Question

Moon Ltd (Moon) is a local company listed on the JSE. One of Moons most recent investments is the investment in Planet Ltd (Planet). As

Moon Ltd (“Moon”) is a local company listed on the JSE. One of Moon’s most recent investments is the investment in Planet Ltd (“Planet”).

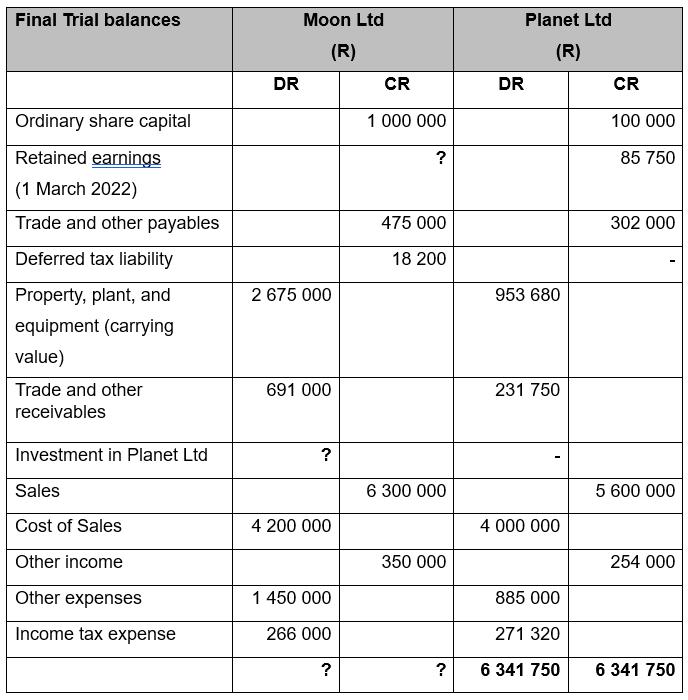

As per below, the following trial balances were obtained from the financial records of Moon and Planet for the financial year ended 28 February 2023:

Notes:

On 1 June 2022, Moon acquired 100% of the ordinary share capital of Planet. Thereby Moon obtaining control over Planet. Planet’s retained earnings on 1 June 2022 was R50 150 and the ordinary share capital at acquisition was R100 000.

1. The following information relates to the at-acquisition matters:

(a) The purchase consideration payable by Moon was settled as follows:

- R110 000 settled in cash on 1 June 2022; and

- Moon issued 25 000 ordinary shares. On the date of acquisition, the market price (fair value) of the Moon shares was R2.00 each and market price (fair value) of Planet shares was R1.00 each.

(b) At acquisition date, all the assets and liabilities of Planet were considered to be fairly valued.

2. All income and expenses (as well as the related tax expense) of Planet were earned evenly throughout the current financial year.

3. At the end of the financial year, 28 February 2023, Moon determined, as part of its annual impairment test, that the recoverable amount of Planet as a cash generating unit is R680 000. The accountant did not take this information into account when the trial balances were created. Ignore tax and deferred tax consequences relating only to impairment losses.

Additional information:

- 1.Moon and Planet both have a 28 February financial year end.

- 2.Moon accounts for investments in subsidiaries at cost in accordance with IAS 27.10(a) in its separate financial statements.

- 3.Moon is not a share dealer for income tax purposes.

- 4.Assume a companies’ Income Tax rate of 28%.

- 5.Ignore the effects of Value Added Tax (VAT).

REQUIRED:

1. Calculate the goodwill or gain on bargain purchase arising on the acquisition of Planet Ltd.

2. Prepare the Consolidated Statement of Profit or Loss and Other Comprehensive Income of the Moon Ltd Group for the financial year ended 28 February 2023. Include all totals and sub-totals.

Final Trial balances Ordinary share capital Retained earnings (1 March 2022) Trade and other payables Deferred tax liability Property, plant, and equipment (carrying value) Trade and other receivables Investment in Planet Ltd Sales Cost of Sales Other income Other expenses Income tax expense DR Moon Ltd (R) 2 675 000 691 000 ? 4 200 000 1 450 000 266 000 ? CR 1 000 000 ? 475 000 18 200 6 300 000 350 000 DR Planet Ltd (R) 953 680 231 750 4 000 000 885 000 271 320 ? 6 341 750 CR 100 000 85 750 302 000 5 600 000 254 000 6 341 750

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answers 1 Goodwill or Gain on Bargain Purchase Goodwill is calculated as the excess of the purchase ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started