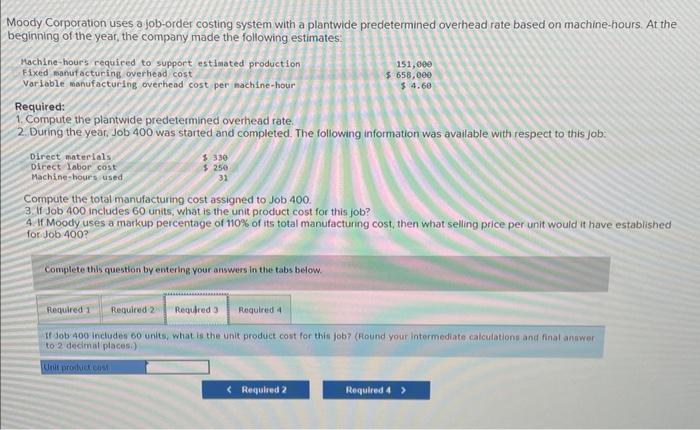

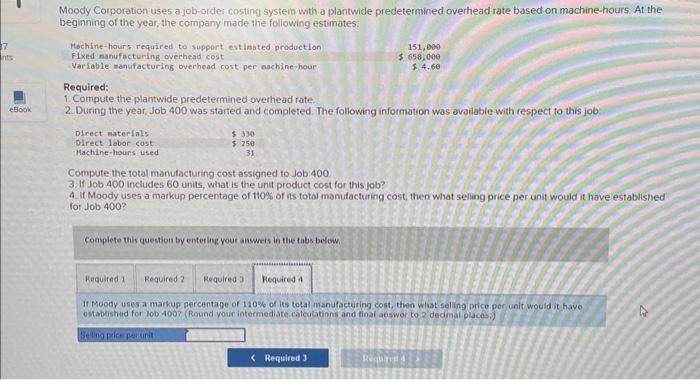

Moody Corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company made the following estimates: Required: 1. Compute the plantwide predetermined overhead rate. 2. During the year, Job 400 was started and completed. The following information was avaliable with respect to this job: Compute the total manufacturing cost assigned to Job 400 . 3. If Job 400 includes 60 units, what is the unit product cost for this job? 4. If Moody uses a markup percentage of 110% of its total manufacturing cost, then what seling price per unit would it have established for Job 400 ? Complete this question by entering your answers in the tabs below. Compute the plantwide predetermined overhead rate. (Round your anower to 2 decimat places.) Moody Corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company made the following estimates: Required: 1. Compute the plantwide predetermined overhead rate 2. During the year, Job 400 was started and completed. The following information was avatable with respect to this job: Compute the total manufacturing cost assigned to Job 400 . 3. If Job 400 includes 60 units, what is the unit product cost for this job? 4. If Moody uses a markup percentage of 110% of its total manufacturing cost, then what seling price per unit would it have establistied for Job 400 ? Complete this question by entering your answors in the tabs beiow Compute the total manufacturing cost assigned to 106 400. (Pound your intermediate calculations to 2 decimal ptaces and your final anower to the neacest dollar amount.) hoody Corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At the eginning of the year, the company made the following estimates: Required: 1. Compute the plantwide predetermined overhead rate. 2. During the year, Job 400 was started and completed. The following information was available with respect to this job: Compute the total manufacturing cost assigned to Job 400 . 3. If Job 400 includes 60 units, what is the unit product cost for this job? 4. If Moody uses a markup percentage of 110% of its total manufacturing cost, then what selling price per unit would it have established for Job 400 ? Complete this question by entering your answers in the tabs below. If sob a 400 includen 60 units, what is the unit product cont for this job? (Hound your intermediate calculations and final angwer to 2 dedimal placesi) Moody Corporation uses a job-order costing systern with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company made the following estimates: Required: 1. Compute the plantwide predetermined overhead rate. 2. During the year, Job 400 was started and completed. The following information was available with respect to this job: Compute the total manufacturing cost assigned to Job 400 3. If Job 400 includes 60 units, what is the unit product cost for this job? 4. If Moody uses a markup percentage of 110% of its total manufacturing cost, then what seling price per unit would it have estabilshed for Job 400 ? Complete this question by entering your answers in the tabs below. If Moedy unes a mackup percentage of 110% of its total manufacturing cost, then what seling price per unit would it have. ostablishad for lob 400 ? (Round your intermediate calculations and final aeswor to 2 deamal places i)