Answered step by step

Verified Expert Solution

Question

1 Approved Answer

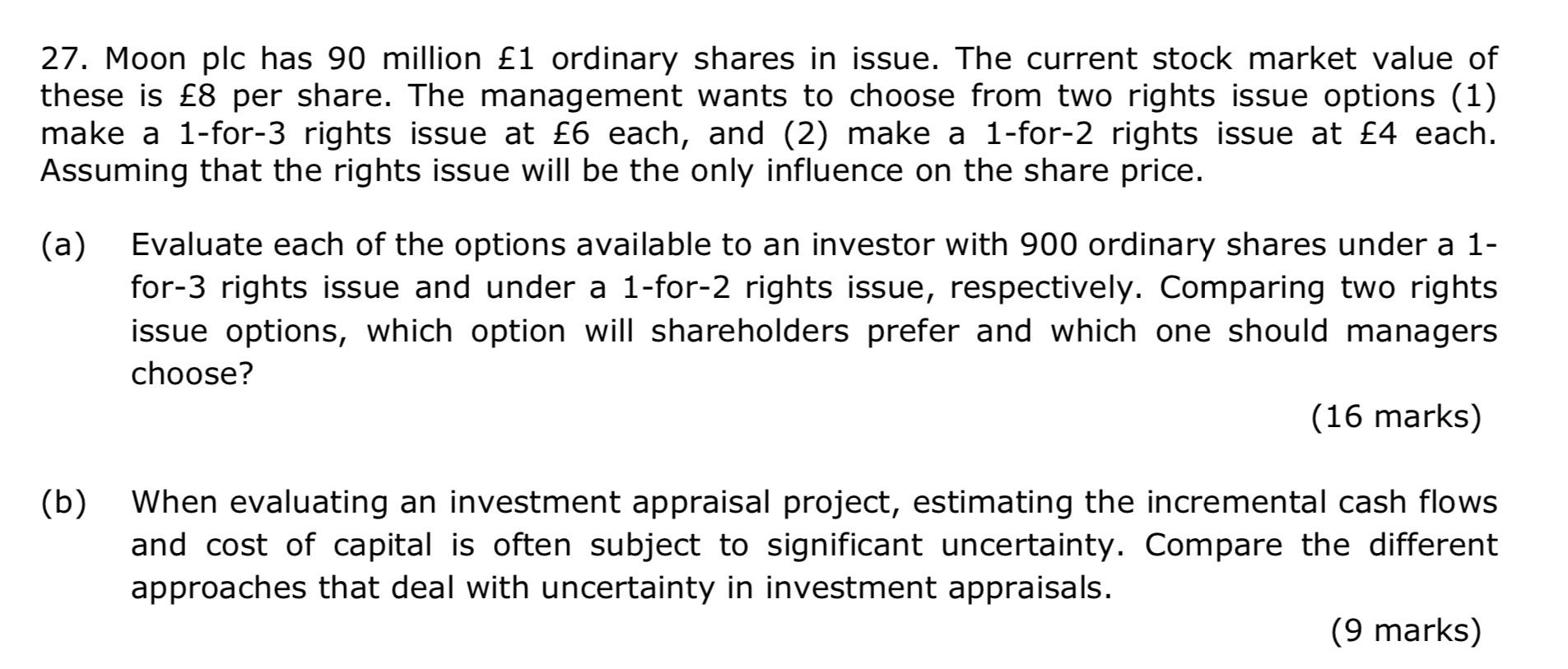

Moon plc has 9 0 million 1 ordinary shares in issue. The current stock market value of these is 8 per share. The management wants

Moon plc has million ordinary shares in issue. The current stock market value of

these is per share. The management wants to choose from two rights issue options

make a for rights issue at each, and make a for rights issue at each.

Assuming that the rights issue will be the only influence on the share price.

a Evaluate each of the options available to an investor with ordinary shares under a

for rights issue and under a for rights issue, respectively. Comparing two rights

issue options, which option will shareholders prefer and which one should managers

choose?

marks

b When evaluating an investment appraisal project, estimating the incremental cash flows

and cost of capital is often subject to significant uncertainty. Compare the different

approaches that deal with uncertainty in investment appraisals.

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started