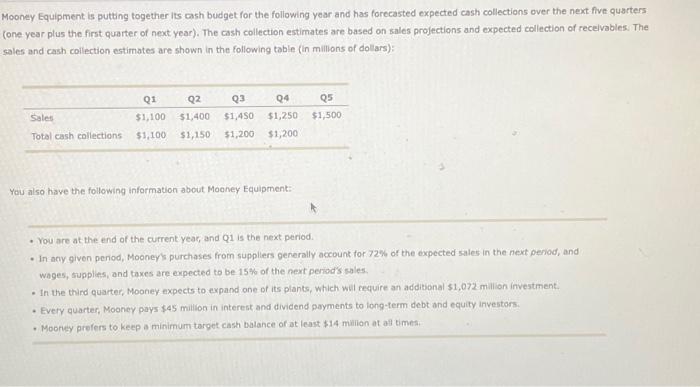

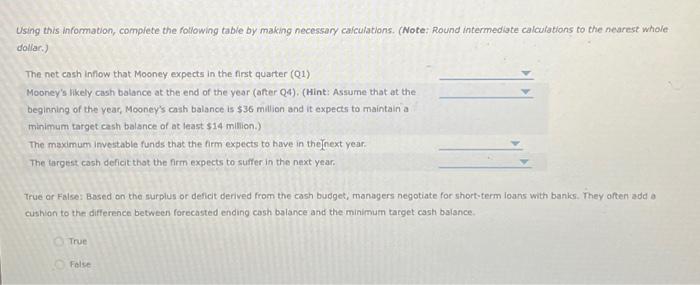

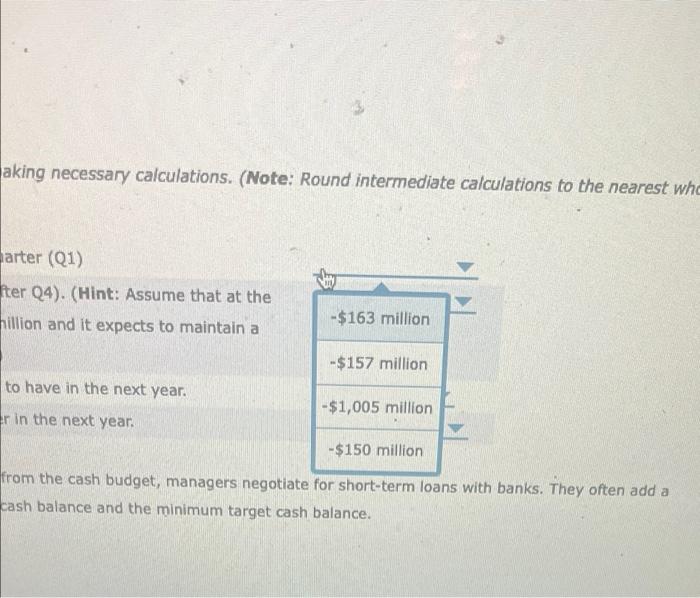

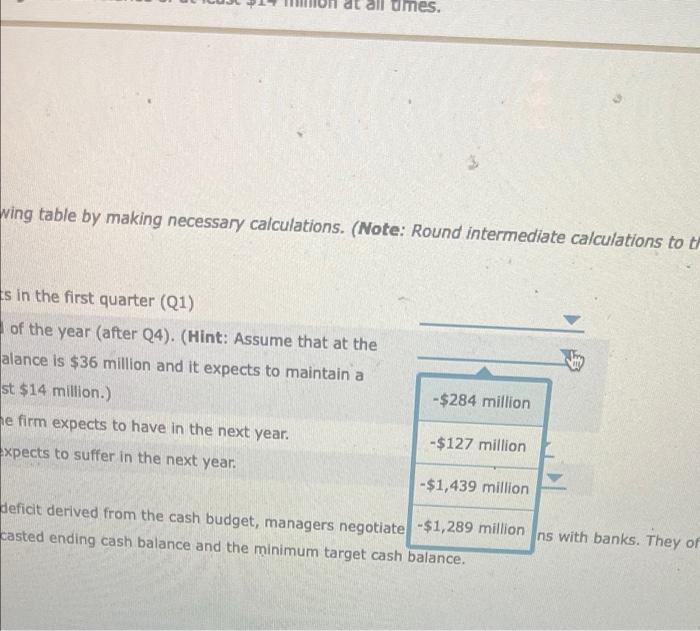

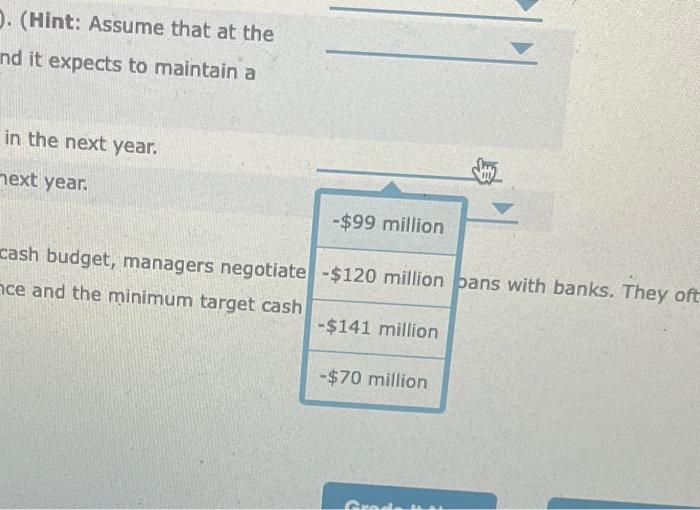

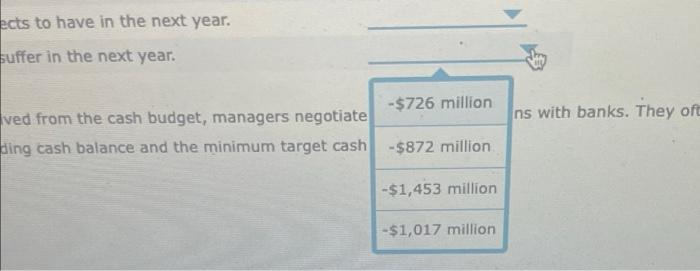

Mooney Equipment is putting together its cash budget for the following year and has forecasted expected cash collections over the next five quarters (one year plus the first quarter of next year). The cash collection estimates are based on sales projections and expected collection of receivables. The sales and cash collection estimates are shown in the following tabin (in Millions of dollars): Q1 $1,100 $1,100 Q2 $1,400 Q3 $1,450 $1,200 04 $1,250 Sales Total cash collections Q5 $1,500 $1,150 $1,200 You also have the following information about Mooney Equipment: You are at the end of the current year, and Q1 is the next period In any given period, Mooney's purchases from suppliers generally account for 72% of the expected sales in the next period, and wages, supplies, and taxes are expected to be 15% of the next period's sales - In the third quarter, Mooney expects to expand one of its plants, which will require an additional $1,072 million investment, Every quarter, Mooney pays $45 million in interest and dividend payments to long-term debt and equity investors Mooney prefers to keep a minimum target cash balance of at least $14 million at all times Using this information, complete the following table by making necessary calculations. (Note: Round intermediate calculations to the nearest whole dollar) The net cash Intiow that Mooney expects in the first quarter (01) Mooney's likely cash balance at the end of the year (after 04). (Hint: Assume that at the beginning of the year, Mooney's cash balance is $36 million and it expects to maintain a minimum target cash balance