Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Moonlight Enterprises is in the business of manufacturing of LED lights. It offers 1/10 net 40 credit terms to its customers. The current level

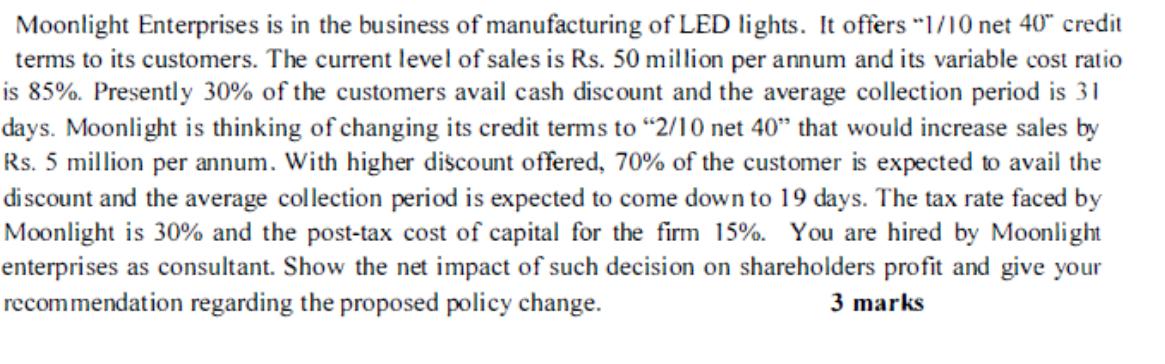

Moonlight Enterprises is in the business of manufacturing of LED lights. It offers "1/10 net 40" credit terms to its customers. The current level of sales is Rs. 50 million per annum and its variable cost ratio is 85%. Presently 30% of the customers avail cash discount and the average collection period is 31 days. Moonlight is thinking of changing its credit terms to "2/10 net 40" that would increase sales by Rs. 5 million per annum. With higher discount offered, 70% of the customer is expected to avail the discount and the average collection period is expected to come down to 19 days. The tax rate faced by Moonlight is 30% and the post-tax cost of capital for the firm 15%. You are hired by Moonlight enterprises as consultant. Show the net impact of such decision on shareholders profit and give your recommendation regarding the proposed policy change. 3 marks

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The question asks to calculate the net impact of a change in credit policy on shareholder profit and to provide a recommendation regarding the propose...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started