Answered step by step

Verified Expert Solution

Question

1 Approved Answer

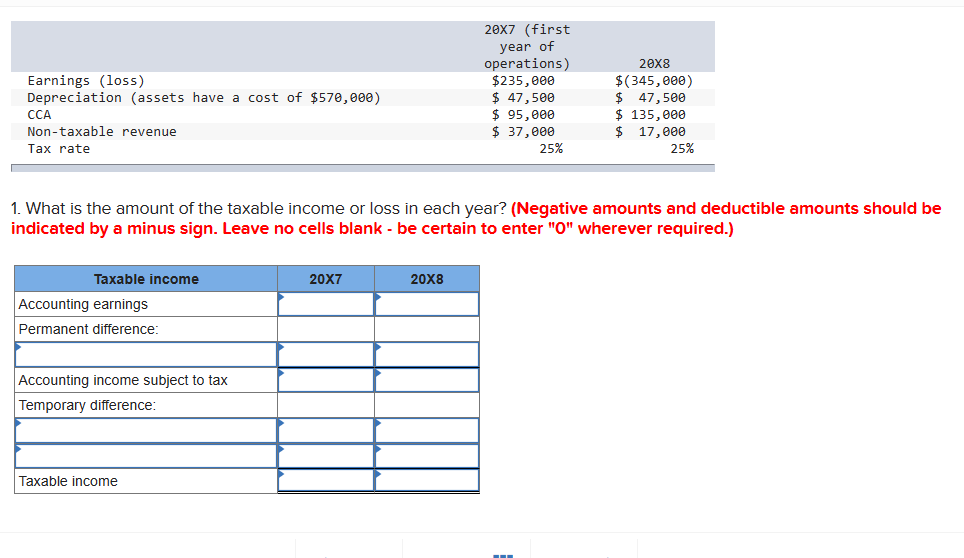

Moon Ltd . reported the following: 2 0 X 7 ( first year of operations ) 2 0 X 8 Earnings ( loss ) $

Moon Ltd reported the following:

Xfirst year of operationsX

Earnings loss $ $

Depreciation assets have a cost of $ $ $

CCA $ $

Nontaxable revenue $ $

Tax rate

What is the amount of the taxable income or loss in each year? Negative amounts and deductible amounts should be indicated by a minus sign. Leave no cells blank be certain to enter wherever required.

How much is the tax refund to be claimed in X

What is the amount of the loss carryforward at the end of X

Repeat requirements based on the assumption that Moon decides to not claim CCA in X or X

a What is the amount of the taxable income or loss in each year? Negative amounts and deductible amounts should be indicated by a minus sign. Leave no cells blank be certain to enter wherever required.

b How much is the tax refund to be claimed in X

c What is the amount of the loss carryforward at the end of XWhat is the amount of the taxable income or loss in each year? Negative amounts and deductible amounts should be

indicated by a minus sign. Leave no cells blank be certain to enter wherever required.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started