Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mooresville Corporation manufactures reproductions of eighteenth-century, classical-style furniture. It uses a job costing system that applies factory overhead on the basis of direct labor hours.

Mooresville Corporation manufactures reproductions of eighteenth-century, classical-style furniture. It uses a job costing system that applies factory overhead on the basis of direct labor hours. Budgeted factory overhead for the year was $1,409,100, and management budgeted 91,500 direct labor hours. Mooresville had no Materials, Work-in-Process, or Finished Goods Inventory at the beginning of August. This transaction was recorded during August:

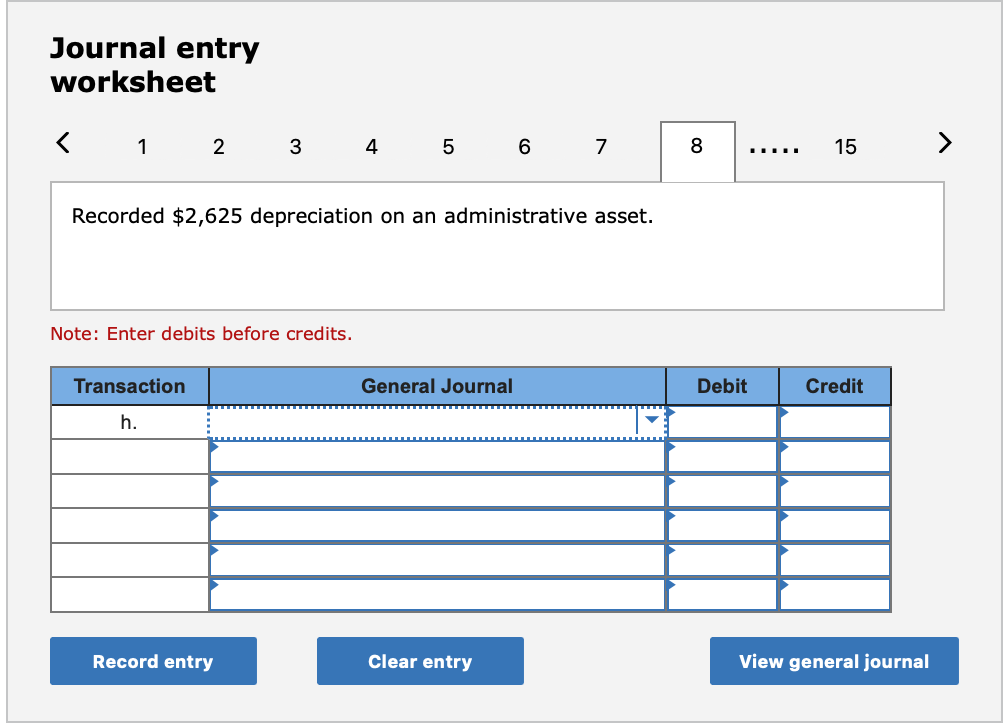

- Recorded $2,625 depreciation on an administrative asset.

LIST OF ACCOUNTS:

- Accounts Payable

- Accounts Receivable

- Accrued Payroll

- Accumulated Depreciation

- Advertising expense

- Cash

- Cost of Goods Sold

- Factory Overhead

- Finished Goods Inventory

- Loss from abnormal spoilage

- Materials Inventory (Direct Materials)

- Materials Inventory (Indirect Materials)

- Prepaid Insurance

- Sales Revenue

- Selling & Administrative Expense

- Work-in-Process Inventory

PLEASE NOTE: THERE IS NO OPTION FOR DEPRECIATION EXPENSE SO PLEASE DO NOT USE!

Journal entry worksheet 1 6 Recorded $2,625 depreciation on an administrative asset. Note: Enter debits before creditsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started