of at least $14 milion.) The maximum Investable funds that the firm expects to have in the[next year. The target cash deficit that the firm expects to suffer in the next year. True or False Based on the surplus or deficit derived from the cash budget, managers negotiate for short-term loans with banks. They often add a cushion to the difference between forecasted ending cash balance and the minimum target cash balance True False aking necessary calculations. (Note: Round intermediate calculations to the nearest whe arter (Q1) ter Q4). (Hint: Assume that at the hillion and it expects to maintain a -$163 million -$157 million to have in the next year. -$1,005 million er in the next year. -$150 million from the cash budget, managers negotiate for short-term loans with banks. They often add a cash balance and the minimum target cash balance. at all times. wing table by making necessary calculations. (Note: Round intermediate calculations to t Is in the first quarter (Q1) of the year (after Q4). (Hint: Assume that at the alance is $36 million and it expects to maintain a st $14 million.) -$284 million he firm expects to have in the next year. xpects to suffer in the next year. -$127 million - $1,439 million deficit derived from the cash budget, managers negotiate -$1,289 million ns with banks. They of casted ending cash balance and the minimum target cash balance. . (Hint: Assume that at the ind it expects to maintain a in the next year. next year. -$99 million cash budget, managers negotiate -$120 million bans with banks. They oft nce and the minimum target cash - $141 million -$70 million ects to have in the next year. uffer in the next year. -$726 million ns with banks. They of ved from the cash budget, managers negotiate ding cash balance and the minimum target cash -$872 million -$1,453 million -$1,017 